VAT Report - Example VAT Report Definitions - Cash VAT

This page describes an example VAT Report definition that is suitable for use when using the

Post Receipt VAT and

Post Payment VAT options, with particular reference to the Cash VAT scheme in the UK. Please refer to the following pages for more details about the VAT Report in Standard ERP:

---

In some countries, you can account for output VAT on the basis of the payments you receive, rather than on the Invoices you issue. Similarly, you can account for input VAT on the basis of the payments you issue, rather than on the Purchase Invoices that you receive. This is sometimes known as accounting for VAT on a cash basis or, in the UK, Cash Accounting.

If you need to account for VAT on a cash basis, follow these steps:

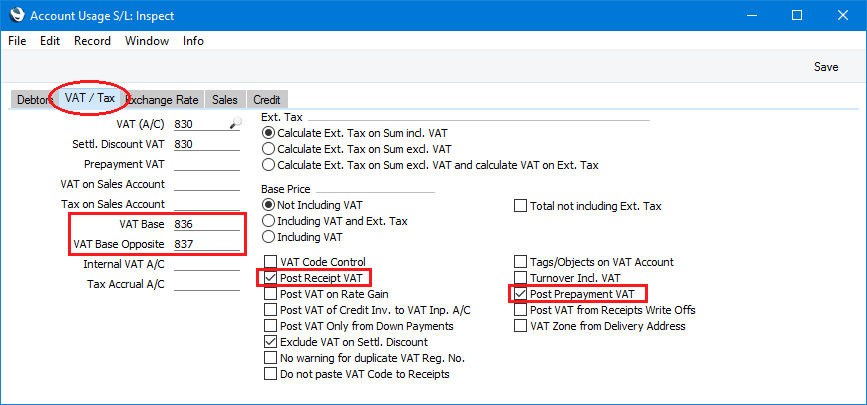

- On the sales side, the Account Usage S/L contains two options that you should select, depending on your requirements:

- Select the Post Receipt VAT option if you need VAT to be posted from normal Receipts (i.e. Receipts in which you are receiving payment against Invoices) and On Account Receipts.

- Select the Post Prepayment VAT option if you would like VAT to be posted from Prepayment Receipts. You will also need to specify a Prepayment VAT Account in the same setting.

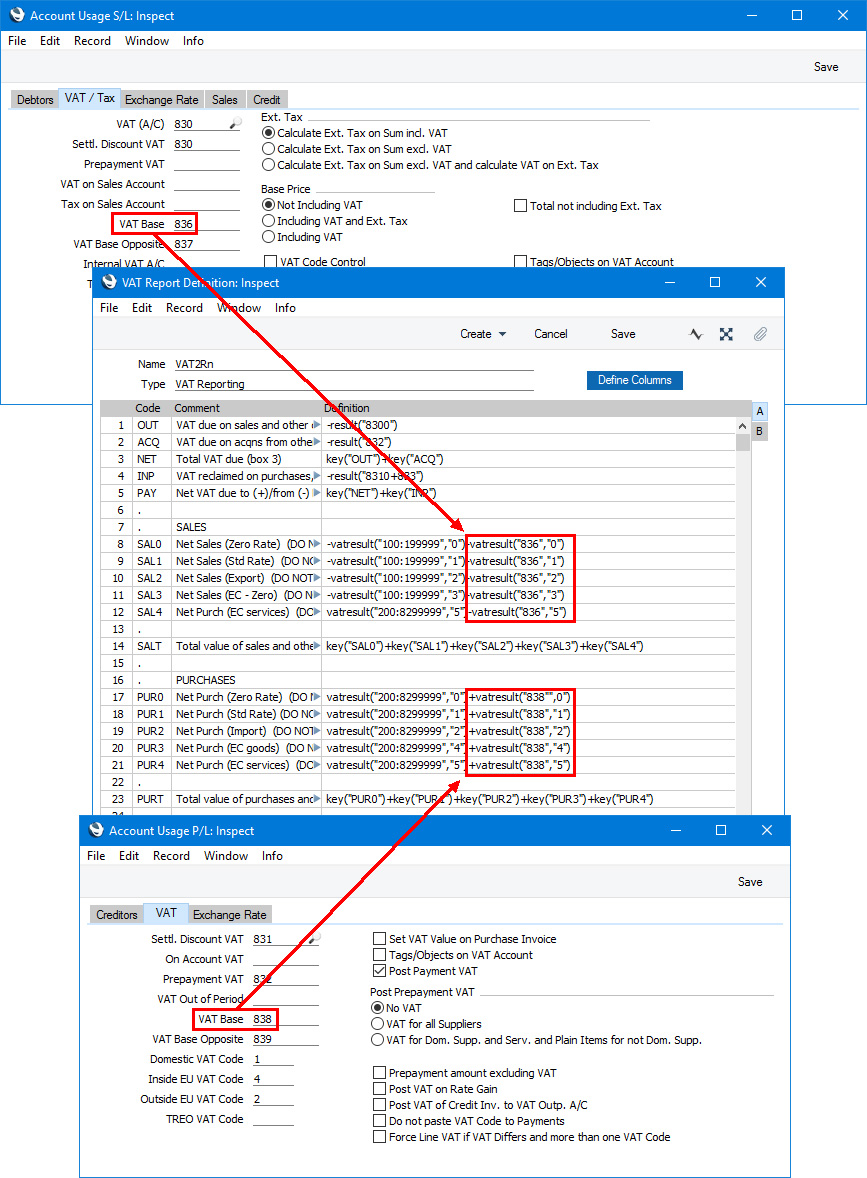

In the UK only (i.e. when the VAT Law in the Company Info setting is "Default"), you should also specify VAT Base and VAT Base Opposite Accounts. When an Invoice is paid, the VAT Base Account will be credited with the Invoice turnover (i.e. value excluding VAT). The V-Cd field in this posting will be filled in. The purpose of this posting is to allow the Invoice turnover to be added to the value of sales and all other outputs excluding VAT (the Box 6 figure on the UK VAT Return) on the payment date rather than on the Invoice Date. The purpose of the VAT Base Opposite Account is solely to balance the VAT Base Account.

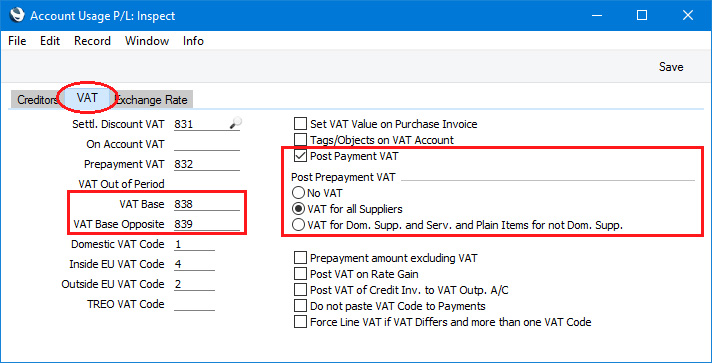

- Similarly, on the purchase side, the Account Usage P/L contains two options that you should select, depending on your requirements:

- Select the Post Payment VAT option if you need VAT to be posted from normal Payments (i.e. Payments in which you are issuing payment against Purchase Invoices) and On Account Payments.

- Select one of the Post Prepayment VAT options if you would like VAT to be posted from Prepayment Payments. You will also need to specify On Account VAT and Prepayment VAT Accounts in the same setting and, depending on your requirements, you may also need to select the Prepayment amount excluding VAT option.

In the UK only, you should also specify VAT Base and VAT Base Opposite Accounts. When you pay a Purchase Invoice, the VAT Base Account will be debited with the Invoice turnover (i.e. value excluding VAT). The V-Cd field in this posting will be filled in. The purpose of this posting is to allow the Purchase Invoice turnover to be added to the value of purchases and all other inputs excluding VAT (the Box 7 figure on the UK VAT Return) on the payment date rather than on the Invoice Date. The purpose of the VAT Base Opposite Account is solely to balance the VAT Base Account.

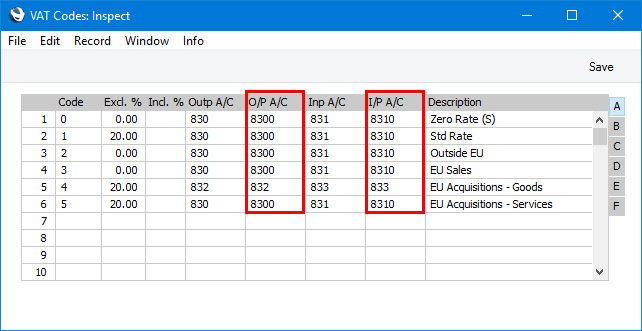

- If you need to account for VAT on a cash basis, Sales Invoices will still post to an Output VAT Account as normal, and Purchase Invoices will still post to an Input VAT Account. However, these Accounts will now be treated as preliminary VAT Accounts. When a Customer pays an Invoice, the Transaction from the Receipt will include an extra VAT element in which the VAT is moved from the Output VAT Account to a final Account, known as the O/P Account. On the purchase side, when you pay a Purchase Invoice, the Transaction from the Payment will include an extra VAT element in which the VAT is moved from the Input VAT Account to a final Account, known as the I/P Account.

The next step is to specify the O/P and I/P Accounts, which you should do in the VAT Codes setting:

Note in the rows for VAT Codes 4 and 5 that the Output and O/P Accounts are the same, and the Input and I/P Accounts are the same. VAT Codes 4 and 5 are used for acquisitions from the EU, and in the UK such transactions cannot be included in the Cash Accounting scheme. Standard ERP still requires O/P and I/P Accounts to be specified: using the same Accounts in effect means that acquisition VAT will be immediately be posted to the final Account, without passing through a preliminary Account.

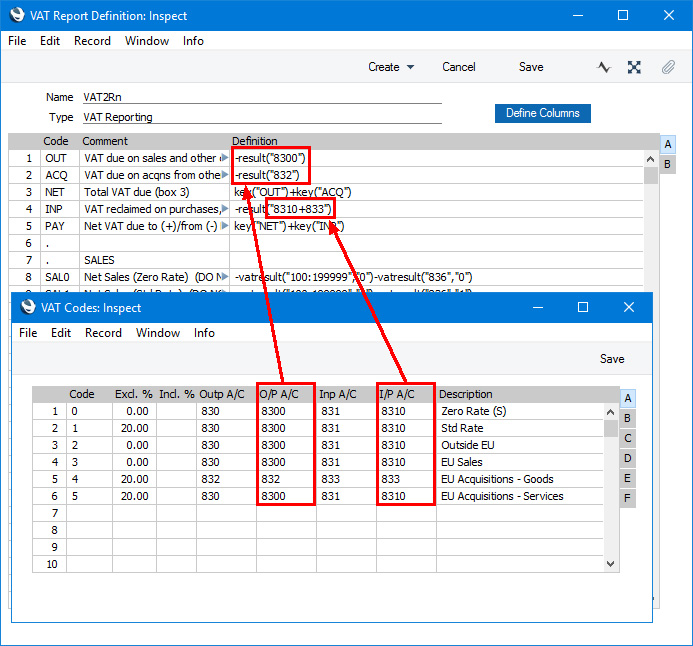

- Finally, you should make two changes to the definition of the VAT Report (in this example, we will add the changes to the example standard VAT Report definition described here). The first change is to ensure that the VAT to be paid or reclaimed will be calculated using the O/P and I/P Accounts instead of the Output and Input Accounts. In the illustration below, we have changed rows 1 and 4:

The second change is to ensure that the values of sales and purchases are calculated from the two VAT Base Accounts. Postings to the sales and cost Accounts should still be included in the calculations, because the value of Invoices that are Cash Notes (i.e. Invoices that are immediately paid and so will not have corresponding Receipts and Payments) will not be posted to the VAT Base Account:

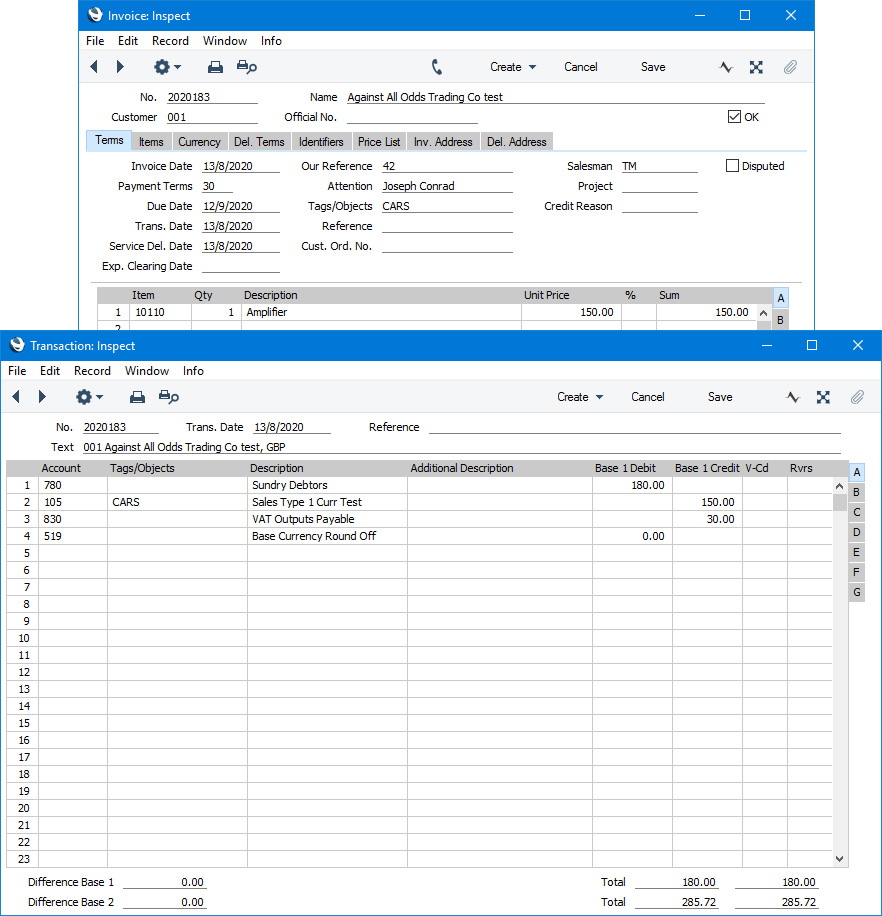

- Illustrated below is an example Invoice together with its Nominal Ledger Transaction. The VAT is posted to the Output Account as normal (row 3), but the posting to the Sales Account (row 2) does not include a VAT Code (V-Cd):

When the Customer pays the Invoice a month later, the Nominal Ledger Transaction shows the VAT being moved from the Output Account to the O/P Account. The sales value excluding VAT is credited to the VAT Base Account and debited to the VAT Base Opposite Account. The posting to the VAT Base Account includes the VAT Code:

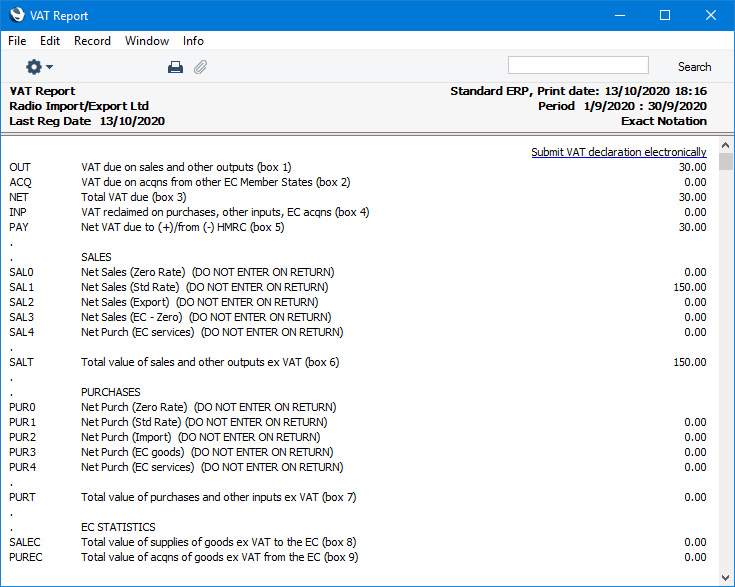

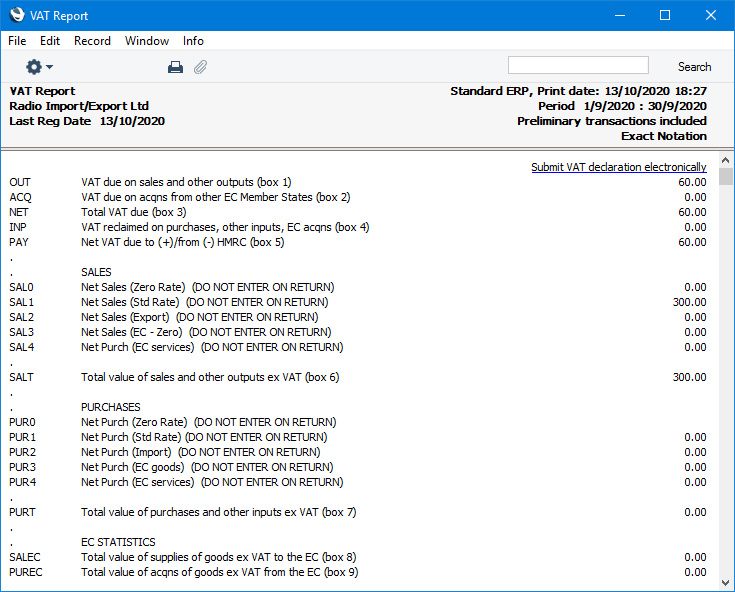

The VAT Report for the month when the Invoice was paid includes the VAT in the payable figure:

The value of the Invoice is included in rows 8-11 and 14 (SAL0-SAL3 and SALT). As previously described, these rows use the VATRESULT command to print the total values of sales and purchases made with each VAT Code. For example, VATRESULT("100";"1") will print the value of sales posted from Invoices to Account 100 with VAT Code 1

When you are accounting for VAT on a cash basis, you need to be able to establish the total value of sales and purchases by payment date, not by Invoice date. To this end, the VAT Code field in postings to Sales and Cost Accounts in Transactions created from Sales and Purchase Invoices will be empty. Transactions created from Receipts and Payments will include postings to VAT Base Accounts, and VAT Codes will be assigned to these postings. This allows you to use the VATRESULT command to establish the total value of sales and purchases by payment date.

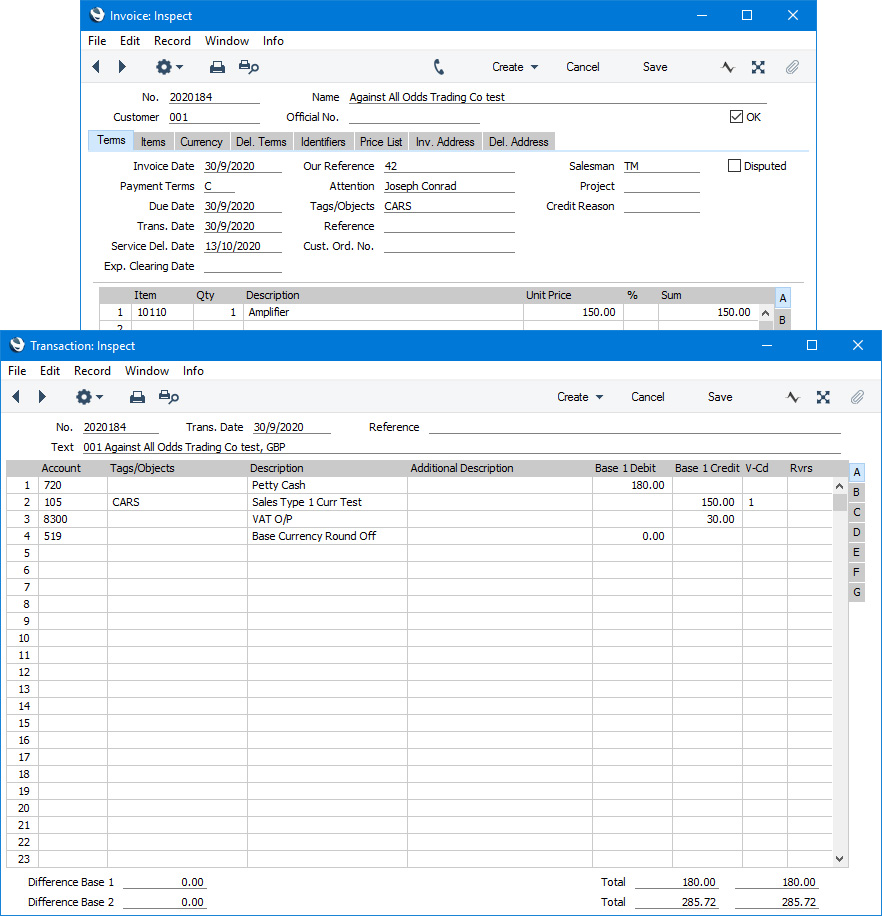

- The next illustration shows an Invoice with a "Cash" Type Payment Term (i.e. a Cash Note) together with its Nominal Ledger Transaction. As the Invoice is a Cash Note there will be no Receipt, so the VAT is posted directly to the O/P Account (row 3) and the posting to the Sales Account (row 2) does include a VAT Code (V-Cd):

On recalculating the VAT Report previously illustrated, it will now include the Cash Note. The value of the Cash Note is included in rows 8-11 and 14 (SAL0-SAL3 and SALT because the figures in these rows are calculated by applying the VATRESULT command to the Sales Accounts as well as to the VAT Base Account:

Please follow the links below for more details about the VAT Report:

---

Reports in the Nominal Ledger:

---

Go back to: