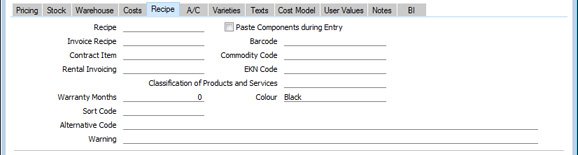

Entering an Item - Recipe Card

This page describes the fields on the 'Recipe' card of the Item record. Please follow the links below for descriptions of the other cards:

---

- Recipe

- Paste Special

Recipes setting, Stock module

- If the Item is a Structured or assembled Item, specify here the Recipe (or bill of materials) that describes how it is made up.

- If the Item is a Structured Item, you must specify a Recipe before you can save it. If you need to create a new Recipe, it is recommended that you open 'Paste Special' and create a new empty Recipe from there. Save the Recipe, save the Item and then return to the Recipe to list the Input and Output Items. Do not save the Item using a different Item Type (i.e. Plain, Stocked or Service) and then specify the Recipe because in most cases you won't be able to change the Item Type to Structured.

- If the Item is a Stocked Item, you can save it before specifying the Recipe. In this case, you can create the Recipe using the 'Recipe' function on the Create menu.

- Paste Components during Entry

- If the Item is a Structured Item and you would like to display its components in sales and outgoing stock transactions (e.g. Quotations, Orders, Invoices and Stock Depreciations), select this option. The components will be listed in these records when you enter the quantity of the Structured Item.

- If you are using this option and the Item is one that you will be using in Work Sheets (i.e. it is a spare part made up of components), you should set the Cost Price on the 'Costs' card to zero, so that gross margin and profit calculations will use the cost prices of the components.

- This option will cause components to be listed on screen and printed on Delivery Notes and Picking Lists. If you do not want the components listed on screen, you can still have them printed on Delivery Notes and Picking Lists (but not other documents such as Order Acknowledgements, Invoices and Quotations). To do this, use the Structured Items setting in the Stock module.

- If you need cost of sales postings to be made from Invoices and you have Structured Items in which you have not ticked this Paste Components during Entry option, it is recommended that you use the Post Structured Items Cost of Sales on Invoice option in the Cost Accounting setting in the Stock module. This will ensure that cost of sales postings will be made when you sell the Structured Items, both in Invoices that you enter directly to the Invoice register and in Invoices that you create from Sales Orders and Deliveries.

- Invoice Recipe

- Paste Special

Recipes setting, Stock module

- This field is relevant for users in Sweden, where sales of Items containing certain materials (e.g. metals) attract a tax per unit sold. By specifying an Invoice Recipe for such Items, the Recipe components will be listed on Invoices (but not Orders or Deliveries).

- Contract Item

- Paste Special

Item register

- If your business is one that sells both goods and the service contracts to maintain them, you will need separate records in your Item register for the Items that you sell and for the service contracts for those Items.

- The records representing the service contracts are sometimes known as "Contract Items". The Base Price of a Contract Item will be the periodic charge for the contract (e.g. the weekly, monthly or annual fee).

- When you sell a service contract, you will usually create a new record in the Contract register in the Contracts module. This Contract will contain the Contract Item and will allow you to issue periodic Invoices for the service contract.

- When you sell an Item, you can create a Contract for that Item from the Invoice. To do this, open the Invoice in which you have sold the Item and choose ' Contract' from the Create menu. As the Contract should contain a Contract Item and not the Item itself, this function requires the Item and its Contract Item to be linked, which you can do using this field. In the record representing the Item itself, specify here the Item Number of the Contract Item record.

- Rental Invoicing

- Paste Special

Item register

- If your business is one that rents Items to Customers, you should have separate records in your Item register for each Item and for the rental charge for that Item. The Item itself will be used in the Stock module (when it is purchased), in the Internal Stock module and in the Assets module (where it will be depreciated), while the Rental Item will provide the rental charge whenever the Item is rented out.

- Use this field to link the two Items. In the record representing the Item itself, specify here the Item Number of the record representing the rental charge for that Item.

- Warranty Months

- Record here the length of the warranty period (if any) covering the Item. This information will be used in the Service Orders module to determine whether Items purchased from your company are under warranty when bought in for repair.

- Alternative Code

- Use this field if you need to identify the Item by means other than the Item Number. The Alternative Code is shown in the 'Items: Browse' and 'Paste Special' windows, so you can use it to search for a particular Item.

- If you are using the EDI (Electronic Data Interchange) module, you should record here the code allocated to the Item by the Customer. When importing EDI Orders, this will enable the import function to convert the Customer's Item Number contained in the import file to your own. Please refer to your local representative for full details.

- Providing an Alternative Code does not clash with your Item Numbers, you can enter it instead of the Item Number whenever you need to refer to an Item (in Orders or Invoices, for example). This might be useful if you have Customers who place orders quoting their own Item Numbers.

- Warning

- Text entered here will appear as a warning or other message whenever you use the Item in a transaction.

- Barcode

- Record the Item's Barcode here.

- Providing a Barcode does not clash with your Item Numbers, you can enter it instead of the Item Number whenever you need to refer to an Item (in Orders or Invoices, for example). This might be useful if you enter transactions using barcode readers: please refer to your local HansaWorld representative for details about using barcode readers.

- If you need to ensure that each Item has a unique Barcode, select the Unique Barcode option in the Item Settings setting in the Sales Ledger. This setting also contains a Barcode Length Excl. Checksum field, which you can use if you need to ensure that each Barcode contains at least a certain number of characters. If you enter an Item with a shorter Barcode, it will be given the appropriate number of leading zeroes when you save the record. For example, if your Barcode Length is five, a Barcode of "4256" will be converted to "04256". No warning will be issued for Barcodes that are longer than the Barcode Length.

- If you need barcodes to be printed in forms (e.g. in Invoices), include the "Barcode" field in your Form Template designs. Assign the field a Style in which you have chosen the appropriate barcode format (Code 128, Code 39 or EAN 13) and font from the IDAutomation family. If you choose to have barcodes printed as QR Codes, there is no need to specify a font

- If the Item is one that has Varieties and you need to enter a separate Barcode for each Variety, use the Barcodes setting in the Stock module. This is described on the Varieties and Barcodes page.

- Commodity Code

- Paste Special

Commodity Code register, Customs module/Commodity Codes setting, Hotel module

- If your business is situated in an EU country, record the Item's Commodity Code/EAN (European Article Number) here. This is required for Intrastat reporting in the event of trade with another member of the EU. Commodity Codes are listed in the Intrastat Classification Nomenclature document available from https://www.uktradeinfo.com/TradeTools/ICN/Pages/ICNhome.aspx.

- Depending on the Intrastat functions that you need to use, you should enter Commodity Codes in this field or in the EKN Code field immediately below. The following functions use this field:

- Exports

- Intrastat P/L (Finland)

- Intrastat S/L (Finland)

- Intrastat P/L (Germany)

- Intrastat P/L (Lithuania)

- Intrastat S/L (Lithuania)

- Intrastat S/L (Sweden, IDEP-SCB)

- Intrastat Invoices

- Intrastat Invoices (UK) (Items without Commodity Codes will not be included in the export file)

- Intrastat Purchase Invoices (UK) (Items without Commodity Codes will not be included in the export file)

- Reports

- Intrastat P/L (Latvia)

- Intrastat S/L (Latvia)

- This field is also used by the Regional Sales Tax and Regional Perception Tax calculations in Argentina. In configuring these taxes using the Regional Sales Taxes and Regional Perception Taxes settings in the Sales Ledger, you can specify separate tax rates for each Commodity Code. When you sell an Item (i.e. include it in an Invoice or Order row), the appropriate tax rate will be applied to the Item depending on the Commodity Code in the Item record or, if blank, in the Item Group to which the Item belongs. Please refer to your local HansaWorld representative for more details.

- EKN Code

- Depending on the Intrastat functions that you need to use, you should enter Commodity Codes in this field or in the Commodity Code field immediately above (in both fields in Germany). The following functions use this field:

- Exports

- Intrastat S/L (Czech Republic)

- Intrastat P/L (Estonia)

- Intrastat S/L (Estonia)

- Intrastat S/L (Germany)

- Ist@at - Items Export (Poland)

- Ist@at - Items Import (Poland)

- Forms

- Intrastat P/L

- Intrastat S/L

- Classification of Products and Services

- This field is used in Brazil and Kenya. In Brazil, a Classification of Products and Services code for each Item on an Invoice should be included when sending the Invoice as an eInvoice (in the <NCM> tag). In Kenya, a Classification of Products and Services code for each Item should be included in the iTax (Kenya) report. In both cases, the Classification of Products and Services code will be taken from the Item record or, if blank, from the Item Group to which the Item belongs.

- This field is also used in Poland, where each Item should be assigned a classification code or PKWiU. The PKWiU for each Item will be printed on Quotations, Orders and Invoices if you have included the "Classification of Products and Services" field in your Form Template designs. The PKWiU will always be taken from the Item record, there will be no fallback to the Item Group.

---

The Item register in Standard ERP:

Go back to:

|