Interest Codes, Interest Terms

You can charge interest on overdue Invoices (those that remain unpaid once the Payment Terms have expired). To charge interest, you will need to raise an Invoice of a special type, known as an "Interest Invoice". In most respects, an Interest Invoice is similar to a "normal" Invoice. However, Interest Invoices will be printed using a different Form Template, and are marked with an "I" in the right-hand column of the 'Invoices: Browse' window.

The most usual method of creating Interest Invoices will be to use the 'Create Interest Invoices' Maintenance function in the Sales Ledger. This function requires you to set an interest rate that it will use when calculating the interest that it will charge to Customers. You can use the following methods to set this interest rate:

- You can enter a default interest rate in the Rate field in the Interest setting. If this is the only method you use, this interest rate will be universal, charged to all Customers at all times. This default interest rate will be copied to each new Invoice, to be shown on the 'Price List' card.

If an Invoice becomes overdue, interest will be charged using an interest rate chosen as follows:

- If you are using the "Inv. Date Rate * Late Days" option in the Interest setting, the interest rate stored in each Invoice will be used (i.e. interest will be calculated using the interest rate that was valid on the day when an overdue Invoice was issued).

- If you are using the "Current Date Rate * Late Days" or "Flat Rate Per Debiting" options in the Interest setting, the interest rate in the Interest setting will be used (i.e. interest will be calculated using the interest rate valid on the day when you run the 'Create Interest Invoices' function).

- If you need to override the default interest rate for a particular Customer, you can enter an interest rate in the Interest Rate field on the 'Terms' card of the Contact record for that Customer. This interest rate will be copied to each new Invoice issued to that Customer.

This will not affect the behaviour of the "Inv. Date Rate * Late Days" option. If you are using the "Current Date Rate * Late Days" or "Flat Rate Per Debiting" options, interest will be calculated using the interest rate in the Contact record (or from the Interest setting in the case of the other Customers).

- If you need interest to be charged using different interest rates depending on the outstanding value of an overdue Invoice and/or depending on the interest period, you should configure your interest rates using the Interest Codes and Interest Terms settings. You should still use the Interest setting to choose other parameters for the 'Create Interest Invoices' function (such as the Item, Running Mode, Calculation, Min. Sum and so on).

The Interest Codes and Interest Terms settings are now described in detail. Follow these steps:

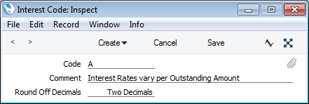

- The first step is to enter a record in the Interest Codes setting in the Sales Ledger. The Interest Code is the overall label given to an interest rate structure.

Ensure you are in the Sales Ledger, open the Interest Codes setting, and create a new record:

- Code

- Enter the unique Code by which the Interest Code is to be identified from elsewhere in Standard ERP. You can use up to five characters. To avoid confusion, it is recommended that you use at least one alpha character in each Code (see step 6 below).

- Comment

- Enter the name for the Interest Code, to be shown in the 'Interest Codes: Browse' window and the 'Paste Special' list.

- Round Off Decimals

- Paste Special

Choices of possible entries

Specify the maximum number of decimals to be used in each interest calculation.

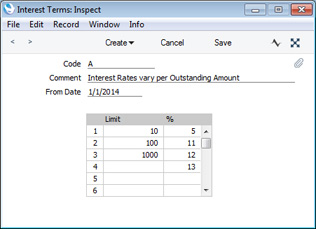

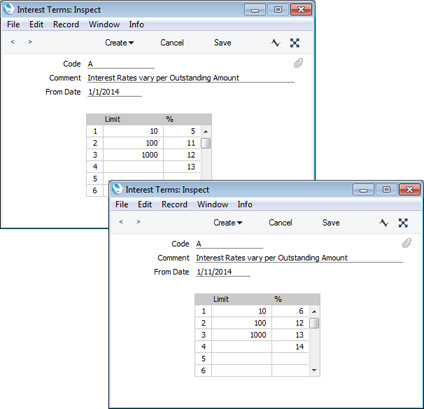

- Having entered the Interest Code in the previous step, you can now enter the interest rate structure itself. In this example, we will configure an interest rate structure that charges interest at different rates depending on the outstanding amount.

Remaining in the Sales Ledger, open the Interest Terms setting, and create a new record:

- Code

- Paste Special

Interest Codes setting, Sales Ledger

- Specify the Interest Code to which the Interest Terms record belongs.

- Comment

- The Comment from the Interest Code will be brought in automatically.

- From Date

- Paste Special

Choose date

- Specify the date when the interest rate structure is to take effect.

- If you will only connect a single Interest Terms record to an Interest Code, you can leave this field blank. Otherwise, if you have several Interest Terms records connected to an Interest Code, one can have a blank date but the others must all have a From Date. This allows you to charge different interest rates at different times (see step 5 below).

- Limit, %

- Use the matrix to draw up the interest rate structure.

- The interest rate that you enter in the % field will be applied to outstanding amounts up to the value that you enter in the Limit field.

- In the example, interest of 5% will be charged on outstanding amounts up to 10.00, interest of 11% will be charged on outstanding amounts from 10.01 to 100.00 and so on. The last row states that interest of 13% will be charged if the outstanding amount is greater than 1000.00: if we had not entered this row, interest would be charged at 12% on these amounts.

- If you are using the "Inv. Date Rate * Late Days" or "Current Date Rate * Late Days" options in the Interest setting, you should enter annual rates of interest in the % column. If you are using the "Flat Rate Per Debiting" option, enter the interest rates that you wish to charge each time you raise an Interest Invoice.

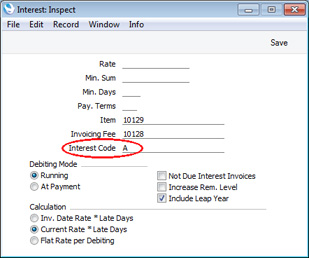

- In the Interest setting, specify the Interest Code that is to supply interest rates to the 'Create Interest Invoices' function:

You should leave the Rate field empty as shown in the illustration. However, you should choose other options in this setting as appropriate as they will still be used as parameters for the 'Create Interest Invoices' function (Interest Codes/Interest Terms provide an alternative means of specifying interest rates, they do not affect the other options in the Interest setting).

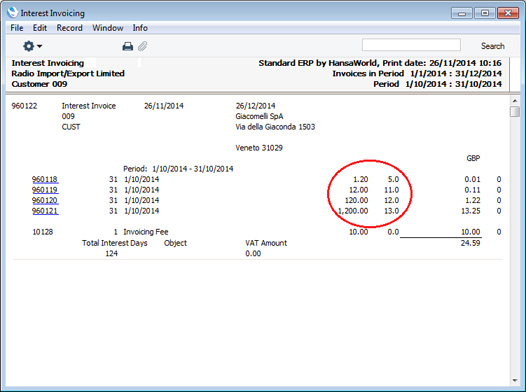

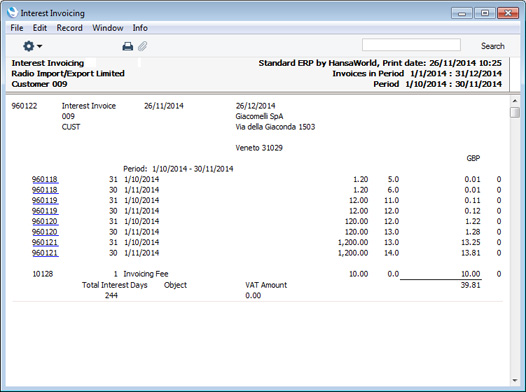

- The Interest Invoicing report lists the Interest Invoices that will be created by the 'Create Interest Invoices' function. This example report illustrates the application of the interest rate structure:

The first Invoice has an outstanding amount of 1.20, so interest is charged at 5% (from the first row in the Interest Term record). The second Invoice has an outstanding amount of 12.00, so interest is charged at 11% (from the second row in the Interest Term record), and so on. The interest amounts themselves (0.01, 0.11, 1.22 and 13.25) are rounded to two decimals as specified in the Interest Code record.

- In this next example, we will create a second Interest Term record, to be used from November onwards:

The Interest Code is the same in both records. So, when you use Interest Code A, the original Interest Term record will be used to calculate interest between January and October, and the new record will be used to calculate interest from November onwards.

When we produce the Interest Invoicing report with October-November as the interest period, the old and new interest rates will both be shown:

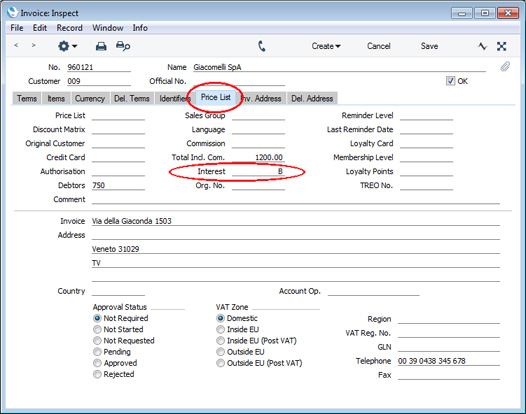

- If you have several Interest Codes, you can specify them yourself in individual Invoices, using the Interest field on the 'Price List' card and using 'Paste Special' to choose the correct one. If you have specified an Interest Code in an individual Invoice, it will be used instead of the one in the Interest setting.

The Interest field in an Invoice can store an interest rate or an Interest Code. If you enter a number in this field, it might be confusing later. For example, if you enter "1" in this field intending to refer to Interest Code 1, it will invoke Interest Code 1, but if you review the Invoice later this might not be apparent immediately (at first glance, it might appear that interest will be charged at 1%). So, as mentioned in step 1, it is recommended that you always include at least one alpha character in your Interest Codes.

---

Settings in the Sales Ledger:

Go back to:

|