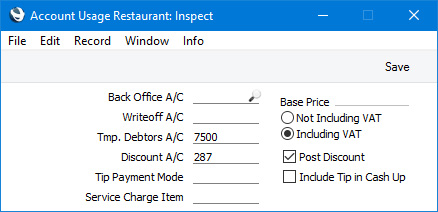

Account Usage Restaurant

This page describes the Account Usage Restaurant setting in the Restaurant module.

---

The Account Usage Restaurant setting allows you to determine some of the Accounts that will be used when Bar Tabs are posted to the Nominal Ledger by the cashing up routines and to specify some options controlling the behaviour of Bar Tabs. Take care to ensure that the Accounts that you specify here exist in the Account register.

- Back Office A/C

- Paste Special

Account register, Nominal Ledger/System module

- The Back Office Account is used when you move cash, cheques and credit card payments into and out of your Till Drawers. A movement into a Till Drawer (e.g. placing a cash float into a Till Drawer) will credit the Back Office Account, while a movement out of a Till Drawer (e.g. removing the day's takings from the Drawer to the back office or bank) will debit it.

- You should record movements into and out of your Till Drawers using the Cash Events setting. A Cash Event will not update the Nominal Ledger immediately. This will be done the next time you create a POS Balance record and save it after marking it as OK. You can do this yourself or it will be done automatically the next time you run the 'Cash Up' Maintenance function.

- The Back Office Account for a particular Cash Event will be chosen as follows:

- The Cred. A/C specified in the Cash Event itself will be used. If you did not specify a Cred A/C in a Cash Event, the Back Office A/C specified here will be copied to the Cash Event when you mark it as OK and save.

- If no Back Office A/C can be copied to the Cash Event (i.e. if you have not specified a Back Office A/C in this field), the Back Office A/C on flip E of the relevant Payment Mode will be used.

Usually, you will only specify a Back Office Account in this setting if you want to use the same Account for every Payment Mode. If you leave this field empty, you should specify Back Office Accounts for each Payment Mode (on flip E).

- This field is the same as the Back Office A/C field in the POS Settings setting, so you can edit it in either setting.

- Writeoff A/C

- Paste Special

Account register, Nominal Ledger/System module

- As well as using Cash Events to record movements into and out of your Till Drawers, you can use them to write off cash that is missing from Till Drawers. This type of Cash Event is known as a "Writeoff" Cash Event.

- "Writeoff" Cash Events will debit a Write-off Account that will be chosen as follows:

- The Cred. A/C specified in the Cash Event itself will be used. If you did not specify a Cred A/C in a Cash Event, the Writeoff A/C specified here will be copied to the Cash Event when you mark it as OK and save.

- If no Writeoff A/C can be copied to the Cash Event (i.e. if you have not specified a Writeoff A/C in this field), the amounts written off will not be recorded in the Nominal Ledger.

The Writeoff A/C will usually be a Balance Sheet Account (e.g. an Account for discrepancies to be investigated). After investigation, you can enter a Nominal Ledger Transaction to send the discrepancy from the Writeoff A/C to the correct Account.

- This field is the same as the Writeoff A/C field in the POS Settings setting, so you can edit it in either setting.

- Tmp. Debtors A/C

- Paste Special

Account register, Nominal Ledger/System module

- If you have added a "Transfer to Sales Ledger" button to the Bar Tab window, you should specify a temporary Debtor Account here. The "Transfer to Sales Ledger" button will create a Sales Ledger Invoice from a Bar Tab in a way that allows the sale to be recorded in the Nominal Ledger from the Bar Tab with a debit posting to the temporary Debtor Account that you specify here. The Nominal Ledger Transaction from the Invoice will credit the temporary Debtor Account and debit the usual Debtor Account for the Customer.

- Discount A/C

- Paste Special

Account register, Nominal Ledger/System module

- If you sell an Item in a Bar Tab for a discounted price, the discounted price will usually be credited to the Sales Account.

- If you would like the full sales price of the Item to be credited to the Sales Account and the value of the discount to be debited to a separate Account, specify that Account here. You must also select the Post Discount option below.

- This Account will be overridden if you have specified a separate Discount A/C in the Item Group to which an Item belongs. If you have not specified a Discount Account here or in the Item Group, the Invoice Discount Account specified in the Account Usage S/L setting will be debited.

- Tip Payment Mode

- Paste Special

Payment Modes setting, Sales/Purchase Ledger

- If a Bar Tab includes a Tip, the value of that Tip will be credited to the Account in the Payment Mode that you specify here. If you are using Tips, you should specify a Payment Mode here because otherwise the value of Tips will be credited to the Base Currency Round Off Account.

- This field is the same as the Tip Payment Mode field in the POS Settings setting, so you can edit it in either setting.

- Service Charge Item

- Paste Special

Item register

- If you are using Service Charges, you should specify a Service Charge Item in this field. Service Charges will be credited to the Sales Account specified in this Item. Please refer to the description of the Service Charges setting here for details.

- Base Price

- Use these options to specify whether prices of Items in Bar Tabs will include or exclude VAT or tax. This option only applies to prices in Bar Tabs, which will solely depend on this option (specifying a Price List in the Default Customer will not affect prices in Bar Tabs).

- Post Discount

- Please refer to the description of the Discount Account above for details about this option.

---

Go back to: