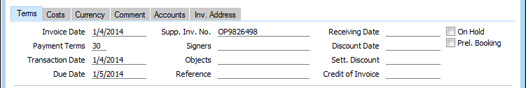

Entering a Purchase Invoice - Terms Card

- Invoice Date

- Paste Special

Choose date

- The date when the Supplier issued the Invoice. This date, together with the Payment Terms, will determine when the Invoice will become due for payment. The date of the previous Purchase Invoice entered will be used as a default.

- Payment Terms

- Paste Special

Payment Terms setting, Sales/Purchase Ledger

- Default taken from Contact record for the Supplier (Purch. Pay. Terms)

- The Payment Term that you specify here will determine the Due Date (below). You can also use Payment Terms to configure a system of early settlement discounts.

- Payment Terms are also the means by which Cash Notes and Credit Notes are distinguished from ordinary Invoices. To change an ordinary Purchase Invoice into a Cash Note or Credit Note, use 'Paste Special' to select a Payment Term whose Type is "Cash" or "Credit Note" respectively. When you then mark the record as OK and save it, the appropriate Nominal Ledger Transaction will be created. From a Cash Note, the Transaction will credit the Cash Account (as specified in the Payment Term record) rather than the Creditor Account. From a Credit Note, the Transaction will be a reversal of the original Invoice Transaction.

- Cash Notes will immediately be treated as paid and so will not appear in your creditor reports. There is no need to enter a Payment against them. If you need to reverse a Cash Note, use a negative Cash Note, not a Credit Note.

- In a Credit Note, you can enter the number of the Invoice to be credited in the Credit of Invoice field (on the 'Terms' card), using 'Paste Special' if necessary to bring up a list of open (unpaid) Invoices.

- In the Baltic States, there are circumstances where Purchase Invoices should follow the same number sequence as that used by Payments, Personnel Payments and Cash Out records. For this to happen, define the number sequences using the right-hand From and To fields on flip C of the Payment Modes setting and check the Common Number Series box in the Cash Book Settings setting in the Cash Book module. Then, enter a Payment Mode to this field: the Purchase Invoice Number will change to one in the correct sequence. When you mark the Invoice as OK and save it, it will be treated as paid and no posting to a Creditor Account will be made. Instead, a credit posting will be made to the Account of the Payment Mode (i.e. a Bank or Cash Account). In some installations, Payment Modes may be included in the 'Paste Special' list.

- Transaction Date

- Paste Special

Choose date

- This date will be used as the Transaction Date in the Nominal Ledger Transaction that will result from the Purchase Invoice. You may thus separate Invoice and Transaction Dates in your ledgers.

! | If you enter different Invoice and Transaction Dates, there will be a timing difference between the Purchase and Nominal Ledgers so long as the Invoice remains unpaid. This will be apparent when comparing the Aged Creditors report with the Creditor Control Account. | |

- If you are using the Disallow Invoice Date after Transaction Date option in the Purchase Invoice Settings setting, you will not be able to save a Purchase Invoice if the Transaction Date is earlier than the Invoice Date.

- Due Date

- The date when the Purchase Invoice is to be paid, calculated from the Invoice Date and the Payment Term. You can change the Due Date, even after you have marked the Invoice as OK. This will be useful if you receive an extended credit time for an Invoice and you need to re-scheduled it in your Purchase Ledger and in cash flow forecast reports such as the Liquidity Forecast.

- If the Payment Term is one with instalments, the Due Date of the final instalment will be shown here.

- In Finland, each Purchase Invoice has a barcode that you can enter or scan into the Barcode field on the 'Accounts' card. If you do so, the Due Date will be brought in automatically, as it is contained in the barcode.

- Supp. Inv. No.

- The number assigned to the Purchase Invoice by the Supplier.

- You can have the Supp. Inv. No. printed in the several documents including the remittance advice by including the "Supplier Invoice Number" field in your Form designs.

- When you save a Purchase Invoice, a check will be made that you have not already used the Supp. Inv. No. with the same Supplier in a previous Purchase Invoice or Expense record (in the Document No. field on flip C). If you have, you will be warned "Invoice with this Supplier Invoice No. already exists", but the record will still be saved. If you want to prevent the saving of such a Purchase Invoice altogether, use the Disallow Invoices with Same Supp. Invoice No. option in the Account Usage P/L setting. This will help reduce the risk of entering the same document more than once, as a Purchase Invoice and/or as part of an Expense claim.

- Usually you can change the Supp. Inv. No. in a Purchase Invoice even after you have marked it as OK and saved it. If you do not want this to be possible, you can prevent it using Access Groups, by denying access to the 'Change Supplier's Inv. No. on OKed Purchase Invoice' Action.

- Signers

- Paste Special

Person register, System module

- The person marking the Purchase Invoice as OK should enter their Signature here. You can enter the Signatures of more than one Person, separated by commas. You can make entering a Signature in this field compulsory by selecting the Signer Required option in the Purchase Invoice Settings setting.

- Objects

- Paste Special

Object register, Nominal Ledger/System module

- You can assign up to 20 Objects, separated by commas, to a Purchase Invoice, to be transferred to the consequent Nominal Ledger Transaction. You might define separate Objects to represent different departments, cost centres or product types. This provides a flexible method of analysis that can be used in Nominal Ledger reports. Usually the Objects specified here will represent the Supplier.

- In the Nominal Ledger Transaction generated from a Purchase Invoice, the Objects specified here will be assigned as follows:

- By default, they will be assigned to the debit posting(s) to the Cost Account(s).

This assignment will not occur if you are using the Skip Header A/C Objects on Cost A/C option in the Account Usage P/L setting.

- If you are using the Objects on Creditors Account option in the same setting, they will be assigned to the credit posting to the Creditor Account.

- If you are using the Objects on VAT Account option in the same setting ('VAT' card), they will be assigned to the debit posting(s) to the Input VAT Account(s).

- The Objects on Creditors Account option will also cause any Purch. Objects specified in the Contact record for the Supplier to be copied here as a default, and, when you pay the Purchase Invoice, for the Objects in this field to be copied to the Objects field on flip F of the Payment row. From there, they will be assigned to the debit posting to the Creditor Account.

- Reference

- Default taken from

Contact record for the Supplier (Reference field)

- Record here any additional code by which the Purchase Invoice can be identified. When you pay the Purchase Invoice, this Reference will be copied to the Bank Reference field on flip H of the relevant Payment row. It will then be printed on the Payment Form document provided you have included the "Our Reference (ourref)" field in your Form design.

- Depending on the Payment File Format you have chosen in the Bank Transfer setting in the Purchase Ledger, this Reference may be included in Banking File exports. For this reason, a Reference is mandatory in Purchase Invoices in some countries e.g. Finland and Norway.

- In Finland, each Purchase Invoice has a barcode that you can enter or scan into the Barcode field on the 'Accounts' card. If you do so, the Reference will be brought in automatically, as it is contained in the barcode.

- In Norway, you should enter the KID Code of the Purchase Invoice in this field.

- Receiving Date

- Paste Special

Choose date

- The Receiving Date of a Purchase Invoice is the date you receive it into your possession.

- In some countries (e.g. Slovenia), VAT can be reclaimed based on Invoice Receiving Dates rather than on Invoice or Payment Dates. You will therefore need to create a VAT Correction record from a Purchase Invoice if its Transaction Date is different to its Receiving Date. This will ensure its VAT is attributed to the correct period. You can use the ‘Create VAT Corrections P/L’ Maintenance function to create VAT Correction records from Purchase Invoices in batches, or you can create a VAT Correction record from an individual Purchase Invoice by opening it and selecting ‘Create VAT Correction P/L’ from the Operations menu. Please refer to your local HansaWorld representative for more information.

- If you are using the Require Receiving Date option in the Purchase Invoice Settings setting, it will be mandatory to enter a Receiving Date in each Purchase Invoice.

- Discount Date

- Paste Special

Choose date

- The date by which you should pay the Invoice if you are to receive a settlement discount. This will be calculated using the Settl. Disc. Days specified in the relevant Payment Term record. You can change the Discount Date, even in an Invoice that you have marked as OK.

- Sett. Discount

- The amount of the settlement discount, if any.

- The calculation of this figure will depend on the Settl. Discount % in the relevant Payment Term record and on the Exclude VAT on Cash Discount option in the Account Usage S/L setting. If you are not using this option, the settlement discount will be:

- TOTAL x Settlement Discount %

If you are using this option, the settlement discount will be:

- (TOTAL - VAT Total) x Settlement Discount %

The VAT total in the second equation will be taken from the VAT field in the header or, if this is empty, from the Calculated VAT field in the footer.

- You can overwrite the calculated settlement discount figure if necessary. You should do so after entering all other information to the Purchase Invoice, as adding rows, changing amounts etc will cause the settlement discount figure to be re-calculated.

- If you pay the Purchase Invoice before the Discount Date (above), a discount row will be added to the Payment automatically, with this figure as a suggested discount amount.

- If you enter a Purchase Invoice that was created using the equivalent in the Supplier's system of the Exclude VAT on Settl. Discount option, the VAT total in the Supplier's Invoice will not be the same as the figure that appears in the Calculated VAT field in the footer of the 'Costs' Card. You will need to copy the VAT total from the Supplier's Invoice to the VAT field in the header. This will ensure the correct figure is posted to the Input VAT Account and that the settlement discount is calculated correctly. If the Purchase Invoice is one with several rows, possibly with different VAT Codes, you may need to enter the correct figure in each row (in the VAT field on flip C) to ensure the correct amounts are posted to the Input VAT Accounts. The sum of these VAT amounts will be placed in the VAT field in the header, and this figure will be used in the settlement discount calculation. You will need to use the Set VAT Value on Purchase Invoice option in the Account Usage P/L setting if you want to use the VAT field on flip C.

- Credit of Invoice

- Paste Special

Open Purchase Invoices

- If you are entering a Purchase Credit Note (a "debit note"), enter here the number of the Purchase Invoice being credited. The Purchase Invoice being credited cannot itself be a credit note.

- Remember to specify a Payment Term of type "Credit Note" in the Payment Terms field: you must leave the Credit of Invoice field blank when the Payment Term is of any other type.

- On Hold

- Check this box in a Purchase Invoice if you wish to prevent it from being paid by the 'Create Payments Suggestion' Operations menu function. However, the full outstanding amount will still be offered as a default when you type the Invoice Number into a Payment record: if you want to prevent this, use the Hold Amount field in the header. You can change this check box after the Invoice has been marked as OK and saved.

- Marking a Purchase Invoice as On Hold can affect the following reports:

- Prel. Booking.

- This option allows for the preliminary (temporary) booking of Purchase Invoices. If you tick this box, a Nominal Ledger Transaction will be generated for the preliminary booking when you next save the Invoice. Normal VAT and Cost Account postings will be made, but, instead of the usual Creditor Account, a preliminary Account (defined on the 'Creditors' card of the Account Usage P/L setting) will be credited. As long as the Purchase Invoice is in this temporary state, you can change the Cost Accounts in any of the Purchase Invoice rows. When you mark the Purchase Invoice as OK and save it again, a new Nominal Ledger Transaction will be created, reversing the posting to the preliminary Account and replacing it with a credit to the normal Creditor Account. Any change in the Cost Accounts used will also be reflected in this Transaction.

- You can use Access Groups to control who can tick the Prel. Booking box in Purchase Invoices and Purchase Credit Notes. To do this, deny access to the 'OK Purchase Invoices' and 'OK Purchase Credit Notes' Actions respectively.

- If you need Purchase Invoices to pass through an approval process before you can mark them as OK, you can configure such a process using the Approval Rules register in the Business Alerts module. The same approval process will also control access to the Prel. Booking box i.e. passing through the same approval process will allow you to tick both the Prel. Booking and OK check boxes. Please refer to the description of the Approval Status options on the 'Inv. Address' card for brief details about the approval process and here for full details.

- The Prel. Booking check box is described in more detail on the Preliminary Booking page.

---

In this chapter:

Download:

Go back to:

|