Entering a Receipt - Matrix Part 2 (Flips F-J and Footer)

This page describes the fields on flips F-J of the matrix in the Receipt window, and the fields in the footer of the same window. Please follow the links below for descriptions of the other cards:

---

Flip F- Objects

- Paste Special

Object register, Nominal Ledger/System module

- Default taken from Invoice ('Terms' card) or Contact record for the Customer (Sales Objects), and Payment Mode

- You can assign up to 20 Objects, separated by commas, to each Receipt row. This will allow detailed analysis by department or cost centre.

- In the Nominal Ledger Transaction is generated from a Receipt, these Objects will be assigned as follows:

- By default, they will be assigned to the credit posting to the Debtor Account.

- If you are using the Objects on Bank A/C option in the Account Usage S/L setting, they will be assigned to the debit posting to the Bank or Cash Account. This will be in addition to any Objects specified in the Payment Mode, which will always be assigned to the Back or Cash Account.

- If you are using the Objects on VAT Account option in the same setting ('VAT / Tax' card) together with the Post Receipt VAT and/or Post Prepayment VAT options, they will be assigned to all VAT postings.

- If you specify an Invoice Number on flip A, Objects will be copied here from the 'Terms' card of that Invoice, providing you are using the Objects on Debtors Account option in the Account Usage S/L setting.

- In the case of On Account Receipts and Prepayments, Objects will also be copied here, providing you are again using the Objects on Debtors Account option. When you enter a Customer Number for an On Account Receipt or for a Prepayment that is not connected to a Sales Order, they will be taken from the Sales Objects field on the 'Accounts' card of the Contact record for the Customer. When you enter an Order Number in the Order No. field on flip D for a Prepayment that is connected to a Sales Order, they will be taken from the Objects field on the 'Terms' card of the Order.

- Objects from the Payment Mode will also be copied to this field.

Flip G- Round Off A/C, Round Off

- These fields will be used in the situation where an Invoice is to be treated as fully paid if the Received Value is slightly different to the amount that is outstanding, providing that the difference is within an allowable margin. The difference will effectively be written off.

- For example, if the allowable margin is 0.50 and you receive a cheque underpaying an Invoice by 0.35, the 0.35 will be written off (posted to a write-off Account) and the Invoice will be treated as fully paid. When you save the Receipt in this example, 0.35 will be placed automatically in the Round Off field, and the write-off Account will be placed in the Round Off A/C field. But, if the cheque underpays the Invoice by 0.65, that amount will remain outstanding. In this case, the Round Off and Round Off A/C fields will remain empty.

- If you want to use this feature, set the allowable margin in the Automatic Round Off Limit and Automatic Write Off Limit fields on the 'Round Off' card of the Currency record for the Received Currency. The Write Off Limit will be used when the Received Currency is the same as the Currency in the Invoice being paid, while the Round Off Limit will be used when the Received Currency is different to the Invoice Currency. The remaining outstanding amount on an Invoice will be written off if it is less than the Write Off or Round Off Limit when expressed in the Invoice Currency.

- The Round Off A/C will be taken from the 'Exchange Rate' card of the Account Usage S/L setting on the following basis:

- Write Offs Gain, Write Offs Loss

- Used when the Received Currency is the same as the Invoice Currency, and the Received Currency is not a member of the EMU;

- Rate Round Off

- Used when the Received Currency is different to the Invoice Currency, and the Received Currency is not a member of the EMU;

- EMU Rate Round Off

- Used when the Received Currency is different to the Invoice Currency, and the Received Currency is a member of the EMU;

- EMU Rate Write Off

- Used when the Received Currency is the same as the Invoice Currency, and the Received Currency is a member of the EMU.

- You can change the Round Off A/C in a Receipt row if necessary. However the Round Off figure will be recalculated each time you save the Receipt, so cannot be changed.

- If you set Write Off and Round Off Limits in a Currency record, the same limits will be used in both the Sales and Purchase Ledgers. You will therefore be implementing the feature in both Ledgers.

- You can set Write Off and Round Off Limits in the Currency record that represents your home Currency, meaning you can use this feature as an easy way of automatically writing off small outstanding amounts in domestic Invoices (i.e. those in your home Currency), reducing the need to use the 'Write off Invoices' Maintenance function.

- For more details about this feature, please refer to the pages describing the 'EMU' and 'Round Off' cards of the Currency window.

- Instalment

- Paste Special

Open (unpaid) Instalments

- If an Invoice is payable in instalments, specify the instalment being paid here. An Invoice is payable in instalments if it has a Payment Term that refers to a record in the Instalments setting.

- If you have specified an Invoice Number on flip A, the 'Paste Special' function will only list the open instalments for that Invoice. If you have not specified an Invoice Number, the 'Paste Special' function will list the open instalments for all Invoices.

- When you choose an instalment, the Bank and Received Values will change to the open instalment value and, if the relevant fields were previously blank, other related information will be such as Customer Number and Invoice Number will be brought in as well.

- Reference Number

- Default taken from

Invoice (Reference)

- The Reference is used in Argentina, where you must enter a Withholding Certificate Number in the Reference Number field in a row if the Type of the Payment Mode applying to the row is "Withholding", "Regional Withholding", "Social Insurance Withholding" or "VAT Withholding". This information will be included in export files created by the 'Regional Withholdings (Argentina)' Export function in the Sales Ledger and in the Customer Withholdings report. Please refer to your local HansaWorld representative for more details.

- You can also use this field in Australia to ensure Receipt rows are exported separately by the 'Export Direct Debit' function on the Operations menu of the 'Receipts: Browse' window.

Flip H- Debtors A/C

- Paste Special

Account register, Nominal Ledger/System module

- This field shows the Debtor Account that will be credited from the Receipt row, when you mark the Receipt as OK and save it.

- If you enter an Invoice Number on flip A, the Debtor Account from the Invoice will be brought in.

- If you leave the Invoice Number blank and enter a Customer Number on flip A or an Order Number on flip D, the relevant On Account A/C for that Customer will be brought in.

- In both cases, you can change the Account if necessary.

- Comment

- Record here any comment about the Receipt row. If you use the 'Workflow Activity' function on the Create menu (Windows/Mac OS X) or + menu (iOS/Android) to create an Activity from a Receipt row, this Comment will be copied to the Text field in the Activity.

Flip I- To B. Cur. 1

- This field is also on flip J and is described below.

- Bank Amt in Cur. 1

- The amount received, expressed in Base Currency 1.

- In normal circumstances, the Bank Amount and Received Value fields on flip A are sufficient to express the value of the Receipt. If the Received Currency and Bank Currency are different, the Nominal Ledger Transaction resulting from the Receipt will contain values in all appropriate Currencies, converted using the Exchange and Base Rates applying on the Transaction Date.

- If you know the exact value of the Receipt in Base Currency 1 as added to your bank account, you can either change the Bank Amount (assuming the Bank Currency is Base Currency 1) or you can enter the exact figure in Base Currency 1 here. The first of these choices will post the difference between the original Bank Amount and your amended figure to the Bank Rate Gain or Loss Account (specified on the 'Exchange Rate' card of the Account Usage S/L setting), while the second will post the differences to the Rate Gain or Loss Account specified in the same setting. Please refer here for full details and an example.

- If you don't know the value of the Receipt in Base Currency 1, but you do know the exchange rate, you can use the fields on flip J to enter that exchange rate. A calculated value will then be placed in this field.

- This field must contain a value if so specified for the Payment Mode (using the Force field on flip D).

- Bank Amt in Cur. 2

- The amount received, expressed in Base Currency 2.

- This field must contain a value if so specified for the Payment Mode (using the Force field on flip D).

Flip J- Rate, To B. Cur. 1, To B. Cur. 2

- In a Receipt where the Received Currency and Bank Currency are different and you know the exact value of the Receipt in Base Currency 1, you can enter that value in the Bank Amt. in Cur. 1 field on flip I. Please refer to the description of that field above for the implications.

