Accounting Periods

This page describes the Accounting Periods setting in the Nominal Ledger.

---

When you enter an Invoice or Purchase Invoice, its Due Date will usually be calculated from its Invoice Date using its Payment Term. For example, if the Net Days in a Payment Term is 30, the Due Date in an Invoice will be 30 days after the Invoice Date. This calculation has two limitations:

- In some countries (e.g. in southern Africa), Due Dates are not calculated directly from Invoice Dates in this manner. Instead, a Due Date will depend on the Period in which the Invoice Date falls: Invoices issued on any date in a Period should have the same Due Date. Each Period may not necessarily be a calendar month.

- Calculating Due Dates using Payment Terms does not allow a Due Date always to be the last day of a month, because the calculation does not take the varying numbers of days in each month into account.

To overcome these limitations, you can use Accounting Periods to calculate Due Dates. Follow these steps:

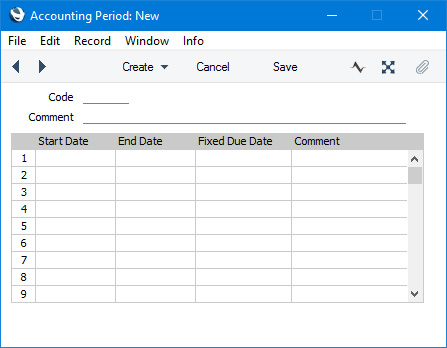

- Create a new record in the Accounting Periods setting in the Nominal Ledger:

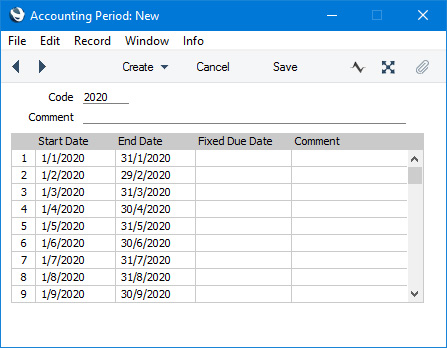

- Enter a Code for the Accounting Period. This must be the same as the Code of a Fiscal Year. When you leave the Code field, the Fiscal Year will be divided into twelve periods, one for each calendar month, and these periods will be listed in the grid:

- Change the Start and End Dates of each Period as necessary. The Start Date of the first Period must be the same as the Start Date of the Fiscal Year. The End Date of the last Period must be the same as the End Date of the Fiscal Year. The Periods can be irregular in duration, but do not omit any dates.

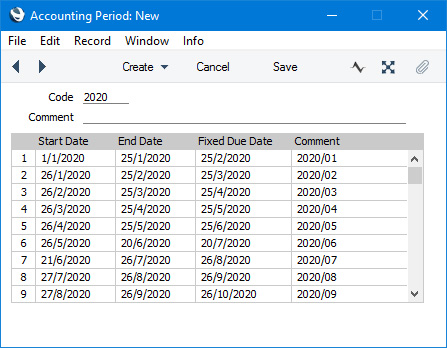

- Specify Due Dates for each Period in the Fixed Due Dates column:

In the example illustrated above, an Invoice or Purchase Invoice dated between 21st June and 26th July will have a Due Date of 26th August.

If you do not specify a Fixed Due Date for a Period, then the End Date of that Period will be used as its Due Date.

The Comment will be printed in reports if you decide to use Accounting Periods to determine the ageing periods in those reports. This is described in point 6 below.

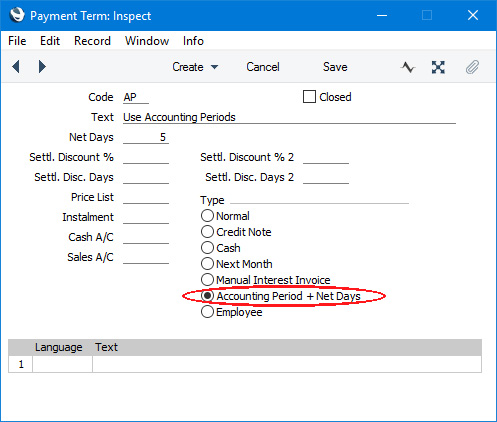

- If you want Accounting Periods to be used when calculating Due Dates, select the Accounting Period + Net Days option in your Payment Term records:

In the example Payment Term illustrated above, the Net Days is 5. This means a Due Date will be five days later than the Due Date specified in the Accounting Periods setting. So, our example Invoice or Purchase Invoice dated between 21st June and 26th July will now have a Due Date of 31st August, if it uses this Payment Term.

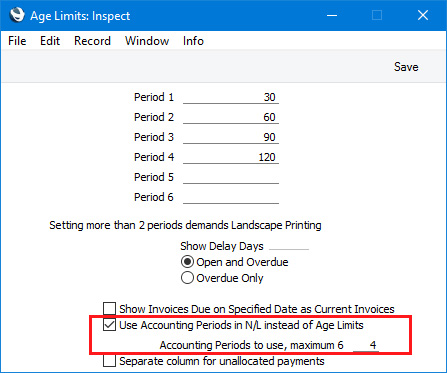

- You can also use Accounting Periods to determine the ageing periods in the Sales and Purchase Ledger reports (Aged and Detailed Aged options), the Payments and Receipts Forecast reports, and the Open Invoice Customer and Supplier forms. To do this, select the Use Accounting Periods instead of Age Limits option in the Age Limits setting in the Sales Ledger, and specify how many Accounting Periods you want to use:

If you are using this option, you should still specify Periods 1-6 as these fields provide the defaults for the Aged Stock Analysis report in the Stock module. It is recommended that the periods you specify in the Age Limits setting are similar to those in the Accounting Periods setting (e.g. if you have periods one month in duration in the Accounting Periods setting, you should have the same in the Age Limits setting).

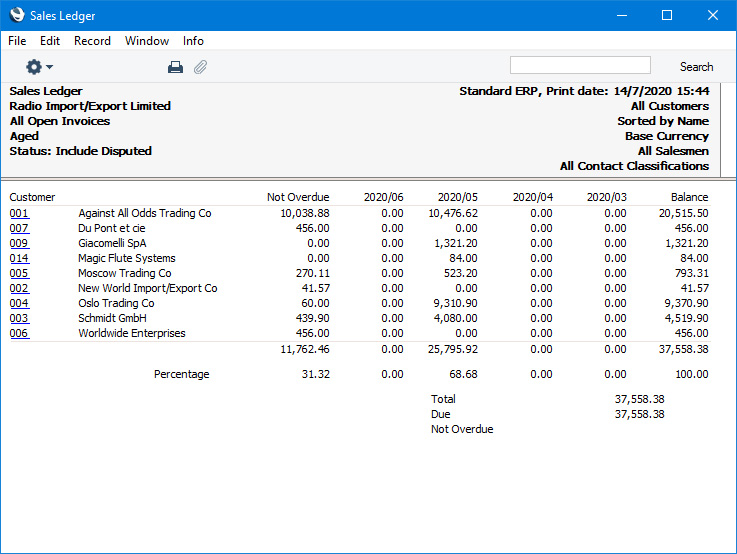

The example Sales Ledger report illustrated below was produced using the Aged option. It has four ageing periods as specified in the Age Limits setting illustrated above (in addition to the Not Due column and the column for Invoices that are older than the last ageing period). These ageing periods are the four most recent Accounting Periods at the time the report is produced. The name (column heading) of each ageing period is taken from the record in the Accounting Periods setting illustrated in step 4:

---

Settings in the Nominal Ledger:

Go back to: