VAT Report - Example VAT Report Definitions - Reverse Charge VAT

This page describes an example VAT Report definition that is suitable for use with Reverse Charge VAT. Please refer to the following pages for more details about the VAT Report in Standard ERP:

---

In a normal transaction, the Supplier should account to the tax authorities for the VAT that is due on the supply. However, in certain situations, it is the Customer who must account for any VAT that is due. If you are the customer in such a situation, you will not pay VAT to the Supplier but instead will pay VAT to the tax authorities at the domestic rate that would apply had you purchased the Items from a local Supplier. This is sometimes known as the "reverse charge" procedure. You can reclaim this VAT, if the purchase relates to VAT taxable supplies that you will go on to make.

One situation when you need to use the reverse charge procedure is when you purchase Items from VAT-registered Suppliers in other countries in the EU. Items that you purchase from other countries in the EU are usually known as "acquisitions" or "arrivals" (the term "imports" usually refers to Items purchased from other countries outside the EU). One method for handling VAT on acquisitions using the reverse charge procedure is described below. An alternative method is to create Internal Invoices from Purchase Invoices for EU Acquisitions. Please refer here for more details.

To include EU Acquisition VAT in the VAT Report, follow these steps:

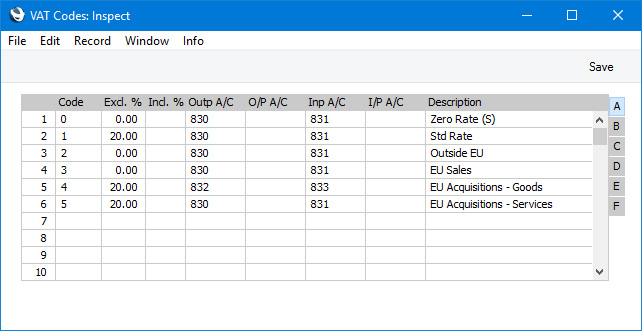

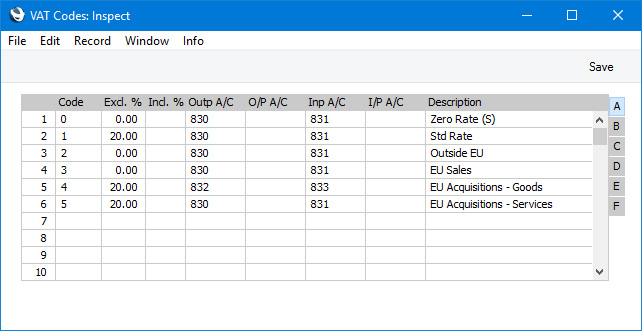

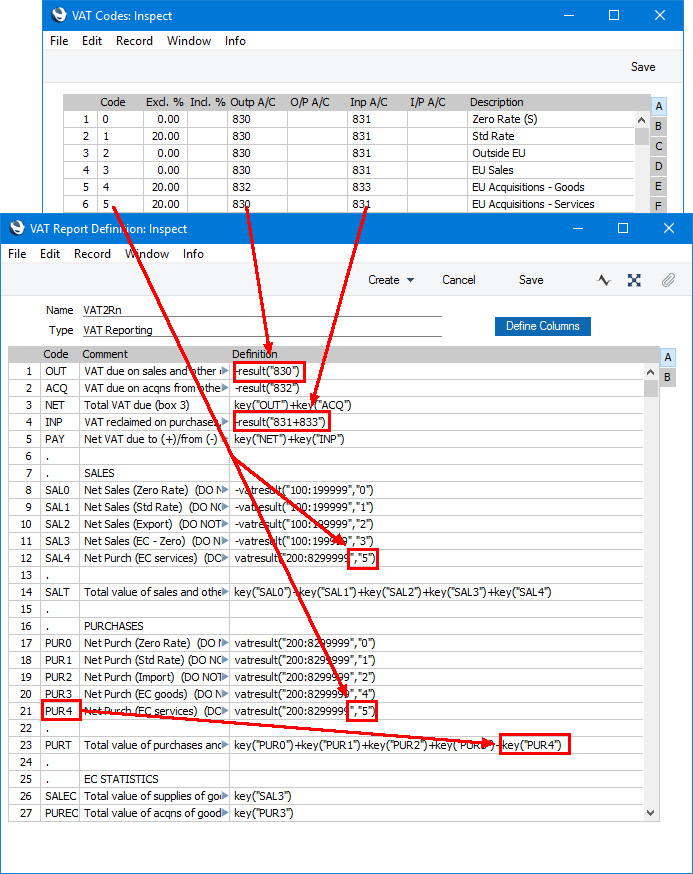

- In the VAT Codes setting in the Nominal Ledger, create two VAT Codes for VAT on EU Acquisitions. Two VAT Codes are needed because purchases of goods and purchases of services need to be reported differently on the UK VAT Return.

VAT Code 4 in the example illustration below will be used for purchases of goods. VAT will be debited to the Input Account in this VAT Code and credited to the Output Account. It is recommended that you use an Output Account that is not used in any other VAT Code.

VAT Code 5 in the example will be used for purchases of services. In this case, you can use the standard Output and Input Accounts (although you can use dedicated Accounts if you prefer).

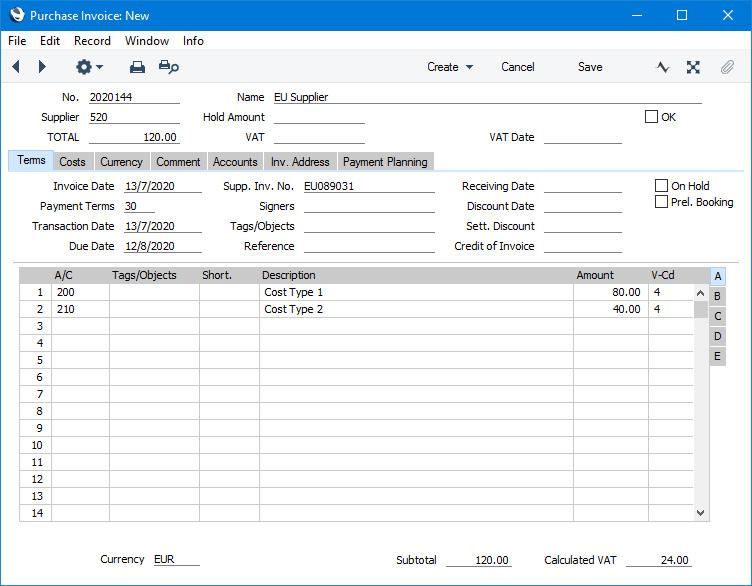

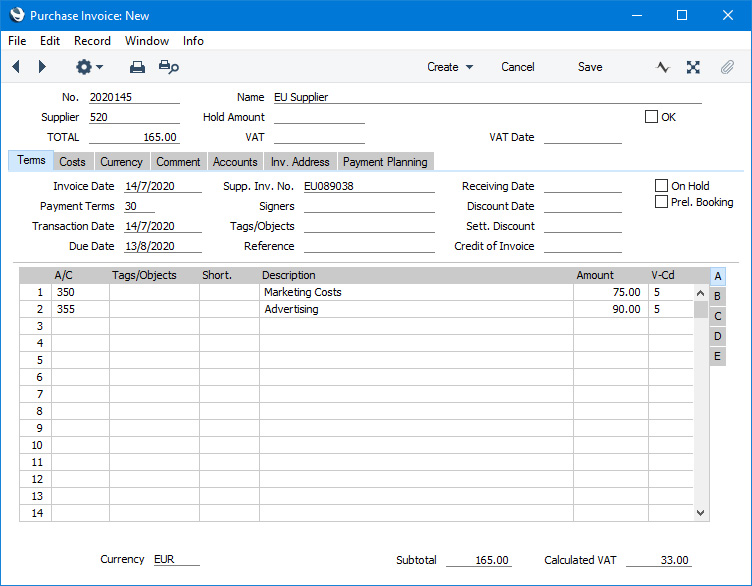

- In a Purchase Invoice for goods received from a Supplier in the Inside EU VAT Zone, enter the total charged by the Supplier (i.e. without VAT) in the TOTAL field and the Amounts in the rows using the VAT Code 4 from step 1. The Calculated VAT field in the footer will be updated automatically. In this example, the Currency in the Invoice is the Euro:

The VAT Code in each row will be chosen as follows:

- The Purch. VAT Code for the Supplier will be used.

- It will be taken from the Account record.

- The VAT Code on the 'VAT' card of the Account Usage P/L setting will be used.

In the case of point (ii), you can only specify a single VAT Code in each Account record. It is therefore recommended that you use dedicated Accounts for purchases of goods from the EU, to ensure that the correct VAT Code will be offered as the default. If you use the same Account for non-EU and EU purchases, there is a risk that the wrong VAT Code will be offered by default and that you don't change it.

In the last case, the appropriate VAT Code for the Zone of the Supplier will be used.

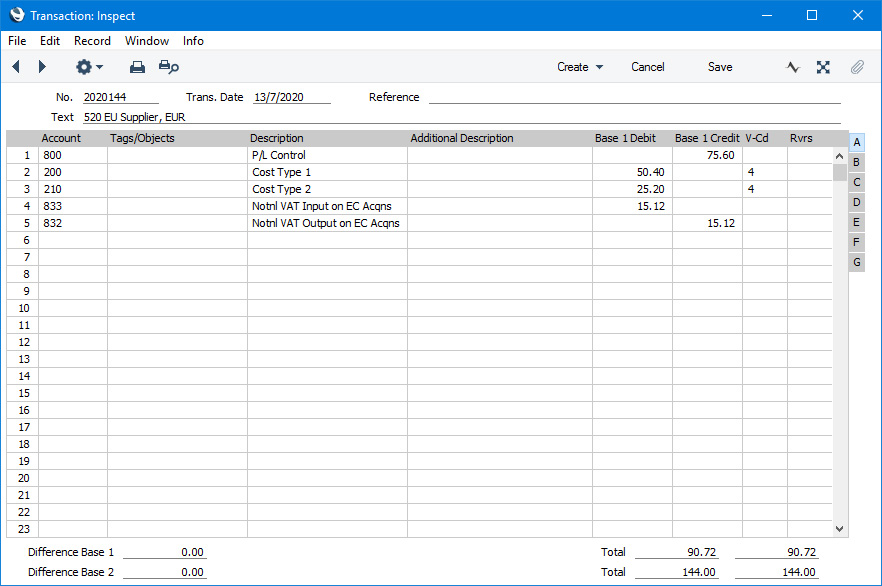

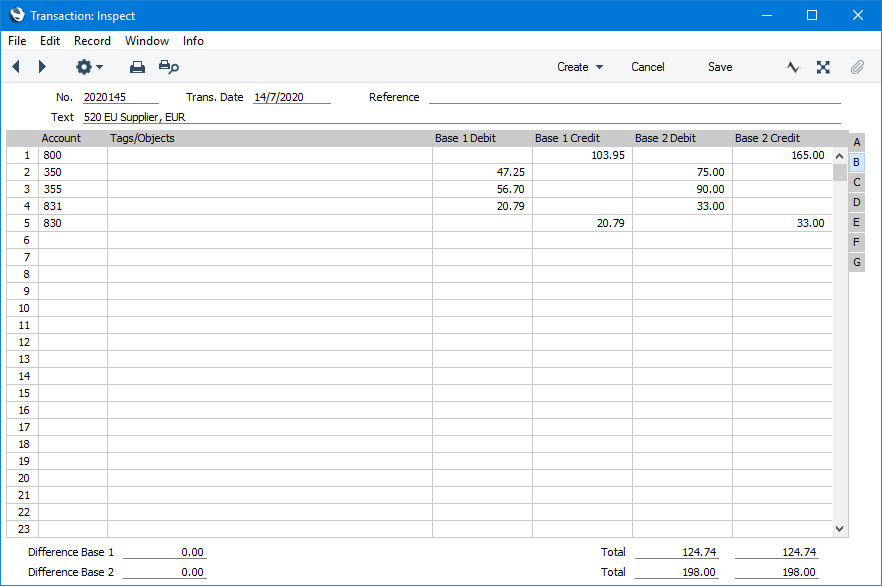

- When you mark the Purchase Invoice as OK and save it, the total charged by the Supplier will be posted to the Creditor Account. Because the Supplier is in the Inside EU VAT Zone, VAT will be debited to the Input Account of the selected VAT Code and credited to the Output Account (EUR figures are shown in the Base 2 Debit and Credit fields, with figures in Base Currency 1 in the Base 1 Debit and Credit fields):

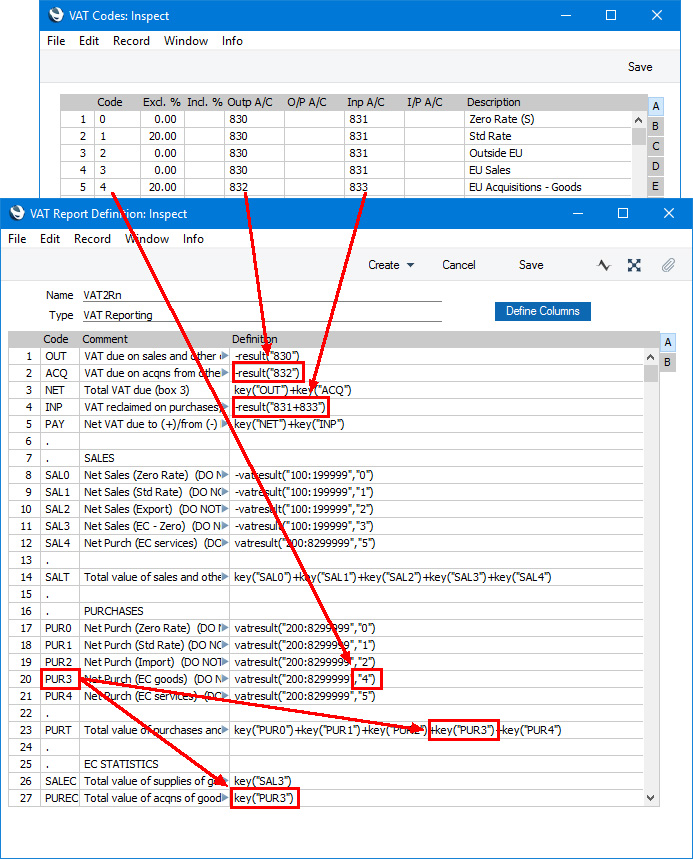

- In the VAT report, you will need to include acquisition VAT when calculating the output VAT that is payable. You will also be able to include it when calculating the input VAT that is reclaimable, if the acquisitions relate to VAT taxable supplies that you make.

In the UK, the output VAT payable on EU goods acquisitions should be included in the VAT report as a separate figure. This has been done in row 2 in the example VAT Report definition illustrated below. In this row, the RESULT command will return the net change in the Output VAT Account used in VAT Code 4, hence the recommendation that this be an Output Account that is not used in any other VAT Code. From there the output VAT will be included in the total output VAT figure in row 3.

It is not necessary to include the input VAT as a separate figure. So, in row 4 the RESULT of the Input VAT Account has been added to that of the domestic Input VAT Account to produce a total figure.

Row 20 uses the VATRESULT command to print the total value of EU acquisitions with VAT Code 4. This figure is then used in rows 23 and 27 (Boxes 7 and 9 on the UK VAT Return).

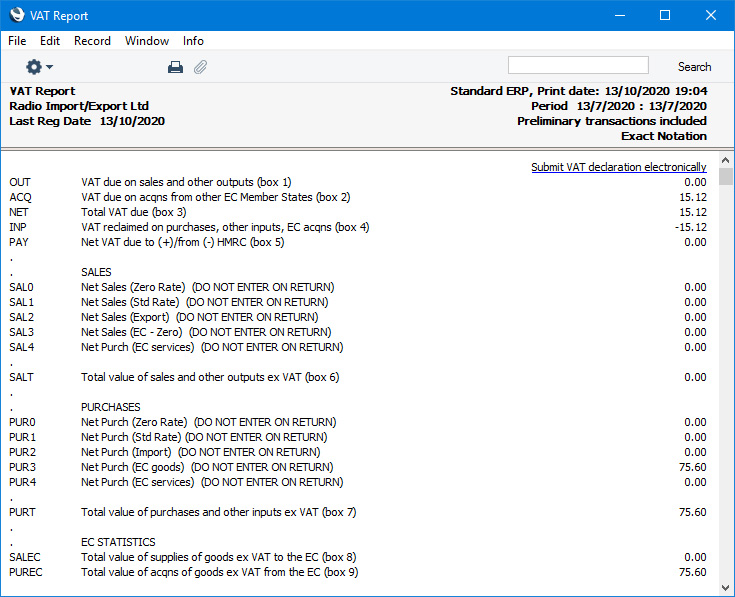

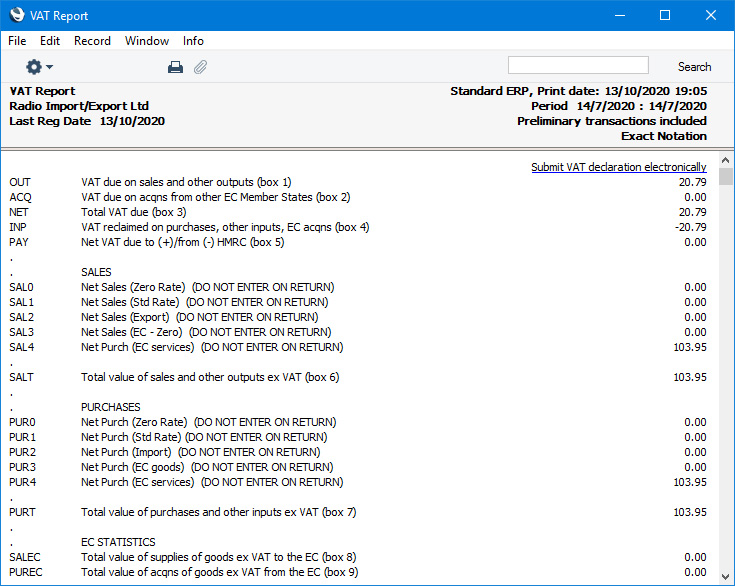

- Using this definition, the Purchase Invoice illustrated above will be included in the VAT Report as shown below:

In the UK, services purchased from Suppliers in the Inside EU VAT Zone need to be reported differently to goods. In step 1 we added a VAT Code 5 for this purpose. This VAT Code uses the standard Output and Input Accounts.

Follow these steps:

- The procedure for entering a Purchase Invoice for services is the same as that for entering a Purchase Invoice for goods. Enter the total charged by the Supplier (i.e. without VAT) in the TOTAL field and the Amounts in the rows using VAT Code 5. Again, it is therefore recommended that you use dedicated Accounts for purchases of services from the EU, to ensure that the correct VAT Code will be offered as the default. The Calculated VAT field in the footer will be updated automatically. In this example, the Currency in the Invoice is the Euro:

- When you mark the Purchase Invoice as OK and save it, the total charged by the Supplier will be posted to the Creditor Account. Because the Supplier is in the Inside EU VAT Zone, VAT will be debited to the Input Account of the selected VAT Code and credited to the Output Account (EUR figures are shown in the Base 2 Debit and Credit fields, with figures in Base Currency 1 in the Base 1 Debit and Credit fields):

- In the VAT report, you will need to include acquisition VAT when calculating the output VAT that is payable. You will also be able to include it when calculating the input VAT that is reclaimable, if the acquisitions relate to VAT taxable supplies that you make. In this respect, reporting services is similar to reporting goods.

However, in the UK, the output VAT payable on EU services acquisitions should not be included in the VAT report as a separate figure (unlike EU goods acquisitions) i.e. it should be included in box 1 in the UK VAT Return and not box 2. As with goods, the input VAT should be included in box 4. This allows you to use the standard Output and Input Accounts, as in this example. You can use dedicated Accounts if you prefer, but if you do, be sure to include them in the RESULT commands that calculate the Output VAT and Input VAT totals in your VAT Report Definition (rows 1 and 4 in the example).

Purchase of services from Suppliers in the EU VAT Zone need to be included in both the sales totals and the purchase totals on the UK VAT Return (boxes 6 and 7). Using a dedicated VAT Code (VAT Code 5 in the example) will allow you to do this. Rows 12 and 21 in the example VAT Report definition use the VATRESULT command to print the total value of EU acquisitions with VAT Code 5. This figure is then used in rows 14 and 23.

- Using this definition, the Purchase Invoice illustrated above will be included in the VAT Report as shown below:

When you enter a Purchase Invoice from a Supplier in the Inside EU VAT Zone, the VAT posting will follow the reverse charge procedure automatically, as described for goods and services above. However, there may be occasions when you need to use the reverse charge procedure with Suppliers in the Domestic or Outside EU VAT Zones. Follow these steps:

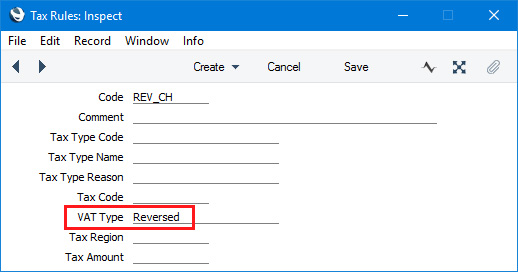

- Create a new record in the Tax Rules setting in the Nominal Ledger. In the VAT Type field, choose "Reversed" using 'Paste Special':

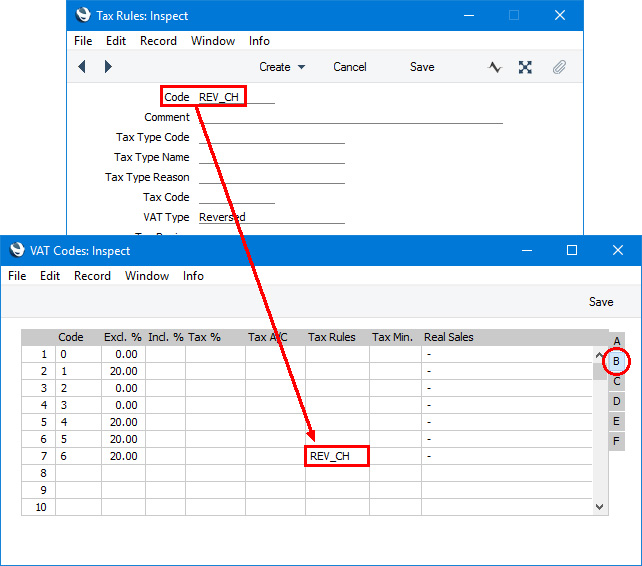

- In the VAT Codes setting, create a VAT Code for reverse charge VAT. Specify Input and Output Accounts and the VAT rate and, in the Tax Rules field on flip B, enter the Tax Rule record that you created in step 10:

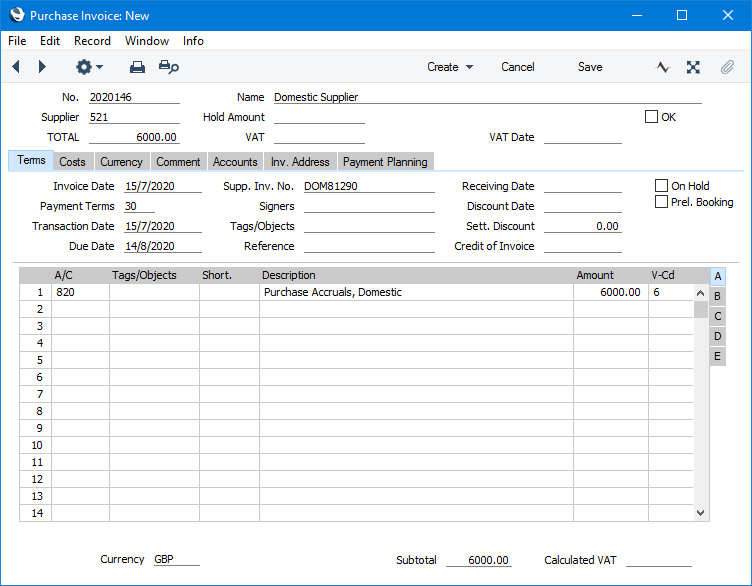

- In a Purchase Invoice that is to be subject to the reverse charge procedure, enter the total charged by the Supplier (i.e. without VAT) in the TOTAL field and the Amounts in the rows using the VAT Code from step 11:

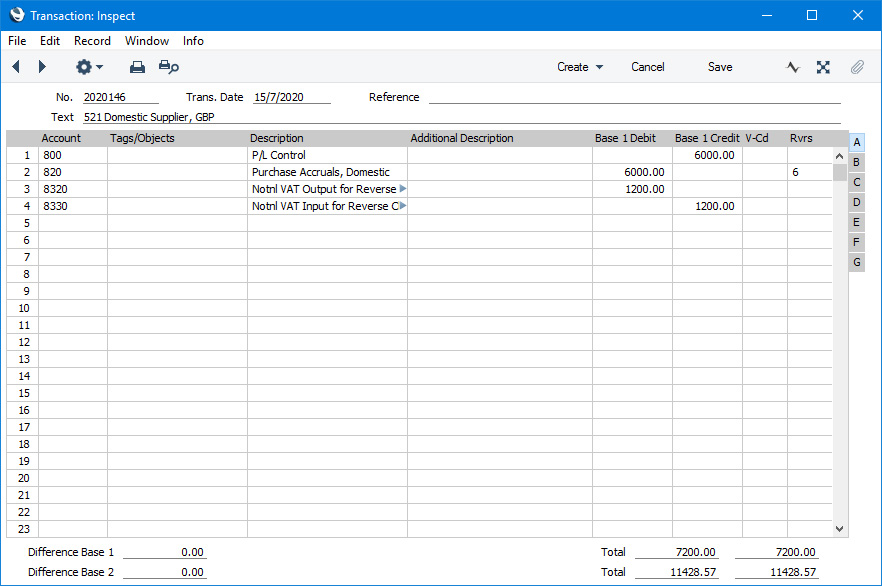

- When you mark the Purchase Invoice as OK and save it, the total charged by the Supplier will be posted to the Creditor Account. Because the Tax Rule in the VAT Code is "Reversed", VAT will be debited to the Input Account of the selected VAT Code and credited to the Output Account, and the VAT Code will be placed in the Rvrs field in the row posting to the Cost Account instead of the V-Cd field:

- In the VAT report, you will need to include reverse charge VAT when calculating the output VAT that is payable. Subject to the normal rules, you will also be able to include it when calculating the input VAT that is reclaimable.

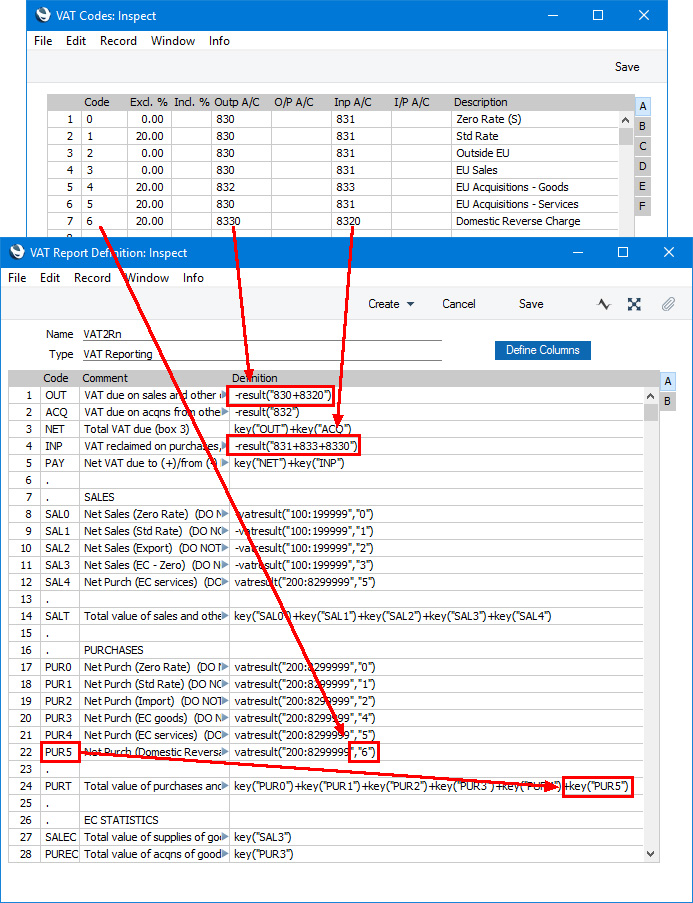

In the UK, you must include the output tax payable on purchases under the reverse charge in the output VAT total (box 1 in the UK VAT Return). This has been done in row 1 in the example VAT Report definition illustrated below. In this row, the RESULT command will return the total net change in the standard Output VAT Account (Account 830) and in the Output VAT Account used in VAT Code 6 (Account 8320). From there the output VAT will be included in the total output VAT figure in row 3.

You should not include the VAT exclusive value of the purchases (box 6 on the UK VAT Return). So, rows 8-12 do not include a VATRESULT calculation for VAT Code 6.

If you will reclaim input VAT, you should include it in the input VAT total. In row 4 the RESULT of the Input VAT Account has been added to those of the domestic Input VAT Account and the EU Acquisitions Input Account to produce a total figure.

Row 22 uses the VATRESULT command to calculate the total value of reverse charge purchases with VAT Code 5 (in calculating this figure, VATRESULT will check both the V-Cd and Rvrs fields in Transaction rows). This figure is then used in row 24 (Box 7 on the UK VAT Return).

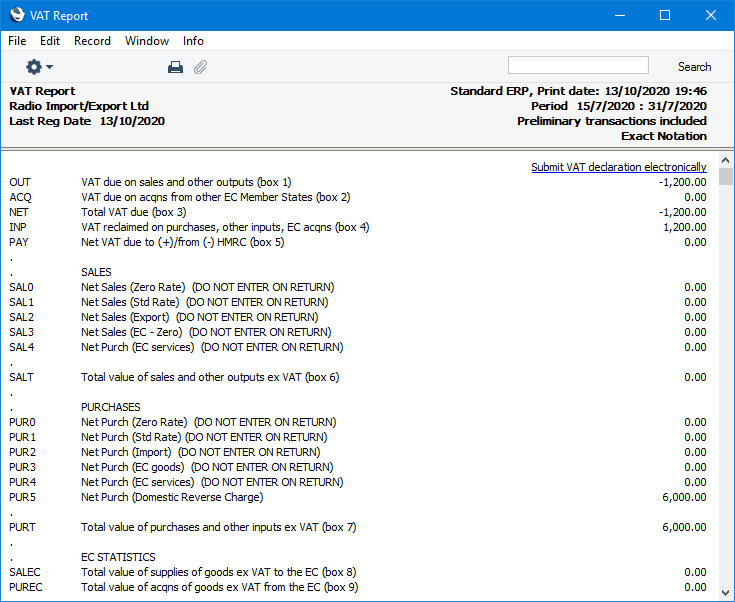

- Using this definition, the Purchase Invoice illustrated above will be included in the VAT Report as shown below:

Please follow the links below for more details about the VAT Report:

---

Reports in the Nominal Ledger:

---

Go back to: