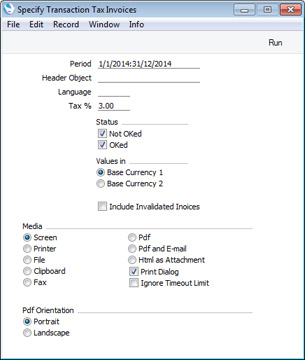

Transaction Tax Invoices

The Transaction Tax Invoices was designed for use in Bolivia but can be used in any country where an additional tax is levied on Sales Invoices and where that tax is payable by the company issuing the Invoices, not by Customers. The report is a simple list of Invoices, showing TOTALS and additional tax amounts.

When printed to screen, the Transaction Tax Invoices report has the Standard ERP Drill-down feature. Click on any Invoice Number to open an individual Invoice record.

- Period

- Paste Special

Reporting Periods setting, System module

- Specify the report period. Invoices whose Invoice Dates fall in the period specified here will be included in the report.

- Header Object

- Paste Special

Object register, Nominal Ledger/System module

- If you specify an Object here, the report will list Invoices featuring that Object. This refers to Objects entered at Invoice level, not those entered in the Invoice rows. If you enter a number of Objects separated by commas, only those Invoices featuring all the Objects listed will be included in the calculations.

- Language

- Paste Special

Languages setting, System module

- If you would like to list Invoices with a particular Language, specify that Language here.

- Tax %

- Use this field to specify the tax rate of the additional tax. For each Invoice, the report will show the TOTAL and the additional tax amount (i.e. TOTAL * Tax % / 100).

- Status

- Specify here whether you would like Invoices that have been marked as OK, Invoices that have not been marked as OK or both to be included in the report.

- Values in

- If you are using the Dual-Base system, values in this report can be shown in either Base Currency. Use these options to choose which Currency is to be used on this occasion.

- If you are not using the Dual-Base system, use the Base Currency 1 option to produce a report in your home Currency.

- Include Invalidated Invoices

- Use this option if you would like Invalidated Invoices to be included in the report.

---

Reports in the Sales Ledger:

Go back to: