Nominal Ledger Transactions from Production Records

When you mark a Production record as

Finished and save it, a Nominal Ledger Transaction will be generated automatically if you have so determined in the

Sub Systems setting in the Nominal Ledger and in the

Number Series - Productions setting. This Transaction will contain two sets of credit postings, one for the Input Costs and one for the Work Cost:

- The Input Costs will be credited to the Stock Account from the Location.

- If the Location does not have a Stock Account, or you have not specified a Location, and if you are using the Use Item Groups for Cost Accounts option in the Cost Accounting setting in the Stock module, the Input Costs will be credited in the appropriate proportions to the Stock Accounts of the Item Groups to which the Input Items belong.

- In all other circumstances (i.e. if you are not using the Use Item Groups for Cost Accounts option or an Input Item does not belong to an Item Group), the Production Components Stock Account, as specified on the 'Stock' card of the Account Usage Stock setting in the Stock module, will be credited.

If you have specified Tags/Objects in any of the input rows, separate credit postings will be made for each Tag/Object - Account combination. If you have specified Tags/Objects on the

'Comment' card, they will be assigned to all credit postings.

The choice of Stock Account described in steps 1 and 2 above means that it will not be possible to distinguish the value of Items removed from stock to be used in Productions from the value of the same Items removed from stock for other purposes (e.g. Delivery or Stock Depreciation). If you need to make such a distinction, specify Components Usage and Production Control Accounts in the Account Usage Stock setting, in the Item records for the components and/or in the Item Groups to which the components belong. If you do so (i.e. if you specify both a Components Usage Account and a Production Control Account), the Transaction will contain additional postings, debiting the value of the components to the Components Usage Account and crediting that value to the Production Control Account.

If you are using the Use Item Groups for Cost Accounts option, the Work Cost will be credited to a Production Work Cost Account chosen as follows:

- The Production Work Cost Account will be taken from the Item Group to which the Item in the row with the Work Cost belongs.

- If the Item Group does not have a Production Work Cost Account, the Production Work Cost Account will be taken from the Account Usage Stock setting.

- If there is no Production Work Cost Account in the Account Usage Stock setting, the Stock Account in the Item Group to which the Item in the row with the Work Cost belongs will be used as the Production Work Cost Account.

Therefore, if you are using the

Use Item Groups for Cost Accounts option and you have specified Production Work Cost Accounts in your Item Groups, be sure to enter the Work Cost in the appropriate row in the Production before marking it as Finished, so that the correct Account is credited.

If you are not using the Use Item Groups for Cost Accounts option, the Work Cost will always be posted to the Production Work Cost Account in the Account Usage Stock setting. In this case, you will not be able to save a Finished Production with a Work Cost if you have not specified a Production Work Cost Account in the Account Usage Stock setting.

If you have specified Tags/Objects in a row with a Work Cost, those Tags/Objects will be assigned to the Work Cost posting, together with any Tags/Objects that you have specified on the 'Comment' card.

If any Input Items in the Production are Plain or Service Items, they will be treated as Work Cost. Their value will be credited to a Production Work Cost Account chosen as described above, using if appropriate the Production Work Cost Account in the Item Groups to which the Plain or Service Items belong.

If the Production contains a row for Machine Cost (i.e. you are using the Auto Calculate Cost of Produced Items option in the Production Settings setting, you have specified a Machine Cost Item in the same setting, and you have specified a Running Cost/hr in the Asset record for the Machine specified in the Production), the Machine Cost will also be credited to a Production Work Cost Account. This will be chosen as described above, using if appropriate the Production Work Cost Account in the Item Group to which the Machine Cost Item belongs.

The value of the Output Item(s) will be debited to an Account chosen as follows:

- The value of the Output Item(s) will be debited to the Stock Account from the Location.

- If the Location does not have a Stock Account, or no Location has been specified, and if you are using the Use Item Groups for Cost Accounts option in the Cost Accounting setting, the Stock Account of the Item Group to which the Output Item belongs will be debited.

- In all other cases, the Production Components Stock Account on the 'Stock' card of the Account Usage Stock setting will be debited.

If you have specified Tags/Objects in any of the output rows, separate debit postings will be made for each Tag/Object - Account combination. If you have specified Tags/Objects on the

'Comment' card, they will be assigned to all debit postings.

When you first specify a Recipe in a Production record, the Input and Output Costs in each row will be taken from that Recipe. Each time you save the Production, these figures will be updated with the Item's unit stock value (if the row contains an Input Item), by the Item's Cost Price (if the row contains an Input Item that is a Plain Item) or by a unit value calculated from the total value of the components including the Work Cost (if the row contains an Output Item). The unit stock value of each Input Item will be calculated using the Cost Model specified in the relevant Item or Item Group record. If that Cost Model is Default, the Primary Cost Model specified in the Cost Accounting setting will be used.

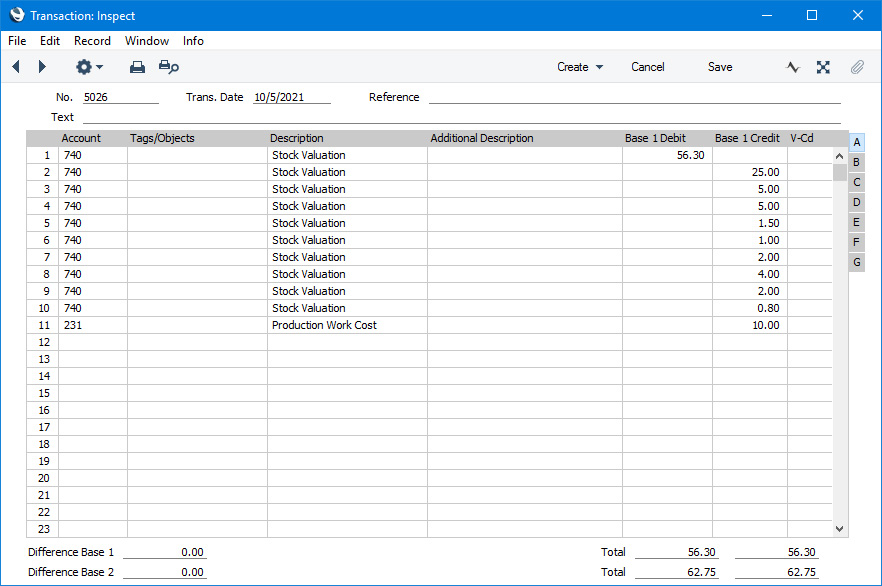

Illustrated below is an example of a Nominal Ledger Production Transaction:

In practice, one possible way to operate is as follows:

- Place each component in an Item Group where the Stock Account is a Components Stock Account;

- Place each assembled Item in an Item Group where the Stock Account is a Finished Goods Stock Account;

- The Locations where components and assembled Items are stored do not have their own Stock Account; and

- The Production Location has a Work in Progress Account as its Stock Account.

When using the

Use Item Groups for Cost Accounts option, the result will be:

- When you receive the components into stock using a Goods Receipt, the Components Stock Account will be debited;

- When you move the components to the Production Location using a Stock Movement, the Components Stock Account will be credited and the Work in Progress Account debited;

- The Production will both debit and credit the Work in Progress Account. Any Work Cost will be included in the debit posting to the Work in Progress Account and credited to a Work Cost Account;

- When you move the assembled Item to its Location using a Stock Movement, the Work in Progress Account will be credited and the Finished Goods Stock Account debited.

If you have marked the Production as Finished but Discarded, the Transaction will depend on the

Create Stock Depreciation from Discarded Production option in the

Production Settings setting. If you are using this option, the assembled Items will be added to stock by the Production and then immediately removed

via an automatic

Stock Depreciation. The Transaction from the Production will therefore be as described above. If you are not using the

Create Stock Depreciation from Discarded Production option, there will be no Output Costs because the Out Qty in the Production will be zero. Therefore in this case the Input and Work Costs will be balanced by a debit posting of the same value to the Discarded Production Cost Account, again as specified in the

Account Usage Stock setting.

If you are using the Create Stock Depreciation from Discarded Production option, the automatic Stock Depreciation will credit the value of the discarded Items to the relevant Stock Account and debit it to the Discarded Production Cost Account. Note however that this Stock Depreciation will be treated as a normal removal from stock. So, the value of the discarded Items will be calculated using the Cost Model specified in the relevant Item or Item Group record. If that Cost Model is Default, the Primary Cost Model specified in the Cost Accounting setting will be used. This calculated value (perhaps a Weighted Average or FIFO value) may not be the same as the value of the components in the Discarded Production.

If a Production has a Routing, you have a choice about how to update the stock valuation in the Nominal Ledger, as follows:

- You can update the stock valuation in the Nominal Ledger each time you Finish a Production Operation. In this case, the value of the Production so far will be posted to a Work In Progress Account. This will be cleared when you Finish the last Production Operation.

- You can wait until Finishing the Production before updating the stock valuation in the Nominal Ledger, posting every removal and addition to stock at once. All Production Operations must be Finished before you can Finish the Production.

You should make this choice using the

Generate Transaction options in the

Account Usage Production setting. If you choose the second option, the Transaction will be as described above. Please refer to the

Nominal Ledger Transactions from Production Operations' page for details about the first option.

Once the Transaction has been generated, you can look at it straight away using the 'Open NL Transaction' function on the Operations menu (Windows/macOS) or Tools menu (iOS/Android) (subject to access rights).

---

The Production register in Standard ERP:

See also:

Go back to: