Entering a Payment - Payments Card Part 2 (Flips F-K and Footer)

This page describes the fields on flips F-K and in the footer of the 'Payments' card of the Payment record. Please follow the links below for descriptions of the other cards:

---

Flip F- Tags/Objects

- Paste Special

Tag/Object register, Nominal Ledger/System module

- Default taken from Purchase Invoice ('Terms' card) or Contact record for the Supplier (Purch. Tags/Objects), and Payment Mode

- You can assign up to 20 Tags/Objects, separated by commas, to a Payment row and all transactions generated from it. You might define separate Tags/Objects to represent different departments, cost centres or product types. This provides a flexible method of analysis that can be used in Nominal Ledger reports.

- In the Nominal Ledger Transaction generated from a Payment, the Tags/Objects specified here will be assigned as follows:

- By default, they will be assigned to the debit posting to the Creditor Account.

- If you are using the Tags/Objects on Bank A/C option in the Account Usage P/L setting, they will be assigned to the credit posting to the Bank or Cash Account. This will be in addition to any Tags/Objects specified in the Payment Mode, which will always be assigned to the Bank or Cash Account.

- If you are using the Tags/Objects on VAT Account option in the same setting ('VAT' card) together with the Post Payment VAT and/or Post Prepayment VAT options, they will be assigned to all VAT postings.

- If you specify a Purchase Invoice Number on flip A, Tags/Objects will be copied here from the ('Terms' card of that Purchase Invoice, providing you are using the Tags/Objects on Creditors Account option in the Account Usage P/L setting.

- In the case of On Account Payments and Prepayments, Tags/Objects will be copied here if you are using the Tags/Objects on On Account A/C option, also in the Account Usage P/L setting. When you enter a Supplier Number for an On Account Payment or for a Prepayment that is not connected to a Purchase Order, the Purch. Tags/Objects specified on the 'Accounts' card of the Contact record for the Supplier will be copied here. When you enter a Purchase Order Number in the Order No. field on flip D for a Prepayment for a Prepayment that is connected to a Purchase Order, the Tags/Objects specified on the 'Terms' card of the Purchase Order will be copied here.

- Tags/Objects from the Payment Mode will also be copied to this field.

Flip G- Round Off A/C, Round Off

- These fields will be used in the situation where a Purchase Invoice is to be treated as fully paid if the Sent Value is slightly different to the amount that is outstanding, providing that the difference is within an allowable margin. The difference will effectively be written off.

- For example, if the allowable margin is 0.50 and you issue a cheque underpaying an Invoice by 0.35, the 0.35 will be written off (posted to a write-off Account) and the Invoice will be treated as fully paid. When you save the Payment in this example, 0.35 will be placed automatically in the Round Off field, and the write-off Account will be placed in the Round Off A/C field. But, if the cheque underpays the Invoice by 0.65, that amount will remain outstanding. In this case, the Round Off and Round Off A/C fields will remain empty.

- If you want to use this feature, set the allowable margin in the Automatic Round Off Limit and Automatic Write Off Limit fields on the 'Round Off' card of Currency record for the Sent Currency. The Write Off Limit will be used when the Sent Currency is the same as the Currency in the Invoice being paid, while the Round Off Limit will be used when the Sent Currency is different to the Invoice Currency. The remaining outstanding amount on an Invoice will be written off if it is less than the Write Off or Round Off Limit when expressed in the Invoice Currency.

- The Round Off A/C will be taken from the 'Rate' card of the Account Usage P/L setting on the following basis:

- Write Off Round Off

- Used when the Sent Currency is the same as the Invoice Currency, and it is not a member of the EMU;

- Rate Round Off

- Used when the Sent Currency is different to the Invoice Currency, and the Sent Currency is not a member of the EMU;

- EMU Rate Round Off

- Used when the Sent Currency is different to the Invoice Currency, and the Sent Currency is a member of the EMU;

- EMU Rate Write Off

- Used when the Sent Currency is the same as the Invoice Currency, and it is a member of the EMU.

You can change the Round Off A/C in a Payment row if necessary. However the Round Off figure will be recalculated each time you save the Payment, so cannot be changed.

- If you set Write Off and Round Off Limits in a Currency record, the same limits will be used in both the Sales and Purchase Ledgers. You will therefore be implementing the feature in both Ledgers.

- You can set Write Off and Round Off Limits in the Currency record that represents your home Currency, meaning you can use this feature as an easy way of automatically writing off small outstanding amounts in domestic Invoices (i.e. those in your home Currency).

- Instalment

- Paste Special

Open (unpaid) Instalments

- If an Invoice is payable in instalments, specify the instalment being paid here. An Invoice is payable in instalments if it has a Payment Term that refers to a record in the Instalments setting.

- If you have specified a Purchase Invoice Number on flip A, the 'Paste Special' function will only list the open instalments for that Purchase Invoice. If you have not specified a Purchase Invoice Number, the 'Paste Special' function will list the open instalments for all Invoices.

- When you choose an instalment, the Bank and Sent Values will change to the open instalment value and, if the relevant fields were previously blank, other related information such as Supplier Number and Purchase Invoice Number will be brought in as well.

- Reference Number

- This field can be used in Estonia by certain state companies to record the RK Reference for each Payment row. This reference will be generated automatically depending on how you have configured the RiigiTarkvara setting in the Nominal Ledger (only available in Estonia i.e. if the VAT Law in the Company Info setting is "Estonian").

- In Estonia and some other countries, the Reference Number will be included in some Banking File export files and electronic payments.

Flip H- Creditors A/C

- Paste Special

Account register, Nominal Ledger/System module

- This field shows the Creditor Account that will be debited from the Payment row, when you mark the Payment as OK and save it.

- If you enter a Purchase Invoice Number on flip A, the Creditor Account from the Purchase Invoice will be brought in.

- If you leave the Purchase Invoice Number blank and enter a Supplier Number on flip A or a Purchase Order Number on flip D, the relevant On Account A/C for that Supplier will be brought in.

- In both cases, you can change the Account if necessary.

- Bank Reference

- Default taken from

Purchase Invoice (Reference field)

- The Bank Reference will be brought in from the Purchase Invoice being paid and will be printed on the Payment Form provided you have included the "Our Reference (ourref)" field in your Form Template design.

- Depending on the Payment File Format you have chosen in the Bank Transfer setting in the Purchase Ledger, this Reference may be included in Banking File exports and electronic payments. For this reason, a Reference is mandatory in Purchase Invoices in some countries e.g. Finland and Norway so that it will always be copied to this field.

- The Bank Reference will be included in Banking File export files when you are using the following Payment File Formats:

- To Bank A/C.

- Paste Special

Bank Accounts of the Supplier

- The number of the Supplier's bank account that will receive the Payment is brought in from the 'Accounts' cards of the Purchase Invoice or the Contact record for the Supplier. If it is taken from the Contact record for the Supplier (e.g. in the case of On Account and Prepayment Payments), it will be chosen from the following fields and in the following order:

- The IBAN Code will be used.

- The Bank Account

- The Bank Account 2

If a Supplier has more than one Bank Account (e.g. their Contact record has both a Bank Account and a Bank Account 2), you can change from the default using 'Paste Special'.

- Sort Code

- The branch number of the bank holding the Supplier's bank account will be brought in from the 'Accounts' cards of the Purchase Invoice or the Contact record for the Supplier.

- P. Code

- Paste Special

Payment Codes setting, Purchase Ledger

This field is used in Sweden, where every payment to a beneficiary domiciled outside Sweden (in a foreign currency or in Swedish kronor) that exceeds a counter value stipulated by the National Tax Board (Riksskatteverket) must be reported to the Tax Board by the intermediary bank. Included in the report should be a Payment Code, a three-digit code representing a category (i.e. export/import, services etc.).

- The Payment Code will be brought in from the 'Accounts' card of the Purchase Invoice. It will be included in Banking File exports if you produce them using the Foreign Country Payment option and if the Payment File Format you have specified in the Bank Transfer setting in the Purchase Ledger is Sweden - Handelsbanken.

Flip I

- Bank Fee

- Enter any fee charged by the bank for the payment. This figure should be in the Bank Currency. Bank fees will be debited to the Bank Fee Account specified on the 'Creditors' card of the Account Usage P/L setting. The Sent Value plus the Bank Fee will be credited to the Bank Account specified in the Payment Mode. The Sent Value will be debited to the Creditor Account.

- Note that this field allows you to specify a Bank Fee for each row (or for a single particular row) in a Payment, remembering that each row can have a different Payment Mode and therefore a different credit (Bank) account. If you want to record a single Bank Fee for the entire Payment, use the 'Add Bank Fee' function on the Row menu.

- To B. Cur. 1

- This field is also on flip J and is described below.

- B. Cur. 1 V.

- The amount paid, expressed in Base Currency 1.

- In normal circumstances, the Bank Amount and Sent Value fields on flip A are sufficient to express the value of the Payment. If the Sent Currency and Bank Currency are different, the Nominal Ledger Transaction resulting from the Payment will contain values in all appropriate Currencies, converted using the Exchange and Base Rates applying on the Transaction Date.

- If you know the exact value of the Payment in Base Currency 1 as withdrawn from your bank account, you can either change the Bank Amount or you can enter the exact figure in Base Currency 1 here. The first of these choices will post the difference between the original Bank Amount and your amended figure to the Bank Rate Gain or Loss Account (specified on the 'Rate' card of the Account Usage P/L setting), while the second will post the rate differences to the Rate Gain or Loss Account specified in the same setting. Please refer here for full details and an example.

- If you don't know the value of the Payment in Base Currency 1, but you do know the exchange rate, you can use the fields on flip J to enter that exchange rate. A calculated value will then be placed in this field.

- This field must contain a value if so specified for the Payment Mode (using the Force field on flip D).

- B. Cur. 2 V.

- The amount sent, expressed in Base Currency 2.

- This field must contain a value if so specified for the Payment Mode (using the Force field on flip D).

- Coef. Value

- The Bank Amount on flip A will be calculated automatically from the Sent Value, taking exchange rates into account if necessary. If you then change the Bank Amount, this will be interpreted as changing the exchange rate. In the resulting Nominal Ledger Transaction, a posting to the value of the difference between the original Bank Amount and your amended figure will be made to the Bank Rate Gain or Loss Accounts specified on the 'Rate' card of the Account Usage P/L setting.

- If you change the Bank Amount in this way, it will be because you know the exact amount that will be deducted from your bank account by the Payment. If you don't know this figure, but you do know the exchange rate that will be levied by the bank, you can enter that exchange rate in this field. The Bank Amount will recalculated by dividing the Sent Value by this Coef. Value. In other words, you should enter the number of units of the Sent Currency that will buy one unit of the Bank Currency. For example, if the Sent Currency is USD and 1.8 USD will buy 1.00 in the Bank Currency, enter 1.8 here.

Flip J- Rate, To B. Cur. 1, To B. Cur. 2

- In a Payment where the Sent Currency and Bank Currency are different and you know the exact value of the Payment in Base Currency 1, you can enter that value in the B. Cur. 1 V. field on flip I. Please refer to the description of that field above for the implications.

- If you don't know the value of the Payment in Base Currency 1, but you do know the exchange rate, you can use these fields to enter that exchange rate. If the Bank Currency is Base Currency 1, this means the exchange rate between the Sent Currency and Base Currency 1. If the Bank Currency is not Base Currency 1, this means the exchange rate between the Bank Currency and Base Currency 1. A calculated value will then be placed in the B. Cur. 1 V. field (and in the Bank Amount field if the Bank Currency is Base Currency 1).

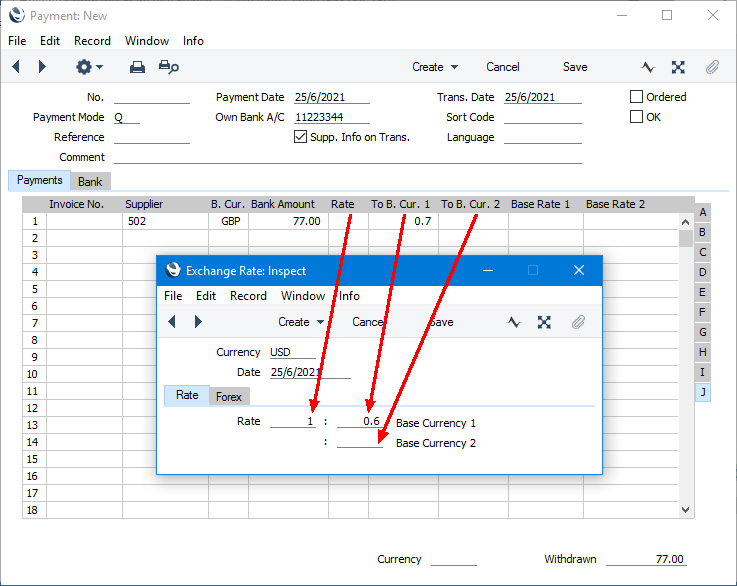

- Each of these fields corresponds to one of the fields in the Exchange Rate record, as shown in the illustration below:

If you make an entry in one of these fields, you are effectively overriding the corresponding field in the Exchange Rate record. For example, the Exchange Rate in the illustration states that 1 USD will buy 0.6 in Base Currency 1. 0.7 has been entered in the To B. Cur. 1 field in the Payment row, changing the exchange rate for that row to 1:0.7 (the Rate and To B. Cur. 2 fields are blank in the Payment row, signifying that these figures are still to be taken from the corresponding fields in the Exchange Rate record).

- If you have entered your Exchange Rates so that they express how many units of the foreign Currency will be bought by one unit of Base Currency 1, you will have an Exchange Rate of 1.6666:1 instead of 1:0.6. To make the equivalent change in a particular Payment row, enter 1.42857 in the Rate field to change to 1.42857:1.

- As changing the exchange rate will cause a calculated value to be placed in the B. Cur. 1 V. field, the difference between the original Bank Amount and your amended figure will be posted to the Rate Gain or Loss Account (specified on the 'Rate' card of the Account Usage P/L setting).

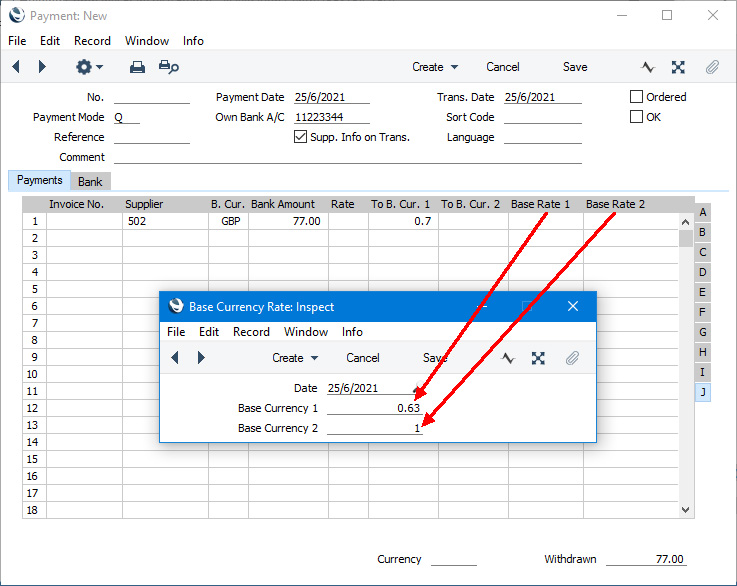

- Base Rate 1, Base Rate 2

- If you are using the Dual-Base Currency conversion system, you can use these two fields to set the exchange rate between your two Base Currencies for a particular Payment row.

- Where the Rate, To B. Cur. 1, To B. Cur. 2 fields described immediately above each correspond to a field in the Exchange Rate record, in a similar manner these fields both correspond to a field in the Base Currency Rates record, as shown in the illustration below. If you enter a figure in one of these fields, you will overrule the figure in the corresponding field in the Base Currency Rates record.

Flip KFlip K is only visible if the VAT Law in the Company Info setting is set to "Argentinean".

- P. Mode

- Paste Special

Payment Modes setting, Sales/Purchase Ledger

- This is the same Payment Mode field as the one on flip C. Please refer to the description of flip C here for details. In rows displaying Withholding Tax (i.e. rows that will be added to the Payment when you run the 'Calculate Withholding Taxes' function on the Operations menu), the Payment Mode will be copied to this field from the relevant Withholding Tax regime (i.e. from flip C of the relevant row in the Withholding Taxes setting).

- W. Tax, W. Tax Base

- These fields will show the Withholding Tax regime and the Base amount (i.e. the amount on which Withholding Tax was calculated) in rows that will be added to the Payment when you run the 'Calculate Withholding Taxes' function on the Operations menu. Please refer to the 'Withholding Tax from Payments - Per Invoice Basis' example here below for details.

Footer- Currency

- If every row in a Payment has the same Bank Currency, that Currency will additionally be shown here so that it can be displayed in the 'Payments: Browse' window.

- Withdrawn

- The sum of the Bank Amounts: the total for the Payment. This field will only contain a value if every row in the Payment has the same Bank Currency.

---

The Payment register in Standard ERP:

Go back to:

|