Create Menu - Invoice - VAT Correction S/L

This page describes the 'VAT Correction S/L' function on the

Create menu in the Invoice record window. If you are using iOS or Android, the 'VAT Correction S/L' function is on the + menu. This function will only be included on the Create or + menus if the VAT Law in the

Company Info setting in the System module is set to "Croatian", "Polish", "Serbian", "Slovenian" or "Ukrainian".

---

In some countries, once an Invoice has been posted to the Nominal Ledger, the posting to the Output VAT Account can be moved to a later month. This might be appropriate if the Invoice has been raised before the goods have been delivered. This is known as a "VAT Correction" or "VAT Movement". This function provides an easy way of doing this.

In order to be able to create VAT Corrections from Invoices, carry out the following configuration work:

- In the VAT Codes setting in the Nominal Ledger, specify an Output A/C Corr. (Output Correction Account) on flip C of each VAT Code.

- Select the Invoice info on N/L Transaction option in the Account Usage S/L setting.

- Check the options in the VAT Correction Settings setting in the Sales Ledger. Please refer to your HansaWorld representative for details about this setting.

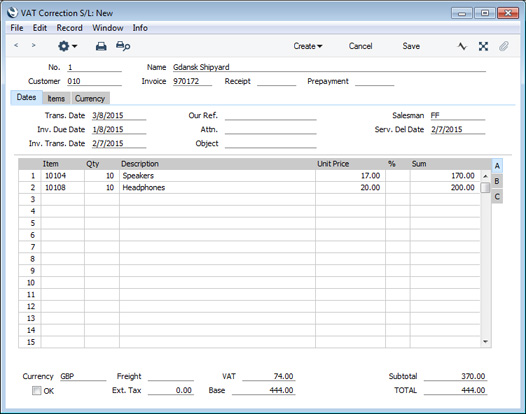

To create a VAT Correction from a particular Invoice, you must first have marked the Invoice as OK and you must have saved all changes to the Invoice (use the [Save] button (Windows/Mac OS X) or √ (iOS/Android)). Then, choose 'VAT Correction S/L' from the Create menu (Windows/Mac OS X) or + menu (iOS/Android). A new record will be created in the VAT Corrections S/L setting. It will be opened in a new window, entitled 'VAT Correction S/L: New', meaning that it has not yet been saved.

The Transaction Date on the 'Dates' card defaults to the current date. Enter the new date for the VAT posting in this field. Make any other changes that are necessary and, when you are sure the VAT Correction record is complete and correct, tick the OK box in the footer and save the record.

The results in the Nominal Ledger will be twofold:

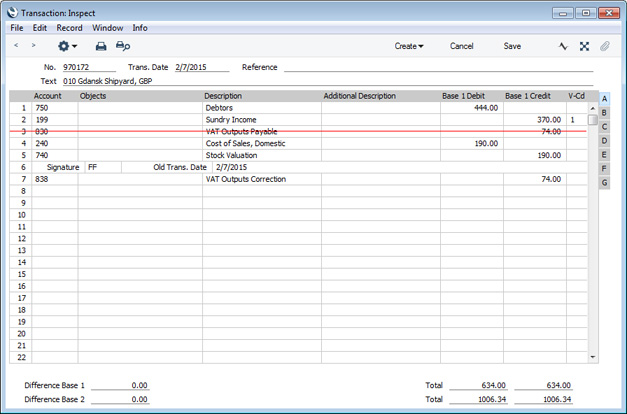

- In the Transaction created from the original Invoice, the posting to the Output VAT Account will be replaced by one to the Output VAT Correction Account.

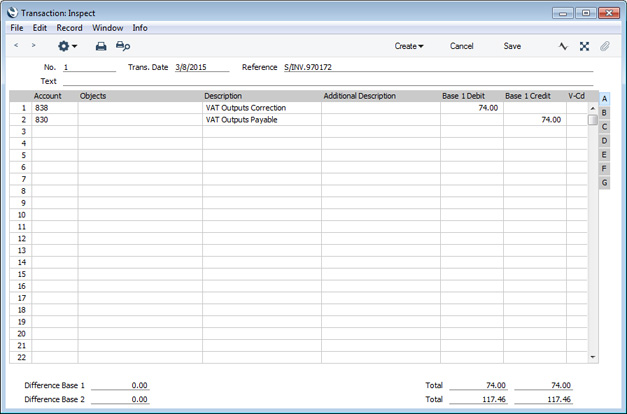

- A new Transaction will be created from the VAT Correction record, reversing the posting to the VAT Correction Account and crediting the Output VAT Account.

- If you created the VAT Correction record from a Credit Note, the postings will usually be reversed, so that the VAT Correction Account will be credited and the Output VAT Account will be debited. The exception is if you are using the Negative Amounts option in the Transaction Settings setting in the Nominal Ledger. In this case, negative amounts will be debited to the VAT Correction Account and credited to the Output VAT Account.

You can view past VAT Correction records using the VAT Corrections S/L setting in the Sales Ledger. You can also enter new records in the setting: type the Invoice Number into the new record to bring in the details of the Invoice.

After you have marked the VAT Correction as OK and saved, you will still be able to change the Transaction Date if necessary. To do this, open the record, choose 'Update Trans. Date' from the Operations menu and enter the new date in the Trans. Date field. You can also invalidate a VAT Correction record by selecting 'Invalidate' from the Record menu (which has a 'cog' icon if you are using iOS or Android).

---

The Invoice register in Standard ERP:

Go back to: