Restaurant - Connecting Printers - Fiscal Printers

A fiscal printer is a device that prints receipts as well as recording them in an internal memory. This information can later be read by tax authorities to ensure that a shop's sales have been registered and reported correctly.

This section describes connecting fiscal printers to tills and devices to print and record Bar Tabs. Precise configuration, connection and operation details will vary depending on the model of fiscal printer that you are using. What follows is a general guide: for more detailed information, please refer to your local HansaWorld representative.

To use a fiscal printer, follow these steps:

- If you have not already assigned Local Machine Codes to your tills and devices, you should do so as the first step.

In the case of tills and devices with live connections to the server, open the Local Machine setting in the User Settings module and ensure the Code field in the header contains the correct Local Machine Code. You should do this separately on each till and device. If the Local Machine Code field was previously empty, you should quit Standard ERP on the till and restart.

In the case of a till or device with a live-sync connection to the server, you will have assigned a Local Machine Code when you connected the till or device to the server for the first time.

- Connect fiscal printers to each till or device likely to receive cash or credit card payments. Usually the connection will be via USB or RS232 serial cables, but some printers can connect using Bluetooth or, in the case of shared printers, ethernet. Please refer to the sections towards the end of this page for details about connecting these printers.

- If you are using a fiscal printer with middleware, install the middleware on each till and device. In the case of the Empirija FB15, only the .dll file from the Empirija middleware installer is required.

- Using the software supplied with the fiscal printers, make sure that:

- The printers have been configured with the correct VAT Codes (i.e. the VAT percentages in the printer should match the percentages in the Excl % field in the VAT Codes setting)

- The till and printer dates match.

- If the fiscal printers have been used before, make sure as well that the last daily report has been printed from each one.

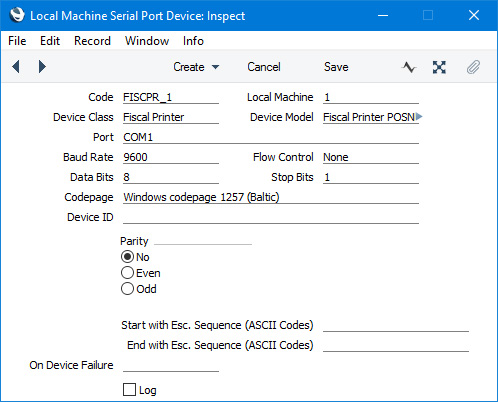

- Working on a desktop client, change to the Technics module and open the Local Machine Serial Port Devices setting. This setting should contain separate records for each individual serial port device (i.e. separate records for each individual fiscal printer). By specifying a Local Machine Code in each record, you will in effect use the setting to specify which tills and devices are connected to fiscal printers. Enter a separate record for each individual fiscal printer as follows:

- Code

- Enter a unique Code for the fiscal printer. The Code can consist of up to ten characters, and you can use both numbers and letters.

- Local Machine

- Paste Special

Local Machines setting, Point of Sales/Restaurant/Technics module

- Enter the Local Machine Code of the till or device to which the fiscal printer is or will be attached.

- Device Class

- Paste Special

Choices of possible entries

- Use 'Paste Special' to set the Device Class to "Fiscal Printer".

- Device Model

- Paste Special

Choices of possible entries

- Use 'Paste Special' to specify the model of fiscal printer that you are using.

- Port

- Specify the till's serial port to which the fiscal printer is connected.

- If the till is a Windows machine, the manual for the fiscal printer may recommend a particular port that you should use.

- If a till is a macOS or Linux machine and you have connected the printer using an RS232-to-USB adapter, you can discover the port number of the new port using the Network section of System Preferences or by typing ls /dev/tty.* in a new Terminal window. Then enter the port number in this field (for example, /dev/tty.usbserial or /dev/tty.KeySerial1).

- Leave the Port field empty if the fiscal printer uses a Bluetooth connection.

- If you are using a shared fiscal printer, enter the IP address of the printer and the port, separated by a colon (e.g. 192.10.1.18:1350).

- Baud Rate, Flow Control, Data Bits, Stop Bits, Parity

- Refer to the manual for the receipt printer to specify the appropriate communications settings. In the case of the Flow Control field, you can choose the relevant value using 'Paste Special'.

- Codepage

- Paste Special

Choices of possible entries

- Specify the code page (character encoding system) that is to be used when communicating with the fiscal printer. This information can again often be found in the manual for the fiscal printer. Examples are:

- Bematech MP-2100 TH FI

- US ASCII.

- Empirija FB15

- Windows codepage 1257 (Baltic).

- POSNET

- Windows codepage 1250 (Central Europe)

- Tremol TSL FP05

- UTF-8 (Unicode).

- End with Esc. Sequence (ASCII Codes)

- Enter the following values, depending on the model of fiscal printer you are using:

- Empirija FB15

- 114 (if a cash drawer is connected directly to the printer and you need the drawer to be opened after printing a receipt) or blank (otherwise).

- On Device Failure

- This field is not used with fiscal printers.

- Log

- If your fiscal printer is an Empirija FB15, select this option if you need communications with the printer to be logged in the hansa.log file. If problems arise (e.g. if an Invoice is not printed by the fiscal printer), this can help with tracing the cause.

Please refer here for more details about the Local Machine Serial Port Devices setting, including details about how information in this setting is sent to the Local Serial Port Devices Cache setting in the User Settings module on each till and device.

- Open the Contact records for each Customer to whom you will issue Fiscal Invoices and tick the Fiscal Invoices Only check box on the 'Terms' card. This will ensure Bar Tabs and Sales Ledger and POS Invoices will be marked as Fiscal Invoices, which in turn will ensure they are printed on fiscal printers. Usually you will at least need to do this for the Customer that you have named as the Default Customer (in the POS Settings or Local Machine settings).

- If your fiscal printer is a POSNET, bear in mind that Item Numbers will be truncated if they contain more than 12 characters. You can avoid this problem by specifying a shorter Alternative Code in each Item record. When Items are printed on Fiscal Invoices, they will be identified by Alternative Code. Only if the Alternative Code is blank will the Item Number be printed.

- Prices in Bar Tabs printed by most fiscal printers should include VAT. You should therefore either specify in the Account Usage Restaurant setting that Base Prices include VAT.

- In the Round Off setting in the System module, most fiscal printers require that you choose "Row Sum" as the Discount Calculation and "Per VAT Code" as the VAT Calculation.

- In Brazil, if you are using the Bematech MP-2100 TH FI fiscal printer, follow these steps to configure your VAT Codes:

- On flip B of the VAT Codes setting, assign each VAT Code to a Tax Rule in which the Tax Type is "ISSQN" or "ICMS". Specify an Excl % in each VAT Code.

- Use the Fiscal Printer VAT Codes (Brazil) setting to map the VAT Codes in Standard ERP to those in the printer. You can do this yourself, or you can select 'Sync with Fiscal Printer' from the Operations menu (with "cog" icon). This setting is located in the Point of Sales module and will only be available if the VAT Law in the Company Info setting is "Brazilian".

The 'Sync with Fiscal Printer' function will extract the VAT percentages from the fiscal printer and list them in the Fiscal Printer VAT Codes (Brazil) setting. For each percentage, it will look in the VAT Codes setting for an "ISSQN" or "ICMS" VAT Code with a matching percentage rate (in the Excl. % field). If a match is found, the function will add a row to the Fiscal Printer VAT Codes (Brazil) setting containing the VAT Code and the printer's code in the Department field. If no matching VAT Code is found, the function will add a row to the setting in which the VAT Code field contains the percentage from the printer followed by the % character. The % character is added to signify that you should add a corresponding VAT Code in the VAT Codes setting. If you have already added some VAT Codes to the Fiscal Printer VAT Codes (Brazil) setting that are not in the printer's memory, the function will send them to the printer. Finally, any non "ISSQN" or "ICMS" VAT Codes will be removed from the Fiscal Printer VAT Codes (Brazil) setting.

- Having completed the steps above, each Bar Tab and Sales Ledger and POS Invoice will be marked as a Fiscal Invoice automatically if you used a Customer in which you have ticked the Fiscal Invoices Only box, as described in step 6.

In the case of a Sales Ledger Invoice, you can override the default fiscal status using the Fiscal Invoice check box on the 'Identifiers' card (i.e. you can use the Fiscal Invoice check box to create and print a Fiscal Invoice for a Customer that does not usually receive them, and vice versa).

In the case of Bar Tabs and POS Invoices, you cannot override the Fiscal Invoice default. So, be sure to tick the Fiscal Invoices Only check box in every Customer that you will use in these transactions.

Each time you finish a Bar Tab or POS Invoice that has been marked as a Fiscal Invoice (by clicking or touching the "Finish" button), it will be sent to, printed by and recorded in the fiscal printer automatically.

- Depending on the fiscal printer, each time you mark a Cash In or Cash Out Cash Event as OK and save, it will be sent to, printed by and recorded in the fiscal printer. However, Cash Out Cash Events created by the 'Cash Up' Maintenance function will not be sent to the fiscal printer.

If you need to reprint a Cash Event, open it and choose 'Send to Fiscal Device' from the Operations menu. You can use Access Groups to control who can use the 'Send to Fiscal Printer' function. To do this, deny access to the 'Print To Fiscal Printer' Action.

- Each transaction printed by a fiscal printer is also stored in its memory. At the end of each day you will need print a report listing the day's transactions. This report is known as a "Z report" in some countries. Use the Fiscal Printer Reports setting in the User Settings module to instruct fiscal printers to print the Z report and other reports. An exception is the Bematech MP-2100 TH FI: in this case you must use "Daily Z Report" and "Daily Report" buttons from the Bar Tab window to print the Z and other reports.

Fiscal Printers - Bluetooth ConnectionSome fiscal printers can be connected to iOS and Android devices using Bluetooth. This description uses the POSNET Temo and Trio as examples: some details may vary, depending on the printer you are using. Please refer to your local HansaWorld representative for details about specific printers.

The POSNET Temo and Trio require Bluetooth 4.0 low energy on iOS and Classic Bluetooth on Android. To connect a POSNET printer to an iOS device using Bluetooth, follow these steps:

- In Standard ERP on the iOS device, ensure you have assigned a Local Machine Code to the device, as described in step 1 above.

- Create a record for the printer/till combination in the Local Machine Serial Port Devices setting in the Technics module, as described in step 5 above. Leave the Port field empty. For POSNET printers, the other settings should be: Baud Rate - 115200; Flow Control - None; Data Bits - 8; Stop Bits - 0; Codepage - Windows codepage 1250 (Central Europe); and Parity - None.

- Enable Bluetooth on the iOS device.

- On a POSNET Temo, make sure Bluetooth is set to NG (New Generation). Set the connection type to Bluetooth and enable pairing.

- On a POSNET Trio, connect the optional Bluetooth module to the printer and make sure Bluetooth is set to Low Energy (by default it will be set to Classic). This can be done by POSNET, or you can use the POSNET app, which is a Windows app.

Using the printer's menu, set the code page to Windows 1250 (Configuration> general parameters> communication functions> PC interface> COM interface> Posnet protocol> Code page Windows 1250). Then set the communication parameters (Configuration> hardware configuration> Communication ports> select COM> select Baud rate 115200, Stop bits 1, Parity None, Flow control None). These settings govern the communication between the printer and the Bluetooth module, which connects to the printer's serial port.

- In Standard ERP, open the Bluetooth Devices setting in the User Settings module.

If you did not enable Bluetooth on the device in step (iii), it will be enabled automatically when you open the Bluetooth Devices setting. In this case you will need to close and re-open the setting before the printer will appear in the list.

- On a POSNET Trio, enable pairing on the Bluetooth module.

- In Standard ERP, wait for the printer to appear in the list. When it does, select it. You will be asked if you want to pair the devices. After pairing, the address of the POSNET device will be placed in the Bluetooth Mac Addr field in the Local Machine setting.

To connect a POSNET printer to an Android device using Bluetooth, follow these steps:

- In Standard ERP on the Android device, ensure you have assigned a Local Machine Code to the device, as described in step 1 above.

- Create a record for the printer/till combination in the Local Machine Serial Port Devices setting in the Technics module, as described in step 5 above. Leave the Port field empty. For POSNET printers, the other settings should be: Baud Rate - 115200; Flow Control - None; Data Bits - 8; Stop Bits - 0; Codepage - Windows codepage 1250 (Central Europe); and Parity - None.

- On a POSNET Temo, make sure Bluetooth is set to Classic.

- On a POSNET Trio, connect the optional Bluetooth module and make sure Bluetooth is set to Classic (the default). This can be done by POSNET, or you can use the POSNET app, which is a Windows app.

- Enable Bluetooth on the Android device.

- On the printer, set the connection type to Bluetooth and enable pairing.

- In Standard ERP, open the Bluetooth Devices setting in the User Settings module and wait for the printer to appear in the list. When it does, select it.

If you did not enable Bluetooth on the device in step (e), it will be enabled automatically when you open the Bluetooth Devices setting. In this case you will need to close and re-open the setting before the printer will appear in the list.

- Restart Standard ERP on the Android device.

Fiscal Printers - Shared Printer with Ethernet Connection to the ServerSome fiscal printers can be shared, so that only one printer is needed and the tills and cash machines can all print to the same printer. The printer should be connected to any client in the network using Ethernet. This description uses the POSNET Thermal HD printer as an example: some details may vary, depending on the printer you are using. Please refer to your local HansaWorld representative for details about specific printers.

To connect a shared printer to the network, follow these steps:

- In Standard ERP on the till or cash machine to which the printer will be connected, ensure you have assigned a Local Machine Code to the till, as described in step 1 above.

- On the printer, set the connection type to ethernet and the default interface to TCP/IP (Configuration> general parameters> communication functions> PC interface). Choose a port, set the communication protocol to POSNET and set the code page to Windows 1250.

- Set the IP address of the printer (Configuration> hardware configuration> TCP/IP). Enter a permanent IP address for the printer or specify that the IP address should be assigned by DHCP.

- Connect the fiscal printer to the till by ethernet.

- Check on the printer (Configuration> hardware configuration> TCP/IP) that it has been given an IP address.

- In Standard ERP, create a record for the printer/till combination in the Local Machine Serial Port Devices setting in the Technics module, as described in step 4 above. Enter the printer's IP address and port from steps (V) and (II) above separated by a colon in the Port field (e.g. 192.10.1.18:1350). For POSNET printers, the other settings should be: Device Model - Fiscal Printer POSNET HD FV EJ (Poland, POSNET Protocol over TCPIP); Baud Rate - 9600; Flow Control - None; Data Bits - 8; Stop Bits - 0; Codepage - Windows codepage 1250 (Central Europe); and Parity - None.

---

Configuring the Bar Tab Window:

Go back to:

|