Prepayments and On Account Receipts

Prepayments and On Account Receipts allow you to receive payments from Customers without reference to specific Invoices (usually before you have raised the Invoices). Prepayments are identified by Prepayment Numbers, while On Account Payments have no identifiers. Please click for full details of

Prepayments and

On Account Receipts.

A typical workflow when working with Prepayments and On Account Receipts will be that you will receive a Sales Order together with a deposit. You will record the deposit as an On Account Receipt or a Prepayment. When you issue an Invoice (for the deposit or for the Order as a whole), you will allocate the deposit to that Invoice, leaving any remaining amount on the Invoice as outstanding.

If you use On Account Receipts, a single On Account balance will be maintained for each Customer. When you receive a deposit, the balance will increase, and when you issue an Invoice, the balance will decrease. In reports, it is only possible to display a single On Account balance figure for each Customer. Prepayments are identified by Prepayment Numbers, allowing separate balances to be maintained for each Prepayment. When you receive a deposit, you will create a new Prepayment, leaving the balances of any other Prepayments received from the same Customer untouched. This allows for the detailed monitoring of Prepayments. When you issue an Invoice, you will connect it to a particular Prepayment, again leaving the balances of other Prepayments untouched. Identification by Prepayment Number allows much greater detail to be shown in reports: for example, the Prepayment History S/L report will list every transaction affecting each Prepayment.

You must use Prepayments for deposits that you receive in foreign Currencies. The added precision given to a Prepayment by its identifying Prepayment Number means that it can be received at a known exchange rate. When you allocate the Prepayment to an Invoice at a later date, the exchange rate might have changed and this can be accounted for. If you use an On Account Receipt for this purpose, receiving a deposit will simply mean that the size of the Customer's On Account balance will be increased. When you allocate the deposit to an Invoice, it will not be possible to establish the origin of the funds withdrawn from the On Account balance as On Account Payments have no identifiers. Therefore it will not be possible to account for exchange rate differences.

If you need to enter Prepayments and On Account Receipts, you must first carry out the following configuration work:

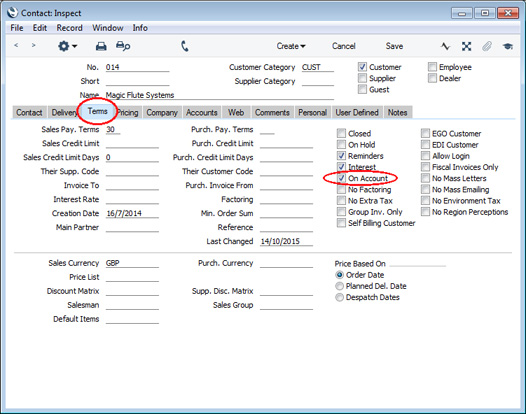

- In the Contact records for each Customer likely to pay deposits, tick the On Account check box on the 'Terms' card:

If you have specified an "Invoice To" Customer for a particular Customer, you should tick the On Account box in the Contact record for the "Invoice To" Customer as well. You will usually specify an "Invoice To" Customer for a Customer who will not pay your Invoices themselves but may, for example, be purchasing through a leasing company or a parent company.

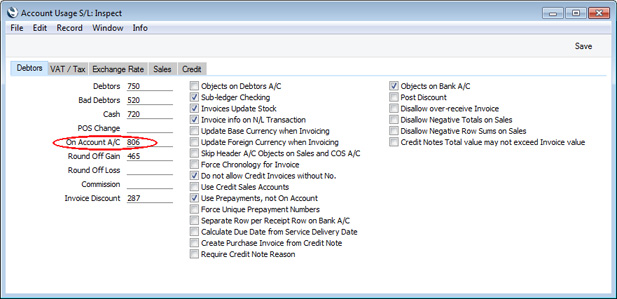

- Specify a default control or suspense Account on the 'Debtors' card of the Account Usage S/L setting, using the On Account A/C field. The Account that you specify here will be credited with the value of each Prepayment and On Account Receipt, and thus should usually be an Account that acknowledges that receiving a deposit creates a liability.

You can also specify separate suspense Accounts in each Customer Category, using the Debtors On Account A/C field, if you wish.

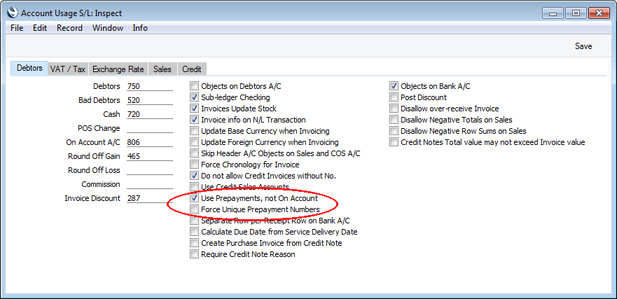

- If you want to make sure that you only use Prepayments (i.e. you want to prevent the use of On Account Receipts), select the Use Prepayments, not On Account option, also on the 'Debtors' card of the Account Usage S/L setting. This option will mean it will be mandatory to enter either an Invoice Number or a Prepayment Number in every Receipt row. This will be useful if you will receive deposits in foreign Currencies as previously mentioned, and may also be helpful if you need to post VAT from Prepayments. The Use Prepayments, not On Account option applies to both the Sales and Purchase Ledgers, so it will prevent the use of On Account Payments in the Purchase Ledger as well.

A second option in the same setting is Force Unique Prepayment Numbers. Select this option if you would like to ensure that every Prepayment has a unique number. In other words, you will only be able to use a particular Prepayment Number in a single Receipt row (with one exception: you will be able to use a Prepayment Number again if the Received Value is negative i.e. if you need to cancel a Prepayment). If you are not using this option, you will be able to use the same Prepayment Number more than once, but only with the same Customer and, if a Prepayment is in Currency, only with the same exchange rate.

- If you need VAT to be posted from Prepayments and On Account Receipts, select the Post Prepayment VAT and/or Post Receipt VAT options respectively on the ' VAT / Tax' card in the Account Usage S/L setting.

You should also specify the following Accounts:

- O/P Accounts for each VAT Code in the VAT Codes setting (these Accounts will be credited with the VAT Value from each Prepayment and On Account Receipt).

- VAT (A/C) Account in the Account Usage S/L setting (this Account will be used if a particular VAT Code does not have an O/P Account).

- Prepayment VAT Account in the Account Usage S/L setting (this Account will be debited with the VAT Value from each Prepayment and credited when you connect a Prepayment to an Invoice).

- A final option to consider is the Use Sales Order No. for Prepayments option in the Down Payments setting in the Sales Orders module. Select this option if you need every Prepayment to be connected to a Sales Order. If you are also using the Force Unique Prepayment Numbers option, the combination will mean you will only be able to receive a single Prepayment against a particular Sales Order.

Please click the following links for more details about:

---

The Receipt register in Standard ERP:

Go back to: