Individual Settings - Account Usage S/L

The Account Usage S/L setting is included in the following Standard products:

- Standard Accounts (Sales Ledger module)

---

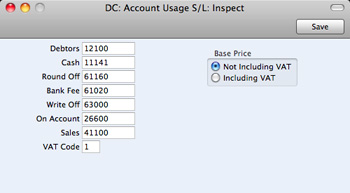

You should use the Account Usage S/L setting to choose the Accounts and VAT Codes that will be used as defaults in your Sales Ledger transactions (i.e. Invoices and Receipts). These defaults will be used in the absence of Accounts or VAT Codes being specified elsewhere (for example, in the Items or Customers used in the transactions). The Accounts that you use here must exist in the Account register, otherwise you will not be able to approve Invoices or Receipts.

If you created your database using the 'Start with standard chart of accounts' option as described on the Starting any Standard product - New Installation page), you will find that most of the fields in the Account Usage S/L setting already contain suggested values. If you have modified this Chart of Accounts or have used your own, you must ensure that you replace these suggested values with the correct Accounts.

! | The Accounts that you use in this setting must also exist in the Chart of Accounts. Otherwise, you will not be able to approve Invoices or Receipts. You must either add the Accounts to the Chart of Accounts (i.e. to the Account register in the Nominal Ledger and System module), or use Accounts that already exist in the Chart of Accounts. |

|

To open this setting, first ensure you are in the Sales Ledger and then click the [Settings] button in the Master Control panel. Then double-click 'Account Usage S/L' in the 'Settings' list. Fill in the fields as described below. Then, to save changes and close the window, click the [Save] button. To close the window without saving changes, click the close box.

- Debtors

- Paste Special

Account register, Nominal Ledger

- When you approve an Invoice (i.e. post it to the Nominal Ledger), its value including VAT will be debited to a Debtor Account. When you approve a Receipt, its value will be credited to the same Account. This Account therefore shows how much your company is owed at a particular time.

- Specify here the Account that you wish to be used as your main default Debtor Account. This Account will be overridden if you have specified a separate Debtor Account in the Customer Category to which a Customer belongs.

- Cash

- Paste Special

Account register, Nominal Ledger

- The Account entered here will be debited instead of the Debtor Account whenever you approve a cash sale (a "Cash Note"). Please refer to the description of the Payment Terms setting for details about Cash Notes.

- This Cash Account will be overridden if you have specified a separate Cash Account for the Payment Term used in a Cash Note.

- Round Off

- Paste Special

Account register, Nominal Ledger

- When necessary, the total and VAT amounts of each Invoice will be rounded up or down to two decimal places. Whenever you approve an Invoice, any amount lost or gained by this rounding process will be posted to the Account specified here.

- This Account can only be defined in the Account Usage S/L setting and is therefore used in Transactions generated from Purchase Invoices as well.

- Write Off

- Paste Special

Account register, Nominal Ledger

- The Account specified here will be debited by bad debts written off by the 'AddWrite-off' Operations menu function on the Receipt window.

- On Account

- Paste Special

Account register, Nominal Ledger

- If you receive On Account Receipts from Customers without reference to specific Invoices (usually before you have raised those Invoices), you may want to use a special Account for such Receipts. Specify that Account here, and switch on the On Account check box on the 'Terms' card of the Contact records for the Customers in question. When you enter and approve an On Account Receipt, its value will be credited to this Account. On Account Receipts are described here.

- Sales

- Paste Special

Account register, Nominal Ledger

- A Sales Account will be credited whenever you sell an Item, allowing you to record the levels of sales of different types of Items in the Nominal Ledger. For each Item that you sell, the default Sales Account will be chosen in this order:

- It will be taken from the Item record itself.

- It will be taken from the Item Group to which the Item belongs.

- This Sales Account in the Account Usage S/L setting will be used.

- VAT Code

- Paste Special

VAT Codes setting, Nominal Ledger

- The VAT Code will determine the Output VAT Account to be credited whenever you sell an Item and the rate at which VAT will be charged. For each Item that you sell, the default VAT Code will be chosen in this order:

- The Sales VAT Code for the Customer will be used.

- It will be taken from the Item record itself.

- It will be taken from the Item Group to which the Item belongs.

- This VAT Code in the Account Usage S/L setting will be used.

You will be able to override the choice of VAT Code in an individual Invoice row if necessary.

- Base Price

- Use these options to specify whether the sales Prices in the Item records are to include VAT. VAT rates are defined in the VAT Codes setting in the Nominal Ledger.

---

In this chapter:

Go back to home pages for: