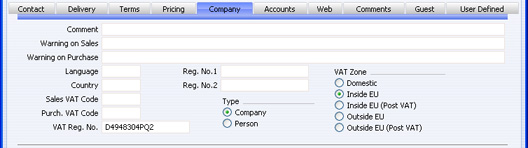

Entering a Contact - Company Card

- Comment

- If the Contact is a Supplier, text entered here will be copied to the Comment field of all their Purchase Invoices ('Other' card).

- Warning on Sales

- If the Contact is a Customer, text entered here will appear as a warning whenever you enter a Sales Order or Sales Invoice in their name.

- Warning on Purchase

- If the Contact is a Supplier, text entered here will appear as a warning whenever you enter a Purchase Order or Purchase Invoice in their name.

- Language

- Paste Special

Languages setting, System module

- You can design different versions of documents such as Invoices, Purchase Orders and Delivery Notes, containing text in various Languages. The appropriate version of each document will be printed for each Contact, depending on Language specified here. You can override this Language in individual Orders, Invoices, etc. In addition, some of the information shown on screen and in printed documents, such as Item Names, Payment Terms and Delivery Modes, will be in the appropriate translation.

- Reg. No. 1

- If the Contact is a limited company, enter their Company Registration Number here.

- The Customer Status report contains a [Credit History] text button that will open a separate report showing the Customer's credit history. This is a chargeable internet service: to use it you must have entered a Reg No 1 in this field for the Customer whose credit history you are interested in, and you must have registered your database in Estonia using the Automatic Internet Enabler method, as described on the 'Enabler Key' page.

- Country

- Paste Special

Countries setting, System module

- Enter the Country in which the Contact is located. If you then enter a VAT Number below, HansaWorld Enterprise will check it is in the correct format for the Country, assuming you have defined VAT Number formats for each Country in the VAT Number Masks setting in the System module.

- Reg. No. 2

- Paste Special

Registration Defaults setting, Sales Ledger

- This field is used in Finland, where companies have two registration numbers.

- Elsewhere, you can use the 'Paste Special' link to the Registration Defaults setting to bring in default Sales and Purchase VAT Codes and Language.

- Sales VAT Code

- Paste Special

VAT Codes setting, Nominal Ledger

- Purch. VAT Code

- Paste Special

VAT Codes setting, Nominal Ledger

- If the Contact is a Customer, the Sales VAT Code will determine the rate at which VAT will be charged in sales to this Contact and the Output VAT Account to be credited.

- When you create Sales Orders or Sales Invoices for this Customer, this Sales VAT Code will take precedence over the VAT Codes specified in the Item and the Item Group and on the 'Sales' card of the Account Usage S/L setting in the Sales Ledger. Usually, you should only specify a Sales VAT Code here for an individual Customer if for some reason your usual VAT accounting method does not apply to them.

- If the Contact is a Supplier, the Purch. VAT Code will determine the rate at which VAT will be charged to you by this Contact and the Input VAT Account to be debited.

- When you enter Purchase Invoices for this Supplier directly to the Purchase Invoice register, this Purch. VAT Code will take precedence over the VAT Codes specified in the Account record and in the Account Usage P/L setting in the Purchase Ledger.

- Similarly, when you create Purchase Invoices for this Supplier from Goods Receipts, this Purch. VAT Code will take precedence over the VAT Codes specified in the Item and the Item Group and in the setting in the Purchase Ledger, but will be overridden by the VAT Code specified for the Item(s).

- VAT Reg No

- It is important that you record the Contact's VAT Number here if they are in the "Within EU" Zone as this information is required for EU VAT reporting purposes.

- When you save the record, there will be a that the VAT Number has not been used in any other Contact record. If this check fails, you will be warned, but you will still be able to save the record. To find the other Customer, open the 'Contacts: Browse' window using the F3/⌘-Shft-F keyboard shortcut and sort the list by VAT Reg. No.

- HansaWorld Enterprise can also check that the VAT Number entered here is in the correct format for the Country specified above. To use this feature, define the correct formats in the VAT Number Masks setting in the System module. If the Country above is blank, the check will be made using the Country from the Company Info setting (i.e. your own country). If that is blank, no validation check will be made. Because of this feature, be sure to enter the Contact's Country above before their VAT Number.

- Type

- Use these options to specify whether the Contact is a company or an individual person. This will affect the check that the VAT Number is correct in Argentina and Paraguay.

- VAT Zone

- Used as default in

Quotations, Sales and Purchase Orders, Sales and Purchase Invoices

- Select a Zone for this Contact. This will be used in Sales and Purchase Orders and in Sales and Purchase Invoices to control VAT calculation and accounting, and the choice of Sales Account. You can assign separate default sales VAT Codes and Sales Accounts to each Zone on the 'Sales' card of the Account Usage S/L setting in the Sales Ledger. You can assign separate default purchase VAT Codes to each Zone on the 'VAT' card of the Account Usage P/L setting in the Purchase Ledger.

- On the sales side, it is important that you record the VAT Numbers (see above) of Customers in the "Within EU" Zone.

- When you raise Sales Invoices for Customers in the "Within EU" and "Outside EU" Zones, VAT will not be charged, irrespective of the VAT Code used on the 'Sales' card of the Account Usage S/L setting. If you want VAT to be calculated and credited to the Output Account from the VAT Code in the normal way, place these Customers in the "Inside EU (Post VAT)" and "Outside EU (Post VAT)" Zones.

- Similarly, on the Purchase Side, VAT will not be calculated on Purchase Invoices received from Suppliers in the "Outside EU" Zone. If the Supplier is in the "Inside EU" Zone, VAT from Purchase Invoices will be debited to the Input Account from the VAT Code and credited to the Output Account from the VAT Code. For this reason, it is recommended that you use dedicated VAT Code for VAT on EU Acquisitions, with Input and Output Accounts that are not used in any other VAT Code. The full Invoice amount will be debited to the Cost Account. If you want VAT to be calculated in the normal way, with no posting to the Output Account and with the total excluding VAT being debited to the Cost Account, place your Suppliers in the "Inside EU (Post VAT)" and "Outside EU (Post VAT)" Zones.

|