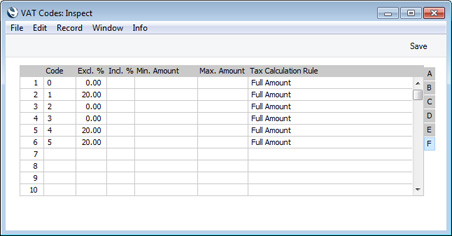

VAT Codes - Flip F

This page describes Flip F of the VAT Codes setting. Please follow the links below for descriptions of the other parts of the setting:

---

- Min. Amount, Max. Amount

- Tax Calculation Rule

- Paste Special

Choices of possible entries

- These fields allow you to specify that VAT will be calculated on a proportion of a sales or purchase value. Choose an option in the Tax Calculation Rule field using 'Paste Special' as follows:

- Full Amount

- VAT will be calculated on the full sales or purchase value.

- Amount in Range

- VAT will be calculated on the part of the sales or purchase value that is between the Min. Amount and Max. Amount that you specify in the fields to the left.

- For example, if the Min. Amount is 100.00, the Max. Amount is 500.00 and the Excl. % is 5%, then VAT on 300.00 will be (300-100)*5% = 10.00.

- You do not need to specify both a Min. Amount and a Max. Amount. If you only specify a Min. Amount, VAT will only be calculated on values greater than or equal to that amount. If you only specify a Max. Amount, VAT will only be calculated on values lower than that amount.

- Skip Calculation

- VAT will not be calculated.

---

Settings in the Nominal Ledger:

Go back to: