VAT and Zones

When you sell or purchase an Item, the calculation of VAT will be controlled by two factors: the VAT Code and the Zone of the Customer or Supplier. Whenever you specify a VAT Code (e.g. in an

Item record or when setting overall defaults in the

Account Usage S/L and

Account Usage P/L settings), you should do so for each Zone.

When you sell an Item, the correct VAT Code for the Zone of the Customer will be placed in the Quotation, Order or Invoice automatically. VAT will then be calculated as follows, depending on the Zone:

- Domestic, Inside EU (Post VAT), Outside EU (Post VAT)

- VAT will be calculated according to the percentage in the VAT Codes setting. In the Nominal Ledger Transaction resulting from the Invoice, VAT will be credited to the Output Account from the VAT Code and debited to the Debtor Account.

- Inside EU, Outside EU

- VAT will not be calculated, even if the VAT Code is not zero-rated. The Nominal Ledger Transaction resulting from the Invoice will not include a VAT element.

When you purchase an Item, the correct VAT Code for the Zone of the Supplier will be placed in the Purchase Order or Purchase Invoice automatically. VAT will then be calculated as follows, depending on the Zone:

- Domestic, Inside EU (Post VAT), Outside EU (Post VAT)

- VAT will be calculated according to the percentage in the VAT Codes setting. In the Nominal Ledger Transaction resulting from the Purchase Invoice, VAT will be debited to the Input Account from the VAT Code and credited to the Creditor Account.

- Inside EU

- Invoices received from other countries in the EU do not carry VAT. However, depending on the nature of the Invoice, VAT can be payable.

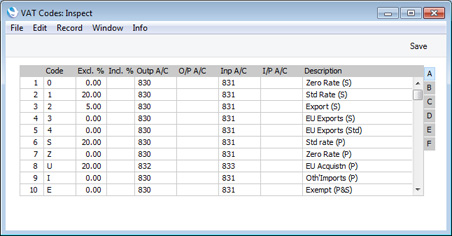

- VAT will be calculated according to the percentage in the VAT Codes setting. In the Nominal Ledger Transaction resulting from the Purchase Invoice, VAT will be debited to the Input Account from the VAT Code and credited to the Output Account from the VAT Code. Therefore, you may need to use a dedicated VAT Code for VAT on EU Acquisitions, with an Output Account that is not used in any other VAT Code (VAT Code "U" in the illustration below).

- Outside EU

- VAT will not be calculated. The Nominal Ledger Transaction resulting from the Invoice will not include a VAT element.

You cannot change the Zone in a Quotation, Order, Invoice or other transaction. You must therefore take care to specify the correct Zone for each Customer and Supplier.

---

In this chapter:

Go back to: