Using Currencies in Nominal Ledger Transactions - Dual-Base System

This page describes Exchange Rates and the Dual-Base conversion system in Nominal Ledger Transactions.

---

If you are using the Dual-Base system, debit and credit values in every posting will be recorded in Base Currency 1 and in Base Currency 2. This page first describes entering a posting in Base Currency 1 or Base Currency 2 and then describes entering a posting in a third (foreign) Currency.

All Transactions should balance in both Base Currencies. If a Transaction does not balance in either Base Currency, you will not be able to save it.

Postings in Base Currency 2

Transitional and voluntary users of the Dual-Base system will be able to enter Transactions in Base Currency 1 or 2 as required.

In the following example the company has a Euro bank account. The home Currency (Base Currency 1) is the Pound Sterling (GBP) and Base Currency 2 is the Euro. The following Transaction is entered showing a sales transaction paid in Euros. The Sales Account is a normal sales account in GBP.

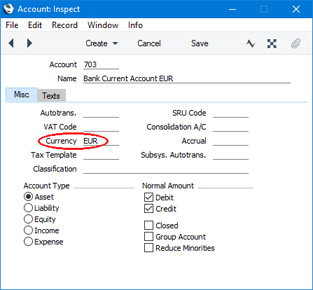

In the Account register, Account 703 represents the Euro bank account. To specify that this Account is a Euro account, "EUR" has been entered in the Currency field:

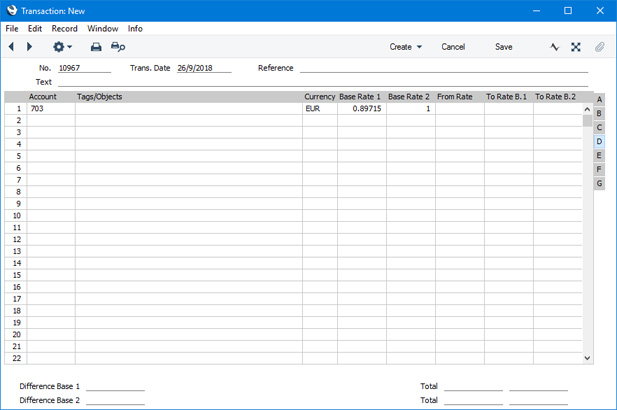

In the Transaction, start by entering the Euro Account number in the first row. The Currency in the row will be changed to EUR automatically and the Base Currency Rate that is valid on the Transaction Date will be brought in as well. Both will be visible on flip D. In the example, the Base Rate 1 and 2 fields show that one Euro buys GBP 0.89715. You can change the rates for a particular posting (unless you have selected the

Prevent Base Rate Changes option for the Euro Currency record), but you should do so before you enter any values. If you use an Account that does not have a Currency specified, you will be able to enter any Currency on flip C or D and the latest conversion rates will be brought in immediately.

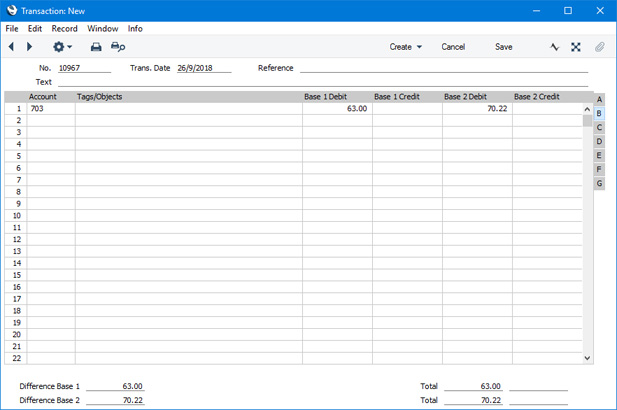

To enter a debit or credit amount in Euros, go to flip B and use the Base 2 Debit or Base 2 Credit field as appropriate. A figure converted to Base Currency 1 will be placed in the Base 1 Debit or Base 1 Credit field as appropriate. Alternatively, enter an amount in the Base 1 Debit or Base 1 Credit field and a figure converted to Base Currency 2 will be placed automatically in the Base 2 Debit or Base 2 Credit field.

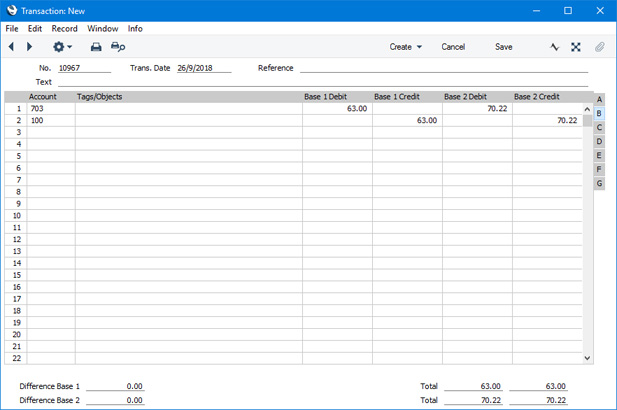

Account 100 is a normal Sales Account in the home Currency. On the second row, enter the Account number as usual, and then select

'Balance Transaction' from the Operations menu (Windows/Mac OS X) or Tools menu (iOS/Android). A balancing value will be placed in the Base 1 Credit column on flip A:

Note: if there already is a Base 1 figure and you change the Base 2 figure, the Base 1 figure will not be updated. This allows you to overrule the standard conversion rate. This feature means you should be careful when duplicating Transactions and then changing values in Base Currency 2. If you want to list Transaction rows where you have overruled the standard conversion rate in this way, print the

Nominal Ledger report using the

Show Base Currency 2 Differences Only option.

Postings in a Foreign Currency

Users of the

Dual-Base system will usually fall into the following categories:

- Companies that have offices in two countries that need to report in both Currencies. For these companies, Foreign Currencies will usually be related to Base Currency 1.

- Companies operating in countries where there is a second Currency (usually the US Dollar or Euro) in common use in addition to the national one. Such companies will usually have their home Currency as Base Currency 1 and the second Currency such as the Euro or US Dollar as Base Currency 2. Foreign Currencies will usually be related to Base Currency 1.

- Companies in countries passing through the process of replacing their home Currencies with the Euro. Such companies will have their home Currency as Base Currency 1 and the Euro as Base Currency 2, so Foreign Currencies will be related to Base Currency 2..

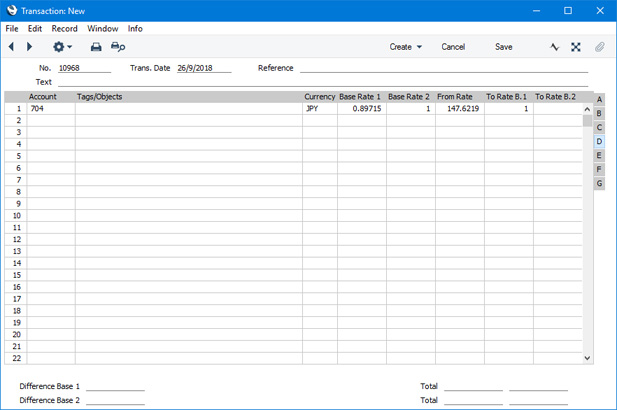

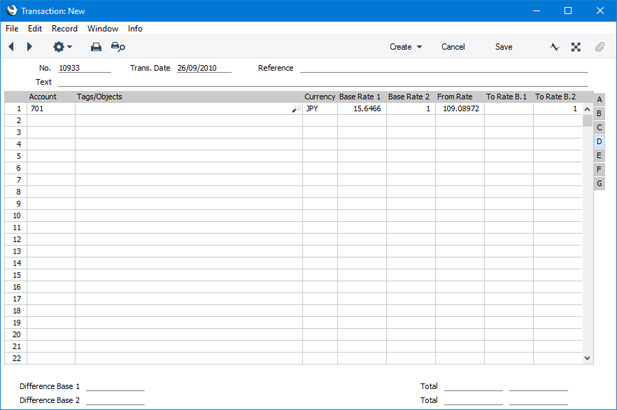

In the first two cases, as the foreign Currency is related to Base Currency 1, entering a Transaction using the simple conversion system and the Dual-Base system are very similar. In the example illustrated below, we have entered a JPY bank account in the first row. This causes the Currency in the row to be changed to JPY automatically and the Exchange and Base Currency Rates that are valid on the Transaction Date to be brought in as well. This is visible on flip D:

The From Rate and To Rate B.1 fields show the exchange rate between the foreign Currency and Base Currency 1, taken from the record in the

Exchange Rate register applying on the Transaction Date. Here, JPY 147.62190 buys GBP 1.00. These fields will only be used if the Currency in the Transaction row is not Base Currency 1 or 2.

The Base Rate 1 and Base Rate 2 fields show in the form of a ratio the exchange rate between the two Base Currencies (taken from the Base Currency Rates setting). This exchange rate will be used to convert between Base Currency 1 and Base Currency 2.

You can change the rates for a particular posting (unless you have selected the Prevent Base Rate Changes and Prevent Foreign Rate Changes options for the JPY Currency record), but you should do so before you enter any values. If you use an Account that does not have a Currency specified, you can enter any Currency on flip C and the latest conversion rates will be brought in immediately.

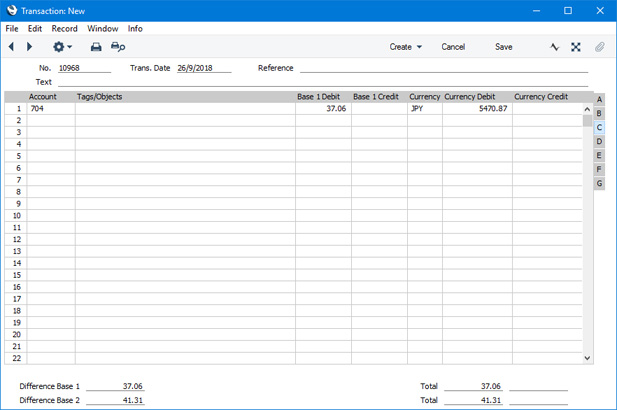

To enter a debit or credit amount in Currency, go to flip C and use the Currency Debit or Currency Credit fields as appropriate. A figure converted to Base Currency 1 using the ratio in the From Rate and To Rate B.1 fields will be placed in the Base 1 Debit or Credit field as appropriate. In addition, a figure converted from Base Currency 1 to Base Currency 2 using the Base Rate 2 and Base Rate 2 will be placed in the Base 2 Debit or Credit field as appropriate, visible on flip B. Alternatively, you can enter an amount in the Base 1 Debit or Base 1 Credit field (or in the Base 2 Debit or Base 1 Credit field) and a figure converted to the foreign Currency will be placed automatically in the Currency Debit or Currency Credit field (and a figure converted to the other Base Currency will also be calculated).

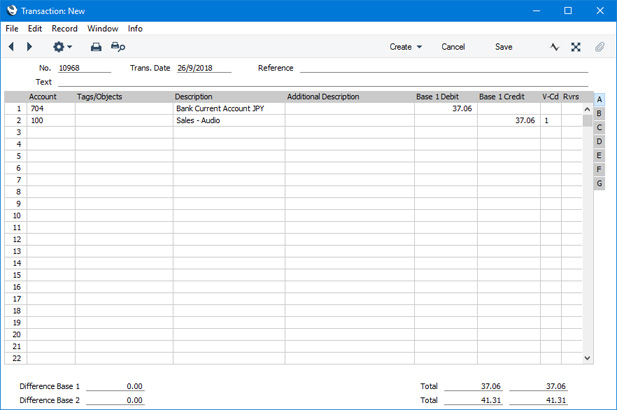

Account 100 is a normal Sales Account in the home Currency. On the second row, enter the Account number as usual, and then select

'Balance Transaction' from the Operations menu (Windows/Mac OS X) or Tools menu (iOS/Android). A balancing value will be placed in the Base 1 Credit column (visible on flips A, B and C):

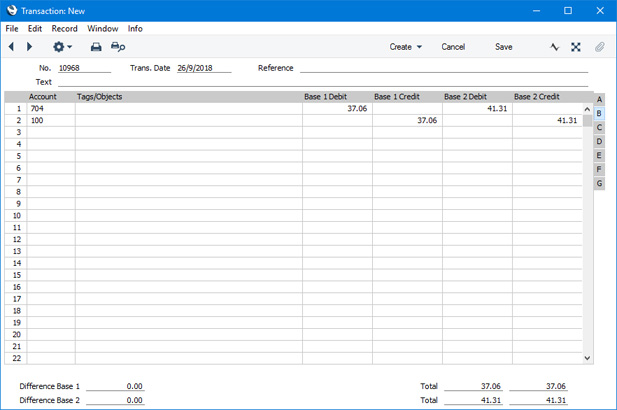

If you wish to view the amounts in both Base Currencies, they are visible on flip B:

In a country that is passing through the process of replacing its home Currency with the Euro, direct conversions from the home Currency to any foreign Currency except the Euro are not possible. Instead, the home Currency should first be converted to the Euro (Base Currency 2), and there should then be a second conversion to the foreign Currency. In this situation, the Exchange Rate should therefore relate the foreign Currency to Base Currency 2. In the following historical example the company has a JPY bank account. The home Currency (Base Currency 1) is the Estonian Kroon (EEK) and Base Currency 2 is the Euro. After specifying the JPY bank account in the first Transaction row, the conversion rates will be brought in to flip D. In the example, the From Rate and To Rate B 2 fields show that one Euro buys JPY 109.08972, while the Base Rate 1 and 2 fields show that one Euro buys EEK 15.6466:

.---

Using Currencies in transactions of various kinds:

Go back to: