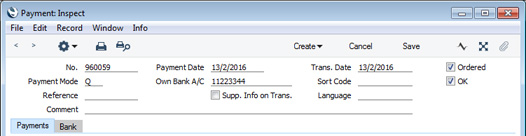

Entering a Payment - Header

This page describes the fields in the Header of the Payment record. Please follow the links below for descriptions of the other cards:

---

- No.

- Paste Special

Select from another Number Series

- The unique identifying number of the Payment. The default will be chosen as follows:

- It will be taken from the number sequence allocated to the current user on the 'Number Series' card of their Person record.

- It will be taken from the number sequence specified in the Number Series Defaults setting in the System module.

- It will be taken from the first valid row in the Number Series - Payments setting.

- It will be the next number following on from the last Payment entered.

You may change the default, but not to a number that has already been used. If you have defined at least one number sequence in the Number Series - Payments setting, the number you change to must be inside a valid number sequence.

- You will not be able to save a Payment if the No. does not belong to a valid number sequence. A valid number sequence is one for the period in which the Transaction Date of the Payment falls and with unused numbers, so this problem will most usually occur at the beginning of a new calendar or financial year. If you change number sequences each year, remember to update your Person records and Number Series Defaults setting if you are using them (steps 1 and 2 above) so that they refer to the new number sequences.

- If you are working in a multi-user environment, the Payment Number will be assigned when you save the Payment for the first time, chosen as described above and providing you have not already specified a number yourself.

- If you have used the Payment Modes setting to define separate number sequences for each Payment Mode and are using the Common Number Series option in the Cash Book Settings setting, the Payment Number will be determined by the default Payment Mode and will change if you change the Payment Mode. Number sequences defined in the Payment Modes setting are not shown in the 'Paste Special' list.

- Payment Mode

- Paste Special

Payment Modes setting, Sales/Purchase Ledger

- The Payment Mode represents both the method of payment (e.g. cheque, credit card or cash) and the Account from which the payment will be issued (e.g. a particular bank account or petty cash). It determines the Nominal Ledger Account that will be credited by the Payment.

- The 'Paste Special' list will display the current balances of the Accounts specified in each Payment Mode. If you have Payment Modes representing different bank accounts, this will help you choose the one that will issue the Payment.

- You can enter payments to different Suppliers against different Invoices in a single Payment record. You can also enter payments with different Payment Modes by specifying Payment Modes in the individual Payment rows (flip C). If a Payment row has its own Payment Mode, the Nominal Ledger Account in that Payment Mode will be credited from that row.

- If you have used the Payment Modes setting to define separate number sequences for each Payment Mode and are using the Common Number Series option in the Cash Book Settings setting, the Payment Number will be determined by the default Payment Mode and will change if you change the Payment Mode.

- If you pay a Supplier using cash, you can record your payment as a Payment using an appropriate Payment Mode (one that credits the Cash Account), or you can use the Cash Out register in the Cash Book module ('Payments' card).

- If the Payment Mode is one in which you have specified a Form Template on flip B, this Form Template will be used when you print the Payment, in place of the Form Template specified in the 'Form Definition' window for the Payment Forms form.

- Reference

- You can use this field if you need to identify the Payment by any means other than the Payment Number. This Reference will be copied to the Reference field in the Nominal Ledger Transaction generated from the Payment.

- The Reference will be shown in the 'Payments: Browse' window, allowing you to search for a Payment with a particular Reference. You can also use the Payment Journal report to list Payments with a particular Reference.

- The Reference will be included in Banking File export files when you are using the following Payment File Formats:

- Comment

- Default taken from

Payment Mode

- This text will be taken from the Payment Modes setting and will be copied to the Text field in the header of the Nominal Ledger Transaction that will result from the Payment. You can change it if necessary.

- Payment Date

- Paste Special

Choose date

- The date when you want the Payment to be executed.

- Once you have Ordered a Payment, you can still change the Payment Date. After marking it as OK and saving, however, no further changes will be possible.

- Changing the Payment Date will usually cause the Transaction Date (below) to change as well. If you are using the Allow Trans. Date Changing option in the Transaction Settings setting in the Nominal Ledger, you will be able to change the Transaction Date if necessary. If you are not using this option, the two Dates must be the same and you will only be able to change the Payment Date, not the Transaction Date.

- Own Bank A/C

- Default taken from

Payment Mode

- The number of the bank account from where you will issue the Payment. This information will be brought in from the Payment Mode.

- The bank account specified here will in most cases be quoted in Banking File export files as the payer bank account. This will be the case even if you specify a Payment Mode with a different Bank A/C No. in an individual Payment row. So, if you use Banking File exports, it is not recommended that you specify Payment Modes in individual Payment rows, because your bank may not take the payment from the account that you are expecting.

- Supp. Info. on Trans.

- Default taken from

Account Usage P/L setting, Purchase Ledger (Supp. Info. on Trans. check box)

- When a Nominal Ledger Transaction is generated automatically from a Payment, this option will cause the Purchase Invoice Number, Payment Date and Supplier to be copied to flip E of the Transaction row(s) posting to the Creditor Account.

- You should use this option if you want to use the Creditors Account report in the Nominal Ledger. This report lists debit and credit postings to the Creditor Account, organised by Supplier. In order to provide this analysis, the report needs the Supplier Number to be copied to flip E of each Transaction row posting to the Creditor Account.

- Trans. Date

- This date will be used as the Transaction Date in the Nominal Ledger Transaction that will result from the Payment.

- If you change the Payment Date (above), the change will usually be copied to this field. If you are not using the Allow Trans. Date Changing option in the Transaction Settings setting in the Nominal Ledger, you will not be able to change this date in any other way. This effectively means that this date will always be the same as the Payment Date. If you are using the Allow Trans. Date Changing option, you will be able to change this date, allowing the Payment and Transaction Dates to be different.

- Sort Code

- Default taken from

Payment Mode

- The Sort Code (branch number) of the bank where the account from where you will issue the Payment is held.

- Language

- Paste Special

Languages setting, System module

- You can use the Language to determine the Form Template that will be used when you print the Payment, and the printer that will be used to print it. This can include sending the document to a fax machine, if your hardware can support this feature. Do this in the 'Form Definition' window for the Payment Forms form, as described here.

- You can also use the Language to determine the text that will appear in Mails created from Payments. Please refer to the description of the 'E-Mail' function on the Create menu (Windows/Mac OS X) or the + menu (iOS/Android) for details.

- Ordered

- The Ordered and OK check boxes are provided to allow for the delay between the issuing of a Payment and the clearing of the funds from your company's bank account. Checking the Ordered box indicates that you have issued a Payment, while checking the OK box indicates that the funds have been cleared. You must therefore check the Ordered box before the OK box.

- When you save a Payment with its Ordered box checked, the Invoice(s) being paid will no longer be treated as open, even if you have not checked the OK box.

- Once you have issued a Payment, it may occasionally transpire that the funds were not cleared from your company's bank account (perhaps because the cheque bounced or was lost). If you are using Windows or Mac OS X, highlight each row in the Payment in turn by clicking the row number and then press the Backspace key. If you are using iOS or Android, long tap on the row number on the left of the relevant row and select 'Delete Row' from the resulting menu. A red line will be drawn through the row, invalidating it and re-opening the Purchase Invoice. You can also invalidate an entire Payment by selecting 'Invalidate' from the Record menu (which has a 'cog' icon if you are using iOS or Android).

- You can use Access Groups to prevent certain users from marking Payments as Ordered. To do this, deny them access to the 'Order Payment' Action.

- If you need Payments to pass through an approval process before you can mark them as Ordered, you can configure such a process using the Approval Rules register in the Business Alerts module. The same approval process will also control access to the OK box i.e. after a Payment has passed through the same approval process, you will be able to tick both the Ordered and OK check boxes. Please refer to the description of the Approval Status field on the 'Bank' card for brief details about the approval process and here for full details.

- OK

- When you tick this box and click [Save] (Windows/Mac OS X) or tap √ (iOS/Android) to save the Payment, a Nominal Ledger Transaction will be generated, if you have so determined in the Sub Systems setting in the Nominal Ledger and in the Number Series - Payments setting. This Transaction will credit the Bank Account specified for the Payment Mode and debit the Creditor Control Account(s) of the Invoice(s) being paid. No further modifications to the Payment will be possible.

- You can use Access Groups to prevent certain users from marking Payments as OK. To do this, deny them access to the 'OK Payments' Action.

- If you would like a warning to appear every time you save a Payment that you have not marked as OK, please refer to the Global Warnings on UnOKed Records setting in the System module.

- If you need Payments to pass through an approval process before you can mark them as OK, you can configure such a process using the Approval Rules register in the Business Alerts module. Please refer to the description of the Approval Status field on the 'Bank' card for brief details about the approval process and here for full details.

---

The Payment register in Standard ERP:

Go back to:

|