Tax Templates - Workflow and Examples - Selling a Tax-Exempt Item

This example describes using Tax Templates to collect and report sales tax.

The example is based on a store in a county where sales are subject to two taxes: the state sales tax (6%); and a county tax (1%). To begin with, the store will only sell to Customers in the same county.

Please refer here for a list of the configuration steps.

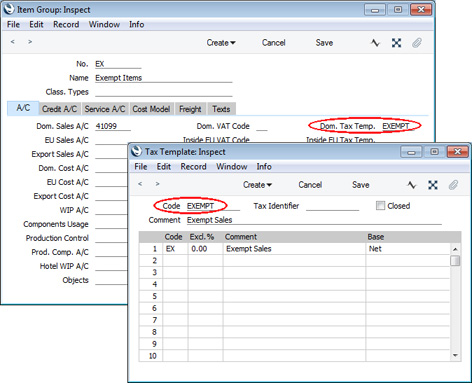

In this part of the example, we will sell an Item that is exempt from tax. We created a suitable "EXEMPT" Tax Template in step 3 on the Configuration page and assigned it to an Item Group for tax-exempt Items in step 4.

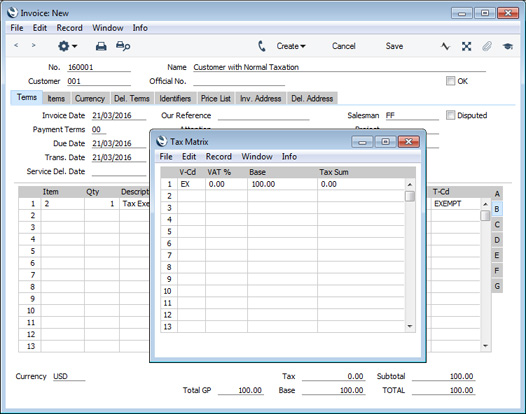

- When you create an Invoice and specify an Item, a Tax Template will be brought in to the T-Cd field on flip B. In this example, as we are selling an Item that is exempt from tax, the "EXEMPT" Tax Template will be brought in from the Item Group to which the Item belongs:

It might be that we sell a taxable Item but the sale is not taxable (e.g. the Customer holds a certificate of tax exemption, or is purchasing the Item for resale). If all sales to the Customer are tax-exempt, we would specify the "EXEMPT" Tax Template in the Contact record for the Customer as illustrated in step 4 on the Configuration page, and the Invoice would be the same as illustrated above. Otherwise (i.e. if we have not specified the "EXEMPT" Tax Template for the Customer, because only some sales to the Customer are tax-exempt) we would need to change the Tax Template in the Invoice row as appropriate.

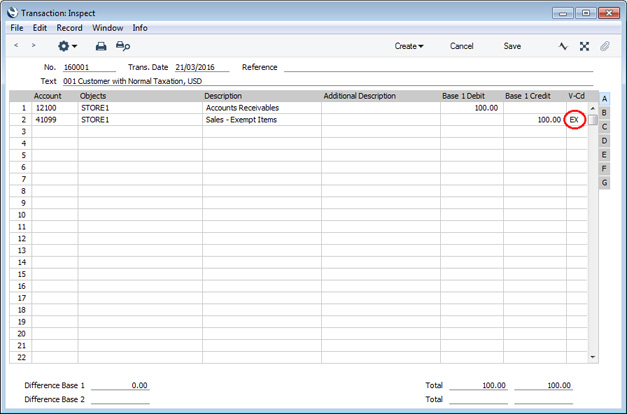

- In the Nominal Ledger Transaction that results from the Invoice, no tax will be included, while the "EX" VAT Code will be assigned to the posting to the Sales Account:

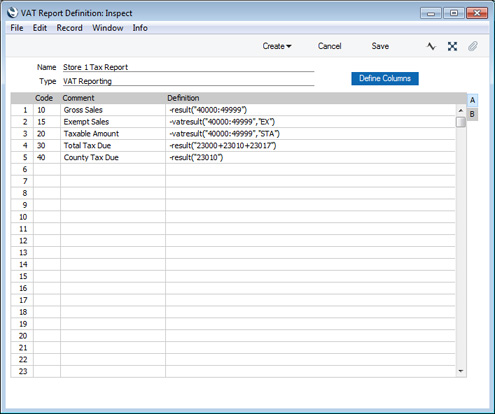

- In this next step, we will add a row to the VAT Report Definition to print the value of tax-exempt sales during the report period:

| Row 2 | -vatresult("40000:49999","EX") | This row will print the total value of sales made with the "EX" VAT Code (i.e. the VAT Code representing exempt sales). In other words, this row prints the total value of tax-exempt sales. |

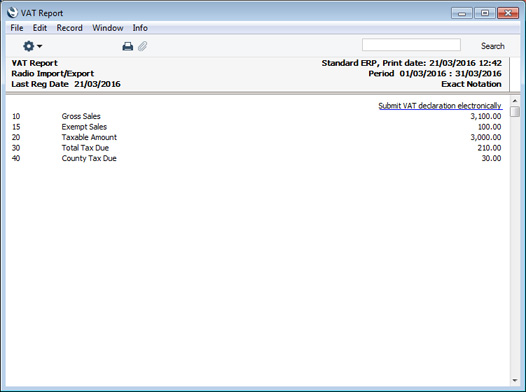

This is the resulting report:

Tax Template Examples:

---

Settings in the Nominal Ledger:

Go back to: