BuyBack Configuration

To configure the Buyback feature, follow these steps:

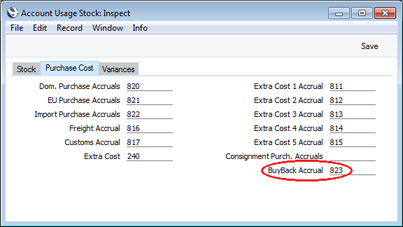

- Specify a BuyBack Accrual Account in the Account Usage Stock setting in the Stock module. This will be the default Account to which Buyback refunds will be posted.

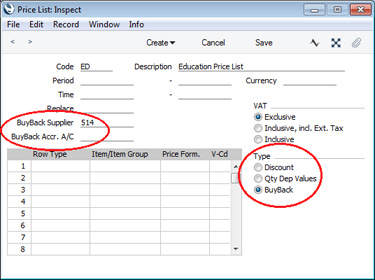

- In the Price List register in the Pricing module, set up a Price List in which the Type is "BuyBack". Specify the BuyBack Supplier (and a BuyBack Accrual Account if you want to override the default Account specified in step 1).

The illustration below shows a Price List that will be used when selling to Customers in education:

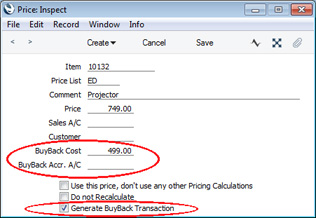

- Create records in the Price register for each Item that you want to be included in the Price List. This may include Items that do not qualify for BuyBack (they may be sourced from a different Supplier) but that nevertheless you will sell at a different price to the standard retail. In each record, specify the Price List created in step 2 and the selling Price. If the Item qualifies for BuyBack, check the Generate BuyBack Transaction box (this will be checked by default when you specify a Price List whose Type is "BuyBack"), and enter the discounted Cost Price in the BuyBack Cost field. If the Item does not qualify for BuyBack, you can leave the BuyBack Cost blank. This will mean the standard Cost Price will be used, so gross profit and margin calculations will remain correct. If necessary, specify a BuyBack Accrual Account if you want to override the default Accounts specified in steps 1 and 2.

In the example illustrated below, an Item will be priced at 749.00 when it is sold to Customers in education (the standard retail price is 995.00), and the discounted Cost Price is 499.00 (the standard Cost Price is 625.00):

- If necessary, assign the Price List to the relevant Customers.

- Although not essential for the operation of the BuyBack feature, you should use the following options if you would like original Purchase Invoice Numbers to be copied automatically to BuyBack records. If you do not want to use any or all of these options, you will be able to enter the original Purchase Invoice Numbers yourself.

- Items that qualify for BuyBack should be Serial Numbered.

- You should use the Transfer Each Row Separately option in the Purchase Invoice Settings setting in the Purchase Ledger.

- You should also use the Invoices Based on Goods Receipts option in the Purchase Invoice Settings setting if you will create Purchase Invoices from Purchase Orders. This option won't be needed if you will always create Purchase Invoices from Goods Receipts.

- You should not use the PO Number only on Goods Receipt rows (not in header) option in the Stock Settings setting in the Stock module.

---

In this chapter:

Go back to: