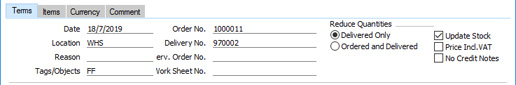

Entering a Return - Terms Card

This page describes the fields on the 'Terms' card in the Returned Goods record window. Please follow the links below for descriptions of the other cards:

---

- Date

- Paste Special

Choose date

- The date of the Return. The default is the current date.

- Location

- Paste Special

Locations setting, Stock module

- The Location into which the Items are to be returned. If you have specified a Main Location in the Stock Settings setting, leaving the field blank means that the Main Location will be used.

- You must specify a Location here if you are using the Require Location option in the Stock Settings setting.

- If you have specified a Default Return Location in the Local Machine setting in the User Settings module, that Location will be copied here as a default. This option is useful if you only have a single Location into which you receive Returned Items. Note that the Local Machine setting is specific to the client machine you are working on and therefore if you need to use the Default Return Location feature you should specify it in the Local Machine setting separately on each client machine. If you have not specified a Default Return Location, then the Location in the originating Order or Delivery will be copied here.

- You can specify a Location in any of the Return rows (flip B), to override the one entered here.

- Reason

- Paste Special

Standard Problems setting, Sales Ledger/Service Orders module

- Specify here a Standard Problem to describe the reason why the Customer needed to return the goods.

- If you need it to be mandatory that a Reason is specified in every Returned Goods record, select the Force Reason option in the Stock Settings setting.

- If you create a Credit Note from a Returned Goods record, the Reason that you specify here will be copied to the Credit Note automatically.

- Tags/Objects

- Paste Special

Tag/Object register, Nominal Ledger/System module

- You can assign up to 20 Tags/Objects, separated by commas, to a Return, to be transferred to the consequent Nominal Ledger Transaction. You might define separate Tags/Objects to represent different departments, cost centres or product types. This provides a flexible method of analysis that you can use in Nominal Ledger reports.

- Usually the Tags/Objects in this field will represent the Customer and the Salesman. By default, they will be taken from the Order, Delivery, Service Order or Work Sheet from which you created the Return, but you can change them if necessary. In a Returned Goods record that you are entering yourself, the Sales Tags/Objects specified in the Contact record for the Customer will be copied here when you enter a Customer Number in the header.

- In the Nominal Ledger Transaction generated from a Return, the Tags/Objects specified here will be assigned to the credit posting to the Cost of Sales or Returned Goods Account (unless you are using the Skip Header A/C Objects on Cost A/C option in the Account Usage P/L setting in the Purchase Ledger). These Tags/Objects will also be assigned to the debit posting to the Stock Account if you are using the Tag/Object on Stock Account option in the Cost Accounting setting.

- Order No.

- If you create a Returned Goods record from an Order or Delivery, the Order Number will be copied here. This field cannot be changed.

- Delivery No.

- If you create a Returned Goods record from a Delivery, the Delivery Number will be copied here. The Delivery and the Return will also be connected to each other through the Link Manager. This field cannot be changed.

- Serv. Order No.

- If you create a Returned Goods record from a Service Order or Work Sheet, the Service Order Number will be copied here. When created from a Service Order, the Service Order and the Return will also be connected to each other through the Link Manager. This field cannot be changed.

- Work Sheet No.

- If you create a Returned Goods record from a Work Sheet, the Work Sheet Number will be copied here. The Work Sheet and the Return will also be connected to each other through the Link Manager. This field cannot be changed.

- Reduce

- Default taken from

Returned Goods Settings setting, Stock module

- In a Return that you created from an Order or Delivery, use these options to control the effect of the Return on the original Sales Order:

- Delivered Quantity

- This option reduces the Del. and Del. OK quantities on flip D of each Order row. You should use it when goods are returned because they are faulty (i.e. the Customer requires a replacement). Then, after marking the Returned Goods record as OK and saving, you can return to the Order to raise another Delivery for the appropriate quantity to fulfil the Order. In this situation you may choose to treat the Item as written off. If you need to return the Items to your Supplier, it is recommended that you update stock levels and then enter a Returned Goods to Supplier record (if you originally purchased the Items using a Purchase Order) or a Stock Depreciation record (if there is no originating Purchase Order).

- Ordered and Delivered Qty

- This option reduces the Order quantity as well as the Del. and Del. OK quantities in each Order row. You should use it when goods are returned without a replacement being required (perhaps the Customer has cancelled the Order). In this case, choose to reduce the ordered quantity and to update stock levels. If the Order has been invoiced, selecting 'Credit Note' from the Create menu (Windows/macOS) or + menu (iOS/Android) in the Returned Goods record will create a Credit Note with appropriate Payment Terms and a reference to the Invoice being credited. If you have created more than one Invoice from the Sales Order, you will not be able to create the Credit Note from the Returned Goods and instead will need to do so from the Order or from the Invoice to be credited.

- Update Stock

- Use this option if you need stock levels for the Items on the Return to be updated and a Nominal Ledger Transaction to be created when you mark the Return as OK and save. If the Item being returned is to be written off, you can then do so using a Stock Depreciation record or a Returned Goods to Supplier record, depending on the circumstances.

- If you deselect this option, stock levels for the Items on the Return will not be updated and a Nominal Ledger Transaction will not be created when you approve the Return, even if you have so specified in the Sub Systems setting in the Nominal Ledger and in the Number Series - Returned Goods setting.

- Price Incl VAT

- Select this option if the Item Costs for the Items in the Return include VAT. The Unit Cost of each Item will be adjusted to show the cost excluding VAT.

- No Credit Notes

- Select this option in a Return if you do not want to be able to create Credit Notes from it. This may be because the Customer is not to be credited, or because you have already issued a partial Credit Note and you do not want to credit the remainder.

- Selecting this option will prevent you from creating Credit Notes from the Return i.e. no Credit Note will be created when you select 'Credit Note' from the Create menu. However you will still be able to create a Credit Note from the original Invoice. An automatic Credit Note will still be created if you are using the Create Credit Note when OKing Returned Goods option in the Order Settings setting.

- You will be able to change this option in a Return that has been marked as OK and saved. However, you can use Access Groups to prevent certain users from changing this option, by granting them Full access to the 'Disallow Changing 'No Credit Notes' on Returned Goods' Action.

---

The Returned Goods register in Standard ERP:

Go back to:

|