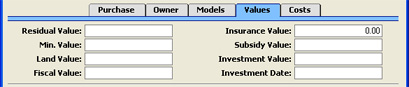

Entering an Asset - Values Card

- Residual Value

- If some of the value of the Asset is not to be depreciated, enter that portion here.

- For example, an Asset was purchased for 1000.00. Enter 1000.00 as the Purchase Value on the 'Purchase' card. The Residual Value is 200.00, so enter 200.00 here. When depreciation is calculated, the basis for the depreciation calculation is taken to be 1000.00 - 200.00 = 800.00. This applies whether the Depreciation Model is Straight Line or Declining Balance. The Residual Value is not taken into account when calculating the net book value of the Asset at the end of the depreciation period (i.e. the net book value at the end of the first year will be 1000 minus the depreciation).

- If the Quantity on the 'Owner' card is greater than one, this field should contain a figure for the Residual Value per unit, not the total Residual Value.

- Insurance Value

- Enter the insurance value of the Asset. In the case of an Asset created from a Purchase Invoice, this will be taken from the Amount field of the Purchase Invoice row. This figure is used by the Insurance Value report.

- Min. Value

- This field is used in Portugal, where there is sometimes a statutory maximum price that can be paid for an Asset. For example, the statutory maximum price for a car might be 29930. If you purchase a car for 39900, enter 39900 as the Purchase Value and 29930 as the Minimum Value. The car will be depreciated as normal, using 39900 as the basis for the calculation. The extra price over and above the statutory maximum (39900 - 29930 = 9970 in the example) is also depreciated using the standard depreciation rate: this depreciation figure is shown in the Fiscal Year Depreciation report as a non-fiscal cost (column 15).

- Subsidy Value

- Please refer to the description of the Contract No. field on the 'Purchase' card for details of this field.

- Land Value

- If the Asset is a building, its value will usually be made up of two components: the building itself and the land. It is recommended that you enter two records for such an Asset: one for each component. Usually, the land component should not be depreciated, so it should be given a "No Depreciation" Depreciation Model.

- If the land is being depreciated or it is not possible to enter two separate records, you can enter the value of the land component. This will be for information only: it will be shown in the Asset History - Portugal report, but it will not affect the calculation of depreciation.

- Investment Value

- In some countries such as Portugal, if an Asset is sold for a profit and that profit is invested in another Asset, the payment of tax can be delayed.

- If that situation applies to this Asset, enter the amount reinvested here. This Investment Value is then depreciated using the standard depreciation rate: this depreciation figure is shown in the Fiscal Year Depreciation report as a non-fiscal cost (column 15).

- Fiscal Value

- If the Asset is a building, its fiscal value (rateable value) can be recorded here. In most cases, this will be for information only: it will be shown in the Asset History - Portugal report. You can choose to base the calculation of depreciation of each Asset on its Fiscal Value instead of on its Purchase Value.

- If the Quantity on the 'Owner' card is greater than one, this field should contain a figure for the Fiscal Value per unit, not the total Fiscal Value.

- Investment Date

- Paste Special

Choose date

- If there is an Investment Value (above), enter the date of investment here. This is recorded for information only.