- If you don't know the value of the Receipt in Base Currency 1, but you do know the exchange rate, you can use these fields to enter that exchange rate. If the Bank Currency is Base Currency 1, this means the exchange rate between the Received Currency and Base Currency 1. If the Bank Currency is not Base Currency 1, this means the exchange rate between the Bank Currency and Base Currency 1. A calculated value will then be placed in the Bank Amt. in Cur. 1 field (and in the Bank Amount field if the Bank Currency is Base Currency 1).

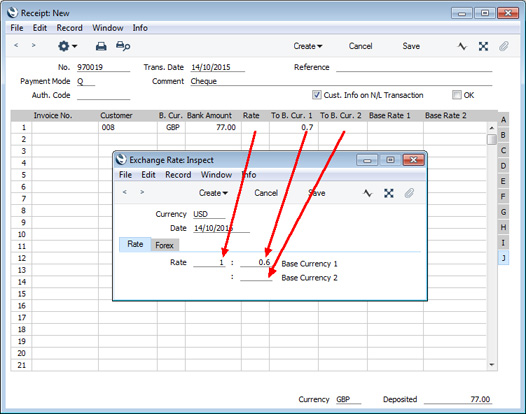

- Each of these fields corresponds to one of the fields in the Exchange Rate record, as shown in the illustration below:

If you make an entry in one of these fields, you are effectively overriding the corresponding field in the Exchange Rate record. For example, the Exchange Rate in the illustration states that 1 USD will buy 0.6 in Base Currency 1. 0.7 has been entered in the To B. Cur. 1 field in the Receipt row, changing the exchange rate for that row to 1:0.7 (the Rate and To B. Cur. 2 fields are blank in the Receipt row, signifying that these figures are still to be taken from the corresponding fields in the Exchange Rate record).

- If you have entered your Exchange Rates so that they express how many units of the foreign Currency will be bought by one unit of Base Currency 1, you will have an Exchange Rate of 1.6666:1 instead of 1:0.6. To make the equivalent change in a particular Receipt row, enter 1.42857 in the Rate field to change to 1.42857:1.

- As changing the exchange rate will cause a calculated value to be placed in the Bank Amt. in Cur. 1 field, the difference between the original Bank Amount and your amended figure will be posted to the Rate Gain or Loss Account (specified on the 'Exchange Rate' card of the Account Usage S/L setting).

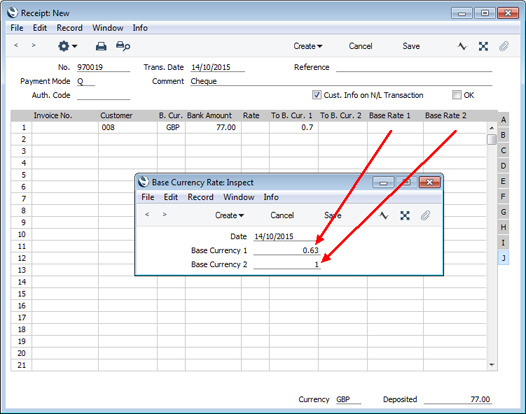

- Base Rate 1, Base Rate 2

- If you are using the Dual-Base Currency conversion system, you can use these two fields to set the exchange rate between your two Base Currencies for a particular Receipt row.

- Where the Rate, To B. Cur. 1, To B. Cur. 2 fields described immediately above each correspond to a field in the Exchange Rate record, in a similar manner these fields both correspond to a field in the Base Currency Rates record, as shown in the illustration below. If you enter a figure in one of these fields, you will overrule the figure in the corresponding field in the Base Currency Rates record.

Footer- Currency

- If every row in a Receipt has the same Bank Currency, that Currency will additionally be shown here so that it can be displayed in the 'Receipts: Browse' window.

- Deposited

- The sum of the Bank Amounts: the total for the Receipt. This field will only contain a value if every row in the Receipt has the same Bank Currency.

---

The Receipt register in Standard ERP:

Go back to:

|