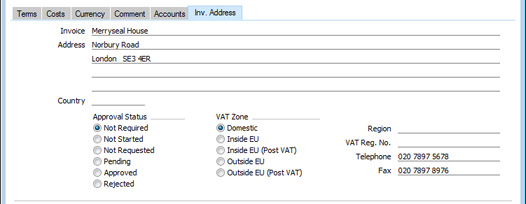

Entering a Purchase Invoice - Inv. Address Card

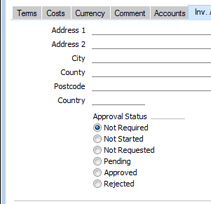

- Address

- Default taken from

Contact record for the Supplier (Invoice Address)

- The Supplier's address will be brought in from the 'Contact' card of their record in the Contact register. You can change the Address in a particular Invoice, but if you need to make a more permanent change, you should do so in the Contact register.

- If you want to give a name to each of the individual address lines, use the 'Address' card of the User Defined Fields - Contacts setting in the CRM module. This can be useful if, for example, you want to indicate that the town or city is always to be typed into the third line of the address:

- Country

- Paste Special

Countries setting, System module

- Default taken from Contact record for the Supplier (Country)

- The Supplier's Country will be brought in from the 'Contact' card of their record in the Contact register.

- Approval Status

- You can use the Approval Rules register in the Business Alerts module to configure an approval process that Purchase Invoices must pass through before you can mark them as OK (or before you can tick the Prel. Booking box). For example, particular managers may need to check and approve every Purchase Invoice in which the TOTAL is greater than a certain value. If you are using such an approval process, these options will display the stage in the process that a particular Purchase Invoice has reached.

- In brief, the options are:

- Not Required

- The Purchase Invoice does not need to pass through an approval process, so you can mark it as OK immediately.

- Not Started

- If you have a configured an approval process for Purchase Invoices, the Approval Status in new unsaved Purchase Invoices will be Not Started. When you save a Purchase Invoice for the first time, the Status will change to Not Required (if the Purchase Invoice does not need to pass through the approval process, which will usually be because its value is too low), or to Not Requested. The Approval Status will be re-assessed each time you save the Purchase Invoice.

- Not Requested

- The Purchase Invoice does need to pass through an approval process, and you have not yet started that process. To start the process, save any changes and then choose 'Send for Approval' from the Operations menu. After doing this, you will no longer be able to modify the Invoice.

- Pending

- The Purchase Invoice has been entered into the approval process, and is waiting to be approved or rejected. If you need to check the progress of the approval process, select 'Invoice Status' from the Operations menu.

- Approved

- The approval process has been completed and the Purchase Invoice has been approved. You can now mark it as OK (although this may have been done automatically, depending on how you have configured the approval process).

- Rejected

- The approval process has been completed and the Purchase Invoice has been rejected. If you have configured the approval process to allow rejected Purchase Invoices to be modified before re-submission, you must set the Approval Status back to Not Requested and then save the record before you can modify the Purchase Invoice.

Please refer here for full details.

- VAT Zone

- Default taken from

Contact record for the Supplier

- These radio buttons show the Supplier's Zone, brought in from the Contact register. The Zone can control the selection of VAT Code or Tax Template in each row of the Purchase Invoice: you will have defined separate default VAT Codes or Tax Templates for each Zone on the 'VAT' card of the Account Usage P/L setting. You cannot change the Zone in a Purchase Invoice: you should make any necessary changes in the Contact register before entering Purchase Invoices.

- VAT in a Purchase Invoice will calculated as follows:

- Domestic, Inside EU (Post VAT) and Outside EU (Post VAT)

- VAT is calculated using the VAT Code of each row. In any Nominal Ledger Transaction resulting from the Purchase Invoice, VAT is debited to the Input Account from the VAT Code and credited to the Creditor Account.

- Inside EU

- Purchase Invoices received from other countries in the EU do not carry VAT. However, depending on the nature of the Invoice, VAT can be payable.

- VAT is calculated using the VAT Code of each row. In any Nominal Ledger Transaction resulting from the Purchase Invoice, VAT is debited to the Input Account from the VAT Code and credited to the Output Account from the VAT Code. Therefore, it is recommended that you use a dedicated VAT Code for VAT on EU Acquisitions, with an Output Account that is not used in any other VAT Code.

- It is usually recommended that you leave the VAT field in the header empty when entering Purchase Invoices from inside the EU.

- Outside EU

- VAT is not calculated. Any Nominal Ledger Transaction resulting from the Purchase Invoice will not include a VAT element.

You can change the names of two of these options if they are not suitable. Using the VAT Zone Label setting in the Sales Ledger, you can replace the string "EU" with your own string (for example "SACU" in South Africa).

- Region Paste Special Regions setting, Sales Ledger

- Default taken from Contact record for the Supplier

- This field can be used in Argentina, where tax legislation states that the calculation of gross income withholding taxes should depend on the Region where the goods or services are received. Please refer to the description of the Supplier Withholdings setting here for more details.

- VAT Reg. No.

- Default taken from

Contact record for the Supplier

- The Supplier's VAT registration number. It is important that this field contains a value if the Supplier is in the "Inside EU" and "Inside EU (Post VAT)" Zones as this information is then required for EU VAT reporting purposes.

- You can have a validation check carried out to ensure that the VAT Number entered here is in the correct format for the Supplier's Country. If you want there to be such a validation check, define the correct formats in the VAT Number Masks setting in the System module. The validation check will take place when you save the Purchase Invoice, and a message will be shown if the VAT Number is in the wrong format. The check will be based on the Country specified in the Contact record for the Supplier or, if that is blank, using the Country in the Company Info setting (i.e. your own country). If that is also blank, no validation check will be made.

- Telephone, Fax

- Default taken from

Contact record for the Supplier

- The Supplier's telephone and fax numbers, as entered on the 'Contact' card of the Supplier's record in the Contact register.

---

In this chapter:

Download:

Go back to:

|