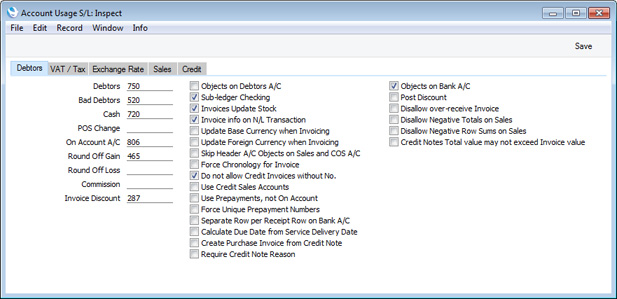

Account Usage S/L - Debtors Card - Fields

This page describes the fields on the 'Debtors' card of the Account Usage S/L setting. Please click the following links for descriptions of the other cards:

---

Account Fields

Each of these fields requires you to enter an

Account Number. In each case, you can use the

'Paste Special' function (Ctrl-Return or ⌘-Return) to help you choose the correct Account.

- Debtors

- When you post an Invoice to the Nominal Ledger, its value including VAT will be debited to a Debtor Account. When you post a Receipt to the Nominal Ledger, its value will be credited to the same Account. This Account therefore shows how much your company is owed at a particular time.

- Specify here the Account that you wish to be used as your main default Debtor Account. This Account will be overridden if you have specified a separate Debtor Account in the Customer Category to which a Customer belongs.

- Bad Debtors

- The 'Transfer to Bad Debtors' Maintenance function allows you to transfer the outstanding balances of overdue Invoices from the Debtor Account specified above to a Bad Debtor Account.

- Enter here the Account Code of the Account that you wish to be used as your Bad Debtor Account. This Account will be overridden if you have specified a separate Bad Debtors Account in the Customer Category to which a Customer belongs.

- Cash

- The Account entered here will be debited from a cash sale (Cash Note), instead of the Debtor Account. Please click here for a full description of Cash Notes.

- This Cash Account will be overridden if you have specified a separate Cash Account in the Payment Term used in a Cash Note.

- POS Change

- This Account will be used from Sales Ledger Invoices that you enter using the Touch-Screen interface and from POS Invoices. When a Customer overpays using cash or a credit card and requires the difference to be paid back in cash, the full amount paid by the Customer will be debited to the Cash or Credit Card Account (taken from the Payment Mode) and the change will be credited to the POS Change Account. This allows the change to be visible in the Nominal Ledger.

- In the case of Sales Ledger Touch-Screen Invoices only, this POS Change Account will be overridden if you have specified a separate POS Change Account for the relevant Payment Mode (on flip E). In the case of POS Invoices, the POS Change Account that you specify in this field will always be used.

- If you do not specify a POS Change Account or the POS Change Account is the same as the Cash or Credit Card Account, then the sale value will be debited to the Cash or Credit Card Account (i.e. the change will not be recorded in the Nominal Ledger).

- On Account A/C

- If you receive a Prepayment or On Account Receipt from a Customer without reference to a specific Invoice (such a payment might be a deposit that you receive before you have raised an Invoice), you can enter it to the Receipt register with a Prepayment Number on flip D of the Receipt row (a "Prepayment") or without a Prepayment Number (an "On Account" Receipt).

- When you enter and post a Prepayment or On Account Receipt to the Nominal Ledger, its value will be credited to the Account that you specify here. Usually this Account should be one that acknowledges that receiving a deposit creates a liability.

- This Account will be overridden if you have specified a separate On Account A/C in the Debtors On Account A/C field in the Customer Category to which a Customer belongs.

- To be able to receive a Prepayment or On Account Receipt from a Customer, you must tick the On Account check box on the 'Terms' card of the Contact record for the Customer in question. Otherwise, you will asked 'Enter invoice number' when you try to save the Receipt.

- Round Off Gain, Round Off Loss

- The total value of each Invoice will be rounded up or down according to rounding rules defined for its Currency/Payment Term combination in the Currency Round Off setting in the System module. If that setting does not contain an entry for that combination, rounding rules will be taken from the Round Off setting also in the System module Whenever you post an Invoice to the Nominal Ledger, any amount lost or gained by this rounding process will be posted to the Round Off Loss or Round Off Gain Accounts specified here, as appropriate.

- You must specify an Account in at least one of these fields, but it is not necessary to specify one in both fields.

- A separate setting in the System module, Round Off, is used to set the rounding rules for Invoices where no Currency has been specified and those with a Currency that has not been entered in the Currency Round Off setting. Again, amounts lost or gained by this rounding process are posted to this Account.

- You can only specify Round Off Gain and Loss Accounts in the Account Usage S/L setting: there are no equivalent fields in the Account Usage P/L setting. So, the Accounts that you specify here will also be used in Transactions generated from the Purchase Ledger.

- Commission

- This Account is used in Russia. Please refer to your local HansaWorld representative for details.

- Invoice Discount

- If you sell an Item for a discounted price, the discounted price will usually be credited to the Sales Account.

- If you would like the full sales price of the Item to be credited to the Sales Account and the value of the discount to be debited to a separate Account, specify that Account here. You must also select the Post Discount option towards the top right of the window (for most Invoices and described here) or in the Hotel Settings setting in the Hotel module (for Invoices created from Hotel Reservations).

- This Account will be overridden if you have specified a separate Discount A/C in the Item Group to which an Item belongs.

- If you are using Multi-Buy Discounts, those discounts will also be debited to the Account specified here. In this situation, there is no need to select the Post Discount option.

---

Settings in the Sales Ledger:

Go back to: