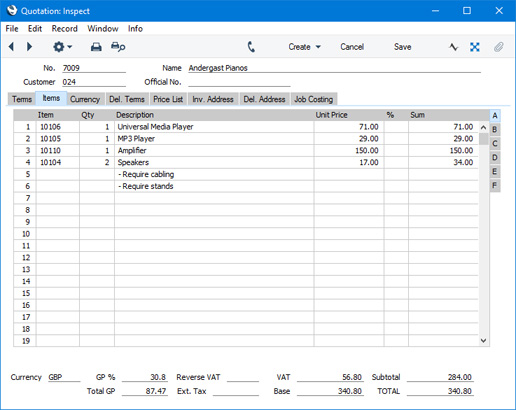

Entering a Quotation - Items Card (Flips A-F)

This page describes the fields on flips A-F of the 'Items' card of the Quotation record. Please follow the links below for descriptions of the other cards:

---

Use the grid on the 'Items' card to list the Items on the Quotation. This grid is divided into six horizontal flips. When you click (Windows/Mac OS X) or tap (iOS/Android) on a flip tab (marked A-F), the two or three right-hand columns of the grid will be replaced.

Before adding any rows to a Quotation, ensure that the Price List, Currency and Exchange Rate specified are correct. As you add Items to the Quotation, the correct prices will be brought in automatically, converted into Currency if necessary. If you change the Currency after you have added Items to the Quotation, the prices of those Items will be converted to that Currency automatically. However, if you change the Exchange Rate, prices already in the Quotation will not be recalculated automatically. To have prices recalculated in this situation, use the 'Update Currency Price List Items' function on the Operations menu (Windows/Mac OS X) or Tools menu (iOS/Android). If you change the Quotation Date and the Exchange Rate changes as a consequence, prices will be recalculated automatically if you are using the Update Prices on records with Currency when changing Dates option in the Item Settings setting in the Sales Ledger. Prices will always be recalculated automatically if you change the Price List.

If you are using Windows or Mac OS X, you can add rows to a Quotation, click in any field in the first blank row and enter appropriate text. To remove a row, click on the row number on the left of the row and press the Backspace key. To insert a row, click on the row number where the insertion is to be made and press Return.

You can also bring Items into a Quotation by opening the 'Items: Browse' window, selecting a range of Items by clicking while holding down the Shift key, and dragging them to the Item field in the first empty Quotation row. You can copy a list of Item Numbers from a spreadsheet or word processor and paste them in the Item field in the first empty row. Finally, you can use the 'Item Search' function on the Operations menu to add Items to the Quotation.

If you are using iOS or Android, you can add rows by tapping the + button below the matrix. To remove a row, long tap on the row number on the left of the row and select 'Delete Row' from the resulting menu. To insert a row, long tap on the row number where the insertion is to be made and select 'Insert Row' from the resulting menu.

Flip A - Item

- Paste Special

Item register

- With the insertion point in this field, enter the Item Number, Alternative Code or Bar Code for each Item included in the Quotation. Pricing, descriptive and other information will be brought in from the Item record. If you leave this field blank, you can enter a short piece of text in the Description field, perhaps using the row for additional comments to be printed on Quotation documentation.

- If the Item is a Structured Item in which you have ticked the Paste Components during Entry box, its components will be listed on the following rows when you enter a Quantity. If you then change the Quantity of the Structured Item, the Quantities of the components will be updated automatically.

- You can use Access Groups to prevent users from selling Items of a particular Type. Assign them an Access Group in which you have granted Full access to the 'Disallow Sales of Plain Items', 'Disallow Sales of Stocked Items', 'Disallow Sales of Structured Items' and/or 'Disallow Sales of Service Items' Actions as necessary.

- Qty

- Enter the number of units offered. The Sum will then be calculated automatically.

- After entering a Quantity, pressing the Enter or Return key will cause the insertion point to move to the Item field in the next row. This will allow you to choose the next Item immediately.

- Description

- Default taken from

Item

- This field contains the name of the Item, brought in from the Item register. Usually, it will be the Item's Description that is brought in but, if you have entered various translations of the Description on the 'Texts' card of the Item record, the correct translation for the Language of the Quotation (specified on the 'Price List' card) will be brought in instead.

- In addition to the Description or its translation, any rows of text that you have entered on the 'Texts' card of the Item record without a Language will be brought in to the following rows of the Quotation, as shown in rows 5 and 6 in the illustration below.

If you want to add an extra description, you can do so: there is room for up to 100 characters of text. If you need more space, you can continue on the following lines.

- You can prevent certain users from changing any Description in a Quotation using Access Groups, by denying them access to the 'Change Item Description on Quotation' Action. Separate similar Actions are available for Orders, Deliveries and Invoices.

- Unit Price

- The Unit Price of the Item according to the Customer's Price List will be brought in when you specify the Item Number. If the Customer does not have a Price List, or the Item is not on the Price List in question, the Base Price from the Item record will be brought in instead. If there is a Price List applying to a Quotation, it will be shown on the 'Price List' card.

- The maximum number of decimal places that you can use in a Unit Price is three. If you need more decimal places, use the Unit Price in combination with the Price Factor on flip D.

- This figure will include VAT (and Extra Tax) if the Price List is one that is Inclusive of VAT or if you have specified on the 'VAT / Tax' card of the Account Usage S/L setting in the Sales Ledger that Base Prices include VAT (or VAT and Extra Tax).

- If the Quotation has a Currency and Exchange Rate, the figure shown will be in the Currency concerned (i.e. having undergone currency conversion).

- Please refer to the Controlling Prices in Quotations page for details about how you can control access to this field and otherwise control pricing in Quotations.

- %

- If you need to offer the Customer a discount on an Item, enter the discount percentage in this field.

- A discount percentage will be brought in to this field automatically if you are using Discount Matrices and if there is a Discount Matrix that includes the Item applying to the Quotation. Discount Matrices allow you to offer quantity discounts based on the value, quantity, weight or volume of each Item sold, so the discount percentage will be recalculated whenever you change the Quantity. If there is a Discount Matrix applying to a Quotation, it will be shown on the 'Price List' card.

- If the Discount Matrix is one that calculates quantity discounts based on Item Group quantities rather than Item quantities, the calculated discount may become incorrect if you specify another Item belonging to the same Item Group in a later row in the Quotation. To cater for this, be sure to select 'Recalculate Discount' from the Operations menu (Windows/Mac OS X) or Tools menu (iOS/Android) when the Quotation is complete. This will recalculate the discount percentage for each Item in the Quotation.

- Please refer here for more details about Discount Matrices.

- The Discount Calculation options in the Round Off setting in the System module allow you to determine whether the discount is to be applied to the Unit Price before it has been multiplied by the Quantity, or to the Sum. In certain circumstances (where there is a very small Unit Price and a large Quantity) this choice can cause the calculated discount to vary due to rounding. Please refer here for details and an example.

- The percentage entered here can act as a discount, margin factor or markup. This is controlled using the Discount Options setting in the System module.

- You can prevent certain users from changing a Discount in any Quotation, Invoice or Order row using Access Groups, by denying them access to the same 'Change Unit Prices' Action that also controls access to the Unit Price field immediately above.

- Please refer to the Controlling Prices in Quotations page for details about how you can control access to this field and otherwise control pricing in Quotations.

- Sum

- The total for the row: Quantity multiplied by Unit Price less Discount. Changing this figure will cause the Discount Percentage to be recalculated. This figure will include VAT (and TAX) if the Price List specified is one that is Inclusive of VAT or if you have specified on the 'VAT / Tax' card of the Account Usage S/L setting that Base Prices include VAT (or VAT and TAX).

- This figure will be rounded up or down according to the Row Sum rounding rules set for the Currency/Payment Term combination in the Currency Round Off setting in the System module. If that setting does not contain an entry for that combination, the Row Sum rounding rules in the Round Off setting also in the System module will be applied.

- Please refer to the Controlling Prices in Quotations page for details about how you can control access to this field and otherwise control pricing in Quotations.

- If you are using the Disallow Negative Row Sums on Sales option in the Account Usage S/L setting in the Sales Ledger, you will not be able to save a Quotation if the Sum in any row is negative.

Flip B- Cust. Item No.

- If you know the Customer's code for the Item (i.e. the Customer's equivalent of the Item Number), you can enter it in this field. For a more permanent record, you can enter this code in the Customer Items setting in the Sales Orders module. After having done so, it will be brought in to this field in future Quotations automatically.

- If you need this code to be printed on Quotation documentation, add the "Customer Item Code" field to the Form Template.

- A/C

- Paste Special

Account register, Nominal Ledger/System module

- The Sales Account specified here will be credited with the Sum in the Nominal Ledger Transactions generated from any Invoices that will eventually result from the Quotation. Sales Accounts are used to record the levels of sales of different types of Items in the Nominal Ledger.

- Please refer here for details about how the Sales Account in each row will be chosen.

- Tags/Objects

- Paste Special

Tag/Object register, Nominal Ledger/System module

- Default taken from Item or Item Group

- You can assign up to 20 Tags/Objects, separated by commas, to a Quotation row. You might define separate Tags/Objects to represent different departments, cost centres or product types. This provides a flexible method of analysis that you can use in Nominal Ledger reports. Usually the Tags/Objects specified here will represent the Item.

- The Tags/Objects that you specify here will be transferred to the Nominal Ledger Transactions that will be generated from any Invoices eventually raised from the Quotation. In those Transactions, these Tags/Objects will be assigned to the credit postings to the Sales Account and, if the Invoices will update the stock valuation in the Nominal Ledger, to the cost of sales postings. This assignment will merge these Tags/Objects with those of the parent Quotation (shown on the 'Terms' card).

- The Tags/Objects specified here will also be transferred to the corresponding row of any Delivery eventually resulting from the Quotation row. They will then be assigned to the debit posting to the Cost Account (Cost of Sales Account) in any Nominal Ledger Transaction generated from that Delivery. They will also be assigned to the credit posting to the Stock Account if you are using the Tag/Object on Stock Account option in the Cost Accounting setting.

- V-Cd

- Paste Special

VAT Codes setting, Nominal Ledger

- In any Invoice that results from a Quotation, the VAT Code entered here will determine the rate at which VAT will be charged on the Item and the VAT Account that will be credited with the VAT value.

- Please refer here for details about how the VAT Code in each row will be chosen.

- Rvrs

- Default taken from

Item (Reverse VAT Code)

- If an Item is one that you will sell on a reverse charge VAT basis to a Customer in the Domestic VAT Zone, the Reverse Charge VAT Code will be placed in this field, copied from the Item record. Please refer to the Reverse Charge VAT in Sales Invoices page for more information. This field will only be visible in Lithuania, Poland and the UK (i.e. when the VAT Law in the Company Info setting is "Lithuanian", "Polish" or "Default").

- T-Cd

- Paste Special

Tax Templates setting, Nominal Ledger

- In some countries, Tax Templates are used instead of VAT Codes to determine the rate at which VAT or sales tax will be charged on the Item and the Output VAT Account that will be credited with the VAT or sales tax value. VAT Codes should be used where each sales and purchase transaction (e.g. each row in a Quotation) is taxed at a single rate, while Tax Templates should be used where different taxes and/or several tax rates are applied to one transaction (e.g. to one row).

- If you need to use Tax Templates, you should choose the Use Tax Templates for Tax Calculation option in the Transaction Settings setting in the Nominal Ledger. This option will cause a Tax Template field ("T-Cd") to appear here instead of the VAT Code field ("V-Cd"). Having done so and having entered your Tax Templates in the Tax Templates setting also in the Nominal Ledger, you should specify the Tax Templates that are to be used in each Quotation row here.

- Please refer here for details about how the Tax Template in each row will be chosen.

Flip C- Cost

- The unit Cost Price of the Item will be used in Gross Profit and Margin calculations.

- The default offered in each row will be chosen as follows:

- If the Price List of the Quotation is one whose Type is "BuyBack", the Cost Price will be taken from the record in the Price register for the Item/Price List/Customer combination.

- The Cost Price from the Item record will be used.

If you need the figure that is brought in to be the Cost Price of the Item plus its Extra Cost, select the Include Item Extra Cost in Cost option in the Cost Accounting setting in the Stock module.

If you duplicate a Quotation, the new Quotation will contain the latest Cost Price from the Item register, and the Gross Profit will be recalculated accordingly. The Cost Price in the original Quotation will not be transferred to the new Quotation.

- You can prevent certain users from viewing Cost Prices in Quotations, Orders and Invoices using Access Groups, by denying them access to the 'View Item's Cost Price' Action. In a Quotation, this will hide the Cost field, the GP field immediately below and the GP % and Total GP fields in the footer.

- GP

- The Gross Profit for the Quotation row is calculated by subtracting the Cost Price (multiplied by the Quantity) from the Sum. The figure is therefore absolute, not a percentage. You cannot change this figure yourself, but it will be recalculated if you change the Unit or Cost Price or the % discount.

Flip D- Salesmen

- Paste Special

Person register, System module and Global User register, Technics module

- If necessary, you can specify a different Salesman or Salesmen (separated by commas) for each row of the Quotation.

- From any Invoices created from the Quotation, the Bonus, Salesman report will assign any commission for the corresponding row in the Invoice to the Salesman specified in the row only (i.e. not to the Salesman specified in the header).

- The 'Workflow Activity' function will not create Activities for the row Salesmen, and the Quotation will not be recognised as belonging to the row Salesmen by the Limited Access feature.

- Invoiced

- This field displays the quantity invoiced from the Quotation row. It will be updated automatically when you create Invoices directly from the Quotation (i.e. not when you create Invoices from Orders that result from the Quotation). The figure will be calculated from all Invoices, including those that have not yet been marked as OK.

- If you delete or invalidate an Invoice related to the Quotation, the Invoiced Quantity in the relevant Quotation rows will be updated automatically.

- If you credit an Invoice related to the Quotation, the Invoiced Quantity will be updated automatically providing you create the Credit Note using the following methods:

- You create the Credit Note by duplicating the original Invoice, and you enter the appropriate Payment Term and the number of the Invoice to be credited before you save the Credit Note for the first time.

- You create the Credit Note by selecting 'Credit Note' from the Create menu (Windows/Mac OS X) or + menu (iOS/Android) from the original Invoice or from the relevant Returned Goods record.

If you create the Credit Note by entering a new record to the Invoice register, the Invoiced Quantity figure in the originating Quotation will not be updated. This is because the Credit Note will not be connected to the Quotation.

- If you are using the Disallow Invoicing more than Quoted option on the card of the Quotation, it will use the Invoiced Quantity figure in each row to prevent the creation of too many Invoices.

- Price Factor

- Default taken from

Item

- The Price Factor is the quantity of the Item that can be bought by the Unit Price. For example, if the Unit Price of an Item refers to a box of 24 units, its Price Factor will be 24. Specifying a Price Factor for such an Item is only necessary if it will be sold in individual units (e.g. if you will break into the box of 24 to sell a single unit). The Price Factor will be used to calculate the price of a single unit (in this example, the Price Factor will be 24).

- When you use an Item with a Price Factor in a Quotation row, the Quantity that you specify on flip A should be the quantity of individual units, not the quantity of boxes. When you enter a Quantity, the Sum will be calculated using the formula (Quantity/Price Factor) * Unit Price.

- The Unit Price field on flip A (and the Base Price field in the Item record) can only support three decimal places. Using a Price Factor can be useful if you need to use more. For example, if the price per unit is 0.0001, you can enter 0.01 as the Unit Price and 100 as the Price Factor. This will result in a Sum of 0.0001 when the quantity is one.

- Recipe

- Default taken from

Item

- If the Item is a Structured Item whose Paste Components During Entry box has not been ticked, its Recipe will be recorded here, brought in from the Item record. A Structured Item is essentially an Item that is assembled by your company on the point of delivery from components held in stock: its Recipe lists those components with quantities. You should not change the contents of this field. Please refer here for more details about Recipes.

Flip E- Unit, Unit Qty, Unit Pr. of Unit

- These fields allow you to quote for an Item using a different Unit to the one specified on the 'Pricing' card of the Item record.

- If you enter a Unit that has a Qty Factor here, the Quantity and pricing for the Quotation row will change accordingly. For example, an Item is usually sold in single units. If you sell two dozen of them, you can enter the Unit representing one dozen (i.e. one whose Qty Factor is "12") in this Unit field and "2" in the Unit Qty field. The Quantity on flip A will change to "24" (i.e. 2 x 12) and the pricing will be adjusted accordingly. The Unit Price of Unit field will show the price for one dozen (i.e. the price of one of the new Unit).

- Use 'Paste Special' from the Unit field to choose from a list of Units.

- Width, Height, Depth

- Default taken from

Item

- These fields contain the dimensions of the Item. You can use them together with the Unit Qty field if the Item is sold by area or volume. Please refer to the description of the Units setting for details and an example.

Flip F- Inv. After

- Paste Special

Choose date

- As an option, you can enter here the earliest date when the row can be included in an Invoice that you create directly from the Quotation (using the 'Invoice' function on the Create menu).

- Inv. Date, Inv. No.

- These fields will display the Invoice Date and Number of the most recent Invoice raised from the Quotation using the 'Invoice' function on the Create menu. If you delete or invalidate the Invoice, the Invoice Date and Number will be removed from these fields. If you credit the Invoice, the Invoice Date and Number of the Credit Note will be copied to these fields.

You only need use the remaining fields on flip F if you have linked the Quotation to a Project. Please refer here for details.

---

The Quotation register in Standard ERP:

Go back to:

|