Prepayments and On Account Receipts - Prepayments

This page describes entering a deposit you have received from a Customer as a Prepayment. Please refer here for details about entering a deposit as an On Account Receipt, and here for details about the configuration required to enter Prepayments.

---

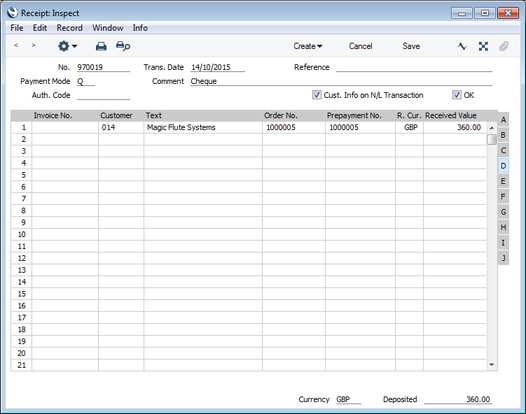

You will usually use a Prepayment Receipt when a Customer has paid a deposit against a Sales Order, before you have issued an Invoice for that deposit. Follow these steps:

- Enter a new record in the Receipt register.

- In the row representing the Prepayment, leave the Invoice Number blank, and instead specify a Prepayment Number on flip D. This can be a number of your own generation, the number allocated to the prepayment by the Customer or, preferably, the number of the Sales Order against which you have received the deposit.

If you want to use the Sales Order Number as the Prepayment Number, open 'Paste Special' from the Order No. field, also on flip D. A list of Sales Orders will open, from which you can choose the correct one. The Sales Order Number will then be copied to the Prepayment No. field, the Customer Number on flip A will change to the one in the Sales Order (or to the Invoice To Customer in the Order if there is one) and the Received Value will be changed to the Order value. Change the Received Value to the value of the deposit if it is not the same as the Order value:

If you want to ensure that you can only receive Prepayments against Orders that have been marked as OK, assign each user to an Access Group that grants Full access to the 'Disallow Prepayment for not OKed Order' Action. If a user enters the Order Number of an Order that has not been marked as OK, they will then not be able to save the Receipt.

If you do not want to use the Sales Order Number as the Prepayment Number, specify the Customer and the Received Value on flip A, enter the Prepayment Number in the Prepayment No. field on flip D and leave the Order No. field empty.

If you want to ensure that only Sales Order Numbers can be used as Prepayment Numbers, select the Use Sales Order No. for Prepayments option in the Down Payments setting in the Sales Orders module. This option will also prevent you from entering a Prepayment that is not connected to a Sales Order.

- If you need VAT to be posted from Prepayments and so have selected the Post Prepayment VAT option in the Account Usage S/L setting, the VAT Code and VAT Value will be brought in automatically to the fields on flip E when you specify an Order Number on flip D, providing every row in the Order has the same VAT Code. If there are different VAT Codes in the Order or you enter a Prepayment that is not connected to an Order (i.e. you leave the Order No. field empty and instead specify a Prepayment No.), you should enter a VAT Code manually. The VAT Value will then be calculated from the Received Value. You can change the calculated figure if necessary, and you can also enter separate rows for each VAT Code with appropriate Received Values.

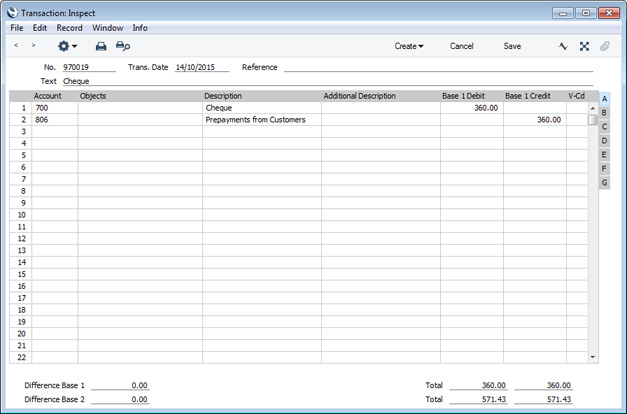

- Mark the Receipt as OK and save it. In the resulting Nominal Ledger Transaction, the Received Value will by default be credited to an On Account A/C chosen as follows:

- The Debtors On Account A/C in the Customer Category to which the Customer belongs will be used.

- The On Account A/C specified in the Account Usage S/L setting will be used.

This Account will be shown in the Debtors A/C field on flip H of the Receipt row where you can change it if necessary before marking the Receipt as OK.

The debit Account will be taken from the Payment Mode as usual:

If the Transaction contains a VAT element, the VAT Value will be debited to the Prepayment VAT Account specified in the Account Usage S/L setting and credited to the O/P Account for the VAT Code.

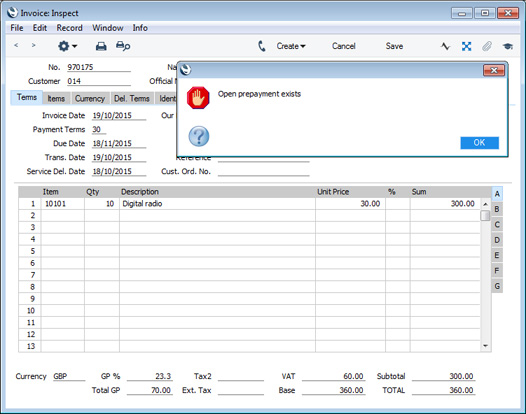

- When you make a sale, you can raise an Invoice. When you do this, you can allocate the Prepayment to that Invoice so that it can be treated as paid.

If you used an Order Number as the Prepayment Number, it is likely that you will create the Invoice from the Order using the 'Invoice' function on the Create menu (Windows/Mac OS X) or + menu (iOS/Android). When you do so and the Invoice is opened for you to check, you will be warned that an open Prepayment (i.e. one that has not yet been allocated to an Invoice) exists in the Customer's name. This will remind you to allocate the Prepayment to the Invoice. The same warning will appear when you create an Invoice from a Quotation and when you enter the Invoice directly to the Invoice register. In the latter case, the warning will appear when you enter the Customer Number: add the Items sold to the grid area in the usual way.

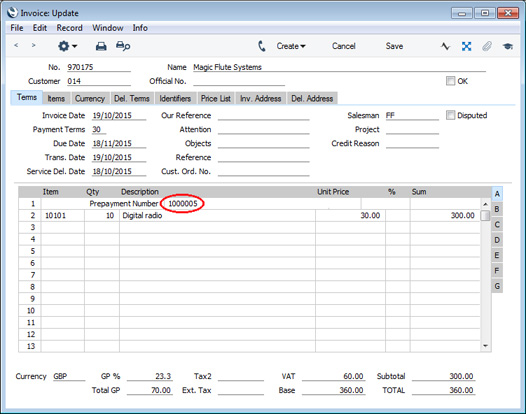

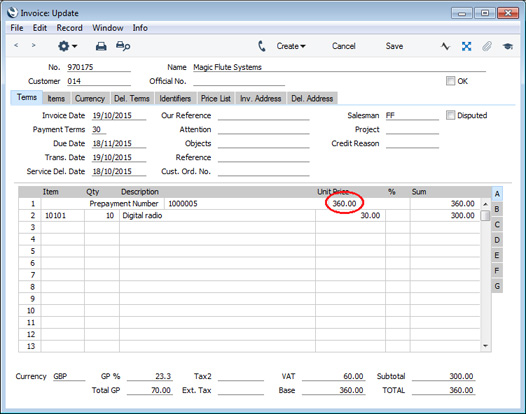

- When you are certain that the Invoice is complete, select 'Connect to Prepayment' from the Operations menu. A new row will be inserted at the top of the grid area, containing the phrase "Prepayment Number". In the field to the right of this phrase, enter the Prepayment Number of the Receipt row representing the Prepayment. You can use 'Paste Special' if necessary to bring up a list of open Prepayments (Prepayments that have not yet been fully allocated to Invoices). This list shows open Receipt rows with a Prepayment Number and without an Invoice Number. Select a Prepayment from the list: the Prepayment Number will be added to the special Prepayment row.

When you press Enter or otherwise move the insertion point away, an amount will be added to the Prepayment row. The amount will be the whole open value of the Prepayment, or the value of the Items including VAT (i.e. the Invoice value) whichever is the lower. This figure will be credited to the Debtor Account when you mark the Invoice as OK and save it, so the Invoice will be treated as paid to that extent.

Note that it is important to ensure that the Invoice is complete before selecting 'Connect to Prepayment' from the Operations menu. The function will calculate the amount that will be placed in the special Prepayment row: this is the amount that will be credited to the Debtor Account and is therefore the amount that will go towards paying off the Invoice. If the Invoice is incomplete when you select the function to the extent that its total is less than the open value of the Prepayment, the Invoice total at that moment will be the amount that will be placed in the special Prepayment row. When you add the remaining Items and/or Freight to the Invoice and you then mark it as OK and save it, this is the figure that will be credited to the Debtor Account. So the Invoice will not be paid off to the extent that it should be, and a proportion of the Prepayment value will remain open.

If you select 'Connect to Prepayment' before the Invoice is complete (it may be that a late change is required) you can either change the amount shown in the special Prepayment row or you can delete the special Prepayment row and use 'Connect to Prepayment' once again. If you choose the former option, you will be prevented from entering an amount that is greater than the open value of the Prepayment, or greater than the Invoice total.

! | Ensure the Invoice is complete before using 'Connect to Prepayment'. | |

If you are unable to save the Invoice after using 'Connect to Prepayment', the probable reason is that the date of the Prepayment is later than that of the Invoice. The date of the Prepayment must be the same as or earlier than that of the Invoice.

If the Prepayment and Invoice are in a foreign Currency and you need the Exchange Rate in the Prepayment to be copied to the Invoice, select "From Prepayment" as the Invoice Rate option in the Sales Invoice Settings setting.

- When you create an Invoice from an Order, you can have the Invoice connected to any relevant Prepayments automatically (steps 5 and 6 above). A relevant Prepayment is one created from the Order in question (i.e. with the Order Number on flip D of the Receipt row). To use this feature, select the Connect to Prepayments when Invoicing option in the Order Settings setting in the Sales Orders module.

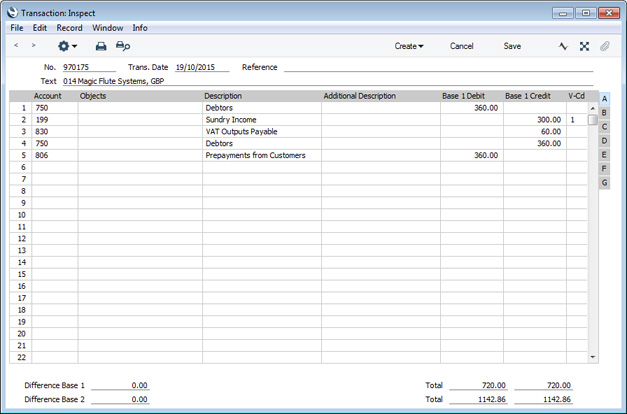

- When you mark the Invoice as OK and save it, the consequent Nominal Ledger Transaction will combine the usual Invoice postings with those incurred by allocating a payment against the Invoice. This maintains a correct Sales Ledger for the Customer:

If the Transaction from the Prepayment contained a VAT element, the Transaction from the Invoice will credit the Prepayment VAT Account specified in the Account Usage S/L setting.

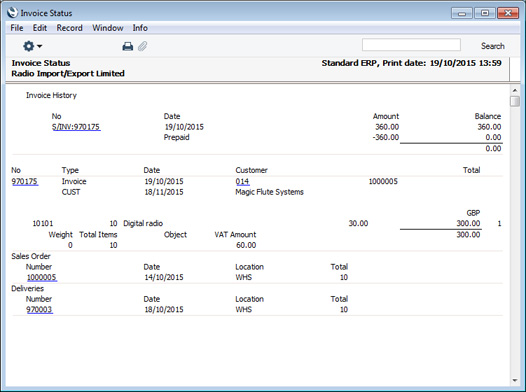

The status of the Invoice and of the Prepayment will now be as follows:

- if the Invoice value is the same as the whole open value of the Prepayment, the Invoice will be treated as paid and will not appear in the Open Invoice Customer Statement. The Prepayment will be fully used up by the Invoice, so it will no longer be regarded as open;

- if the Invoice value is less than the whole open value of the Prepayment, the Invoice will be treated as paid and will not appear in the Open Invoice Customer Statement or in any reports showing Open Invoices. The Prepayment will not be fully used up by the Invoice, so the remaining outstanding amount will still be regarded as open; or

- if the Invoice value is more than the whole open value of the Prepayment, the Invoice will be treated as part-paid. The Prepayment will be fully used up by the Invoice, so it will no longer be regarded as open.

In this example, the Invoice Status report shows the Invoice is treated as fully paid:

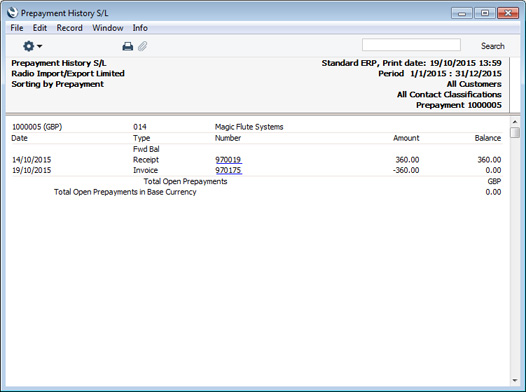

To check the balance on the Prepayment, use the Prepayment History S/L report:

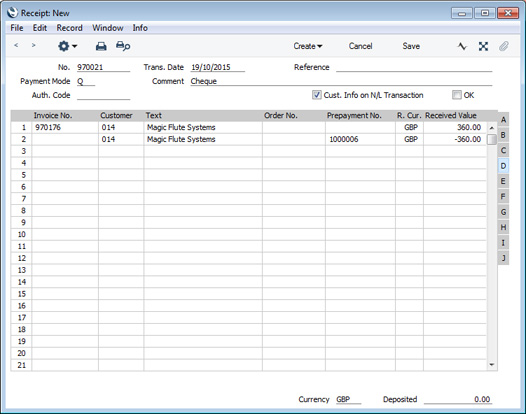

- If you forget to use 'Connect to Prepayment' in an Invoice, you can connect the Invoice and the Prepayment in a new Receipt record.

Specify the Invoice Number on flip A in the first row as normal. Change the Received Value to the value of the Prepayment, if this is less than the default (i.e. less than the total outstanding on the Invoice).

On the second row, enter the Customer on flip A, and the Prepayment Number on flip D. You can use 'Paste Special' from the Prepayment No. field to choose the correct one. As the Received Value, enter the value of the Prepayment (or the total outstanding on the Invoice if this is lower) as a negative figure. If you would like to bring in the open value of the Prepayment as a guide figure, first place the insertion point in the row. Then, open the Row menu by right-clicking (Windows) or ctrl-clicking (Mac OS X) the row number and select 'Write-off Prepayment' from the Row menu. If you are using iOS or Android, select 'Write-off Prepayment' from the Tools menu (with 'wrench' icon). Despite its name, this function will place the open value of the Prepayment in the Received Value field as a negative figure.

Be careful when entering the Received Values. You will not be able to enter a figure in the second row that is larger than the open value on the Prepayment. For example, if the open value on the Prepayment is 1000.00, you will be able to enter -900.00 or -1000.00 but not -1200.00. However, if the Prepayment only covers part of the Invoice value and you leave the Received Value in the first row as the default (i.e. the entire amount outstanding on the Invoice), then the remainder of the Invoice value will be treated as being paid by the Receipt. For example, if the total outstanding on the Invoice is 1500.00, this will be the default Received Value in the first row. If you leave this figure as it is and enter a Prepayment value of -1000.00 on the second row, then the remaining 500.00 will also be paid by the Receipt, using the Account specified in the Payment Mode.

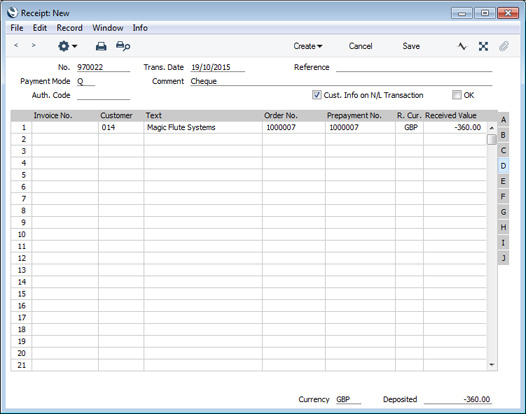

- If you need to reverse a Prepayment because it contains a mistake, duplicate the original Receipt and change the Received Value to a negative figure.

If you can't find the original Receipt, create a new one, specify the Prepayment Number on flip D and then use the 'Write-off Prepayment' function on the Row menu to place the open value of the Prepayment in the Received Value field as a negative value.

If you are using the Force Unique Prepayment Numbers option on the 'Debtors' card of the Account Usage S/L setting, you can usually only use a particular Prepayment Number once. However, you will still be able to reverse a Prepayment (i.e. use the Prepayment Number again together with a negative Received Value) as described in steps 8 and 9 above.

You can use Access Groups to prevent the saving of Receipts in which there is at least one row with a negative Received Value, by denying access to the 'Negative Amount on Receipt' Action. If you deny a particular user access to this Action, you will also prevent that user from reversing Prepayments.

---

The Receipt register in Standard ERP:

Go back to:

|