Sales Invoice Settings

This setting contains various options that you can use to control the behaviour of Sales Invoices.

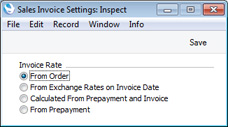

To work with this setting, first ensure you are in the Sales Ledger and then click the [Settings] button in the Navigation Centre or use the Ctrl-S/⌘-S keyboard shortcut. Double-click 'Sales Invoice Settings' in the resulting list. The 'Sales Invoice Settings Inspect' window opens, as illustrated below. When you have selected the option that you need, click the [Save] button in the Button Bar to save the changes. To close the window without saving changes, click the close box.

- Invoice Rate

- These options control how the Base and Exchange Rates will be set in a new Sales Invoice when it is created in the following circumstances:

- Invoice created from Sales Order or Delivery

- If you are using the From Order or the From Prepayment options, the Base and Exchange Rates will be copied from the Sales Order. Otherwise, the latest Base and Exchange Rates will be used in the Invoice, although the prices in Currency will not be changed. This means the Customer will still be charged the agreed price, but the value of the Invoice in your home Currency (and therefore in the Nominal Ledger) will be different to that of the Order.

- If you are using the Update Base Currency when Invoicing and/or Update Foreign Currency when Invoicing options in the Account Usage S/L setting, the latest Base and/or Exchange Rates will be used, irrespective of the option that you choose here.

- Invoice connected to Prepayment

- If you are using either of the first two options, the Base and Exchange Rates that are already in an Invoice will be retained when you connect it to a Prepayment. If you are using either of the last two options, the Base and Exchange Rates in the Invoice will be changed to those in the Prepayment.

- Note: the third option is intended for use in Ukraine. Elsewhere, if you need Prepayment Base and Exchange Rates to be copied to Invoices, use the fourth option.

---

Settings in the Sales Ledger:

Go back to: