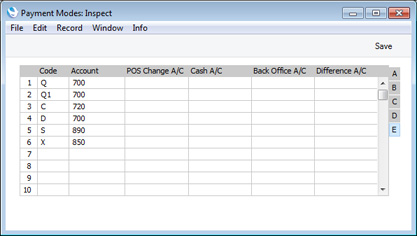

Payment Modes - Flip E

This page describes Flip E of the Payment Modes setting. Please click the following links for descriptions of the other parts of the setting:

---

- POS Change A/C

- Paste Special

Account register, Nominal Ledger/System module

- This Account will be used from Sales Ledger Invoices that you enter using the Touch-Screen interface and from POS Invoices. When a Customer overpays using cash or a credit card and requires the difference to be paid back in cash, the full amount paid by the Customer will be debited to the Cash or Credit Card Account (the Account on flip A of the Payment Mode) and the change will be credited to the POS Change Account. This allows the change to be visible in the Nominal Ledger.

- You can specify a POS Change Account for a particular Payment Mode using this field, and you can also specify an overall POS Change Account on the 'Debtors' card of the Account Usage S/L setting. In the case of Sales Ledger Touch-Screen Invoices only, the POS Change Account will be taken from the Payment Mode or, if blank, from Account Usage S/L. In the case of POS Invoices, this POS Change Account will not be used so it will always be taken from Account Usage S/L.

- If you do not specify a POS Change Account or the POS Change Account is the same as the Cash or Credit Card Account, then the sale value will be debited to the Cash or Credit Card Account (i.e. the change will not be recorded in the Nominal Ledger).

- Cash A/C

- This Account is also on flip D. Please refer here for details.

- Back Office A/C

- Paste Special

Account register, Nominal Ledger/System module

- The Back Office Account will be used in the Point of Sales and Restaurant modules when you record cash movements into and out of your Till Drawers. You should use Cash Events to record such cash movements (i.e. the Cash Events setting in the Point of Sales module or the Cash Event register in the Restaurant module). Examples include placing a cash float into a Till Drawer, and removing the day's takings from the Drawer to the back office.

- You will need to specify a Payment Mode whenever you record a Cash Event. For example, placing a cash float into a Till Drawer and removing cash at the end of a session will typically require a Payment Mode that updates a Cash Account, while removing cheques and credit card slips from the Till at the end of the session may require Payment Modes that update different Accounts.

- At the end of a work session, you will need to record the day’s transactions in the Nominal Ledger. One way to do this is by running the 'Cash Up' Maintenance function. One of the tasks carried out by this function will be to create a Cash Event that moves the contents of the Till to the back office (if you haven't already done this by entering such a Cash Event yourself). It will also post all Cash Events from the session to the Nominal Ledger. Another way is to create a POS Balance record. When you mark a POS Balance record as OK and save, all Cash Events from the session will be posted to the Nominal Ledger. Please refer to step 5 here for more details.

- In the Nominal Ledger Transaction created by the 'Cash Up' function or the POS Balance record, the Back Office Account will be credited with the value of any cash that you place in a Till Drawer (i.e. it will be credited from Cash In Events) and debited with the value of cash, cheques and/or credit card slips that you remove from the Till Drawer (i.e. it will be debited from Cash Out Events). In both cases, the balancing posting will be to the Account on flip A of the relevant Payment Mode.

- In a Cash Event that you enter yourself, the Back Office Account will be chosen as follows:

- The Cred. A/C specified in the Cash Event itself will be used.

- The Back Office A/C in the POS Settings setting will be used.

- The Back Office A/C on flip E of the relevant Payment Mode will be used.

In the Cash Event created by the 'Cash Up' function that moves the contents of the Till to the back office, the Back Office A/C on flip E of the relevant Payment Mode will be used.

- If you have not specified a Back Office A/C in the POS Settings setting, the Back Office Account from the Payment Mode will therefore be credited at the beginning of the session by the Cash In Event that places a float in a Till and debited at the end of the session by the Cash Out Event that records the emptying of the Till. If you have specified a Back Office A/C in the POS Settings setting, this Account will be credited by the Cash In Event that places the float in the Till, but the Back Office Account from the Payment Mode will still be debited at the end of the session. For example, it may be that cash floats will all be supplied from the same Cash Account, but at the end of the day cash from a Till will go back to the Cash Account but cheques and credit card slips will go to the bank.

---

Settings in the Sales Ledger:

Go back to: