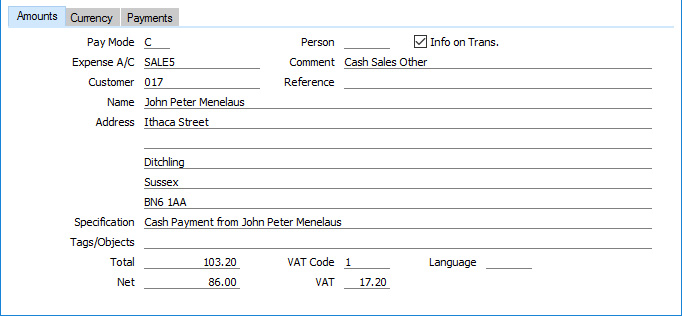

Entering a Cash Transaction - Amounts Card

This page describes the fields on the 'Amounts' card in the Cash In and Cash Out windows. Please follow the links below for descriptions of the other parts of the Cash In and Cash Out record windows:

---

- Pay Mode

- Paste Special

Payment Modes setting, Sales/Purchase Ledger, Cash Book module

- Default taken from Cash Book Settings (Def. Pay. Mode)

- The Payment Mode determines the Nominal Ledger Account that will be debited (Cash In) or credited (Cash Out) with the value of the cash transaction. Usually this will be a Cash or Bank Account.

- You can use a single cash transaction to record the day's cash receipts or payments by listing them on the 'Payments' card. If these cash receipts or payments all use the same Payment Mode (i.e. they will all be received into or issued from the same Cash or Bank Account), specify that Payment Mode here. If a particular cash receipt or payment uses a different Payment Mode, specify that Payment Mode in the relevant row on the 'Payments' card (flip B).

- You must specify a Payment Mode either here or in every row on the 'Payments' card before the cash transaction can be saved. In most cases, the Payment Mode must be one in which the Type (on flip B of the Payment Modes setting) is "Free" or "Cash". However, a row on the "Payments" card in a Cash In or Cash Out record in which the Type is "Cheque" requires a "Received Cheques" Payment Mode, while an "Own Cheque" row in a Cash Out record requires an "Own Cheques" Payment Mode.

- If you have used the Payment Modes setting to define separate number sequences for each Payment Mode and you are using the Common Number Series option in the Cash Book Settings setting, the transaction number will be determined by the default Payment Mode and will change if you change the Payment Mode.

- Person

- Paste Special

Person register, System module and Global User register, Technics module

- To record a cash payment received from or issued to a particular Person, enter their Signature in this field or use the 'Paste Special' function. You should also register the value of the payment by entering a row on the 'Payments' card in which the Type is "Personnel Payment".

- After entering a Signature in this field and pressing Enter or Return, the Person's name, address and other information including Tag/Object will be entered into the appropriate fields. This information will be taken from their Global User or Person record and from their connected record in the Contact register.

- Info on Trans.

- If you select this option in a Cash In record that records the receiving of cash against an Invoice or Purchase Credit Note or in a Cash Out record that records the issuing of cash against a Purchase Invoice or Sales Credit Note, the Invoice Number, Payment Date and Customer/Supplier will be copied to flip E of the row posting to the Debtor or Creditor Account in the resulting Nominal Ledger Transaction.

- A Cash In record that records the receiving of cash against an Invoice or Purchase Credit Note is one in which you have added a row to the 'Payments' card in which the Type is "Invoice" or "Credit Purchase Invoice". A Cash Out record that records the issuing of cash against a Purchase Invoice or Sales Credit Note is one in which you have added a row to the 'Payments' card in which the Type is "Purchase Invoice" or "Credit Invoice".

- Similarly, selecting this option in a Cash In or Cash Out record receiving or issuing a Prepayment will cause the Payment Date and Customer/Supplier (but not an Invoice Number or Prepayment Number) to be copied to flip E of the row posting to the On Account A/C in the resulting Nominal Ledger Transaction.

- This option will be selected by default in a Cash In record if you are using the Invoice Info on N/L Transaction option on the 'Debtors' card of the Account Usage S/L setting, and in a Cash Out record if you are using the Supp. Info. on Trans. option on the 'Creditors' card in the Account Usage P/L setting.

- For details about using Cash In records to receive cash against Invoices or Purchase Credit Notes, please refer to the page describing the 'Payments' card.

- Expense A/C

- Paste Special

Expense Accounts setting, Cash Book module (Def. Expense Account)

- Default taken from Cash Book Settings

- The Expense Account determines the Nominal Ledger Account that will be credited (Cash In) or debited (Cash Out) with the value of the cash transaction (or the value of the cash transaction less VAT if a separate VAT posting is being made). In the case of transactions that you enter directly to the Cash In and Cash Out registers, this might be a Sales (Cash In) or Purchase (Cash Out) Account, or, in the case of cash payments made to or received from members of staff, an Expense Account. For payments of between your bank and petty cash, it will be your Bank Account (the Petty Cash Account will come from the Payment Mode). In the case of cash transactions that you create from Invoices, especially if you are using the Double Transaction method to create cash transactions from Invoices and Purchase Invoices, it may be a temporary holding Account for cash. A separate VAT posting will be made if the VAT field contains a value and if you are using the Post VAT option in the Cash Book Settings setting.

- You can use a single cash transaction to record the day's cash receipts or payments by listing them on the 'Payments' card. If these cash receipts or payments all use the same Expense Account (i.e. they all affect the same Sales or Purchase Account), specify that Expense Account here. If a particular cash receipt or payment uses a different Expense Account, specify that Expense Account in the relevant row on the 'Payments' card (flip B).

- In the case of a 'simple' cash transaction (i.e. one where the grid on the 'Payments' card is empty or contains at least one row of Type "Cash In" or "Cash Out"), you must specify an Expense Account either here or in every row on the 'Payments' card before the cash transaction can be saved.

- Comment

- Default taken from

Expense Account

- The text for the Expense Account. You can change this text for a particular cash transaction.

- Customer

- Paste Special

Customers in Contact register

- To record a cash payment received from a particular Customer, enter their Customer Number or use the 'Paste Special' function. When you press Return, the Customer's name, address and other information will be entered into the appropriate fields. There is no need to enter a Customer Number: leave the field blank if you want to use a single Cash In record to record the day's cash receipts or to record the receipt of cash from a member of staff.

- If the cash payment was made by the Customer to settle an Invoice, enter a row on the 'Payments' card in which the Type is "Invoice" and specify the Invoice Number in the Number field. Alternatively, if the payment is a Prepayment against an Order, enter a row on the 'Payments' card in which the Type is "Prepayment from Customer" and specify the Order Number in the Order field. In both cases, the Customer Number will then be brought in to this field automatically, and the address and other information will also be brought in as previously described.

- This field is used in the Cash In register only.

- Supplier

- Paste Special

Suppliers in Contact register

- To record a cash payment issued to a particular Supplier, enter their Supplier Number or use the 'Paste Special' function. When you press Return, the Supplier's name, address and other information will be entered into the appropriate fields. There is no need to enter a Supplier Number: leave the field blank if you want to use a single Cash Out record to record the day's cash payments or to record a cash payment to a member of staff.

- If you issued the cash payment to the Supplier to settle an Invoice, enter a row on the 'Payments' card in which the Type is "Purchase Invoice" and specify the Invoice Number in the Number field. Alternatively, if the payment is a Prepayment against a Purchase Order, enter a row on the 'Payments' card in which the Type is "Prepayment to Supplier" and specify the Purchase Order Number in the Order field. In both cases, the Supplier Number will then be brought in to this field automatically, and the address and other information will also be brought in as previously described.

- This field is used in the Cash Out register only.

- Reference

- Use this field if you need to identify the cash transaction by means other than the Serial Number. One purpose for the field might be to record the number used by the Customer or Supplier to identify the payment.

- In a Cash In record that was created from a Sales Invoice, this field will contain a string that includes "S/INV." as a prefix and the Invoice Number.

- The Reference will be copied to the Reference field in any Nominal Ledger Transaction that will be created from the cash transaction.

- Name

- The Person, Customer or Supplier Name will be entered after you have entered a Person's initials or the Customer or Supplier Number.

- Address

- The Address of the Person, Customer or Supplier will be entered after you have entered a Person's Signature or the Customer or Supplier Number. In the case of a Person, the address will be taken from the Contact record specified in the Person or Global User record.

- Specification

- Any comment that you enter here (perhaps the circumstances of the cash transaction) will be copied to the Text field in the resulting Nominal Ledger Transaction, and will be shown in the 'Cash In: Browse' or 'Cash Out: Browse' window.

- In the case of the Cash Out register only, when you enter a Person above, their bank account number (from the 'Accounts' card of their Person record) will be copied here automatically.

- The Specification will be copied to the Text field in any Nominal Ledger Transaction that will be created from the cash transaction.

- Tags/Objects

- Paste Special

Tag/Object register, System module

- Default taken from Person, and Customer (Sales Tags/Objects) or Supplier (Purch. Tags/Objects)

- You can assign up to 20 Tags/Objects, separated by commas, to a cash transaction, to be transferred to the consequent Nominal Ledger Transaction. You might define separate Tags/Objects to represent different departments, cost centres or product types. This provides a flexible method of analysis that can be used in Nominal Ledger reports.

- In the Nominal Ledger Transaction generated from a cash transaction, the Tags/Objects specified here will be assigned to the Account that is credited (Cash In) or debited (Cash Out) by the value of the cash transaction (or by the value of the cash transaction less VAT if a separate VAT posting is being made).

- Total

- The total for the cash transaction, including VAT. This figure should be in Currency (specify the Currency on the 'Currency' card).

- If you have used at least one row on the 'Payments' card, the Total figure will be updated automatically and will not be changeable.

- VAT Code

- Paste Special

VAT Codes setting, Nominal Ledger

- Default taken from Cash Book Settings

- The VAT Code entered here determines the rate at which VAT will be charged on the cash transaction and the VAT Account to be used.

- If you would like a VAT element to be included the Nominal Ledger Transactions generated from cash transactions, select the Post VAT option in the Cash Book Settings setting. The VAT will be credited to the Output Account specified for the VAT Code record (Cash In) or debited to the Input Account (Cash Out). The Nominal Ledger Transaction will not include a VAT element if you have not selected the Post VAT option.

- If you are using the Post VAT option, the VAT Code specified here will be assigned to the posting to the Account from the Expense Account in the resulting Nominal Ledger Transaction. If you need it to be assigned to the posting to the VAT Account as well, select the Add VAT Code to VAT A/C rows option in the Transaction Settings setting in the Nominal Ledger.

- If you are using a Cash In record to receive cash against an Invoice and you are also using the Post Receipt VAT option in the Account Usage S/L setting, the VAT Code from the first row of the Invoice will appear here when you enter the Invoice Number on the 'Payments' card. Similarly, if you are using a Cash Out record to issue cash against a Purchase Invoice and you are also using the Post Payment VAT option in the Account Usage P/L setting, the VAT Code from the first row of the Purchase Invoice will appear here when you enter the Purchase Invoice Number on the 'Payments' card.

- VAT

- The VAT total for the cash transaction: this figure will be updated when you enter the Total or the Net figure and whenever you change the VAT Code. This figure should be in Currency.

- This figure will be rounded up or down according to the Default for Calculated Values and VAT rounding rules set in the Round Off setting in the System module acting in combination (the Default for Calculated Values rounding rules govern the calculation while the VAT rounding rules govern the figure after calculation).

- Language

- Paste Special

Languages setting, System module

- You can use the Language to determine the Form Template that will be used when you print the cash transaction, and the printer that will be used to print it. This can include sending the document to a fax machine, if your hardware can support this feature. To configure these printing specifications, use the 'Form Definition' window for the Cash In and Cash Out forms, as described here. You can change the Language before printing a cash transaction, to ensure it is printed on the correct printer or fax machine.

- Net

- The total for the cash transaction, excluding VAT. This figure will be calculated automatically when you enter the Total and whenever you change the VAT Code. This figure should be in Currency.

- This figure will be rounded up or down according to the Total rounding rules set in the Round Off setting in the System module. In the Nominal Ledger Transaction resulting from the cash transaction, any amounts lost or gained in this rounding process will be posted to the Round Off Account specified in the Account Usage S/L setting, providing you are using the Post VAT option in the Cash Book Settings setting. If you are not using this option, the Total will be posted to both sides of the Transaction so there will be no rounding error.

- If you have used at least one row on the 'Payments' card, the Net figure will be updated automatically and will not be changeable.

- Tax

- This field will only be visible if the VAT Law in the Company Info setting is "Argentinean", "Brazilian", "Italian", "Kenyan", "Mexican", "Philippinian", "Portuguese", "Singaporean" or "South African".

- When you define VAT Codes using the setting in the Nominal Ledger, you can use the fields on flip B to specify that an additional tax, such as an environmental tax, is to be levied. This additional tax is usually termed "Extra Tax".

- If the VAT Code specified above is one that you have configured to include Extra Tax, the amount of that tax will be shown in this field, in the Currency of the cash transaction.

- When you mark the cash transaction as OK and save it, this Extra Tax will be credited (in the case of a Cash In record) or debited (in the case of a Cash Out) to the Tax Account specified for the appropriate VAT Code.

- If you have specified a Tax Min. (minimum Extra Tax amount) for a VAT Code, and the Extra Tax in an Invoice is less than this minimum amount, this field will be blank.

- Please refer to the description of flip B of the VAT Codes setting here for more details about how the Extra Tax figure is calculated together with examples.

---

The Cash In and Cash Out registers (Cash Transactions) in Standard ERP:

Go back to:

|