On Account Payments

You can use On Account Payments when you issue payments to Suppliers without reference to specific Invoices (usually before you have received the Invoices). You can enter these payments to the Payment register in the normal way but without specifying a Purchase Invoice Number on flip A:

In the Contact record for each Supplier to whom you are likely to pay deposits, switch on the On Account check box on the

'Terms' card. Then specify the separate control or suspense Account number in the

Account Usage P/L setting, using the On Account A/C field. The specified Account should be one that acknowledges that issuing a deposit creates an asset. The

Nominal Ledger Transaction generated when you approve and save an On Account Payment will debit the Sent Value to this Account. The Credit Account will be taken from the Payment Mode as usual:

You can then connect the On Account Payment to a subsequent Purchase Invoice, to remove it from your Purchase Ledger and your Nominal Ledger. First enter and approve the Purchase Invoice as normal without reference to the On Account Payment. You must then register that the Purchase Invoice has been paid by the On Account Payment. You can do this in a Payment record as a two-step process:

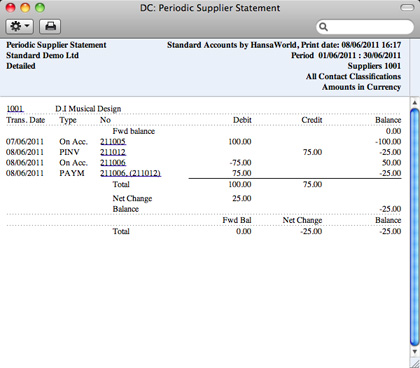

In order to update your Purchase Ledger correctly, you must enter the payment information twice as shown above; first as a normal row, and then with a negative sign as an On Account Payment. The example Periodic Supplier Statement below shows how the Purchase Invoice for 75.00 has been paid by the earlier On Account Payment of 100. The remainder of the On Account Payment is outstanding:

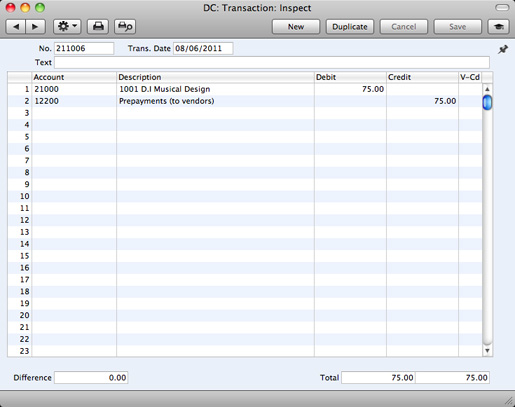

In the Nominal Ledger, the Purchase Invoice is removed from the Creditor Account, and the balance of the On Account A/C is reduced by the value of the Purchase Invoice:

---

In this chapter:

Go back to: