Entering a Revaluation record

This page describes entering a record in the Revaluation register in the Assets module.

---

You can enter records to the Revaluation register in three ways:

- Directly to the Revaluation register in the Assets module.

- Using the 'Revaluate Asset Acquisition Value' Maintenance function.

This method uses the Revaluation Factors and Revaluation Run Lists settings. You can use it when you need to create Revaluation records for several Assets at once, and it should also be used in countries where Assets are revalued periodically on state authorisation (usually because of inflation).

- Using the fields on flip E of the 'Costs' card in the Purchase Invoice window. If you enter an Inventory Number and set the Asset Trans. Type to "Revaluate Asset", a new Revaluation record will be created when you approve and save the Purchase Invoice. This method may be useful if the Purchase Invoice is for an upgrade or additional accessory that will increase the value of an existing Asset.

The first of these options is described here. Please refer to this page for full details about the second option, and here for details about the third.

To open the Revaluation register, first ensure you are in the Assets module. Then, if you are using Windows or macOS, click the [Registers] button in the Navigation Centre and double-click 'Revaluations' in the resulting list. If you are using iOS or Android, tap the [Registers] button in the Navigation Centre and then tap 'Revaluations' in the 'Registers' list.

The 'Revaluations: Browse' window will be opened, listing the Revaluation records that you have already entered.

To enter a new Revaluation record, select 'New' from the Create menu (Windows/macOS) or from the + menu (iOS/Android). You can also use the Ctrl-N (Windows) or ⌘-N (macOS) keyboard shortcuts. Alternatively, highlight in the list a Revaluation that is similar to the one you want to enter and select 'Duplicate' from the same menu.

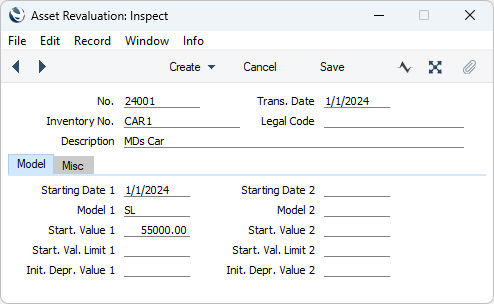

The 'Revaluation: New' window will be opened, empty if you selected 'New' or containing a duplicate of the highlighted Revaluation record. In the case of the duplicate, the Transaction Date of the new record will be the current date, not the date of the original one.

Complete the Revaluation record as appropriate and as described below, then save it using the [Save] button (Windows/macOS) or by tapping √ (iOS/Android) and close the window by clicking the close box (Windows/macOS) or by tapping < (iOS/Android). Then, close the browse window using the close box or < again.

Header

- No.

- Paste Special

Select from another Number Series

- The unique number of the Revaluation record. The default will be chosen as follows:

- It will be taken from the first valid row in the Number Series - Asset Revaluations setting.

- It will be the next number following on from the last Revaluation entered.

- You may change the default, but not to a number that has already been used. If you have defined at least one number sequence in the Number Series - Asset Revaluations setting, the number you change to must be inside a valid number sequence.

- You will not be able to save a Revaluation record if the No. does not belong to a valid number sequence. A valid number sequence is one for the period in which the Trans. Date falls and with unused numbers, so this problem will most usually occur at the beginning of a new calendar or financial year.

- If you are working in a multi-user system, the Revaluation Number will be assigned when you first save the Revaluation record.

- Trans. Date

- Paste Special

Choose date

- In countries where a Nominal Ledger Transaction will be created from the Revaluation, specify the date of that transaction here. Please refer to the description of the 'NL Simulation' function for details about creating Nominal Ledger Transactions from Revaluations.

- In most cases, this Date should be the same as the Starting Dates on the 'Model' card, otherwise there is a risk that the Revaluation record will not be found by the depreciation calculation.

- Inventory No.

- Paste Special

Asset register, Assets module

- Specify the Asset that is to be affected by the Revaluation record.

- Legal Code

- This field is only used in Revaluation records created by the 'Revaluate Asset Acquisition Value' Maintenance function. It will contain the Legal Code specified in the Revaluation Factor used by that function to create the Revaluation record.

- The Legal Code is used in some countries such as Russia and Portugal, where Assets can be revalued due to inflation. It is the serial number of the official authorisation of the revaluation. Revaluation records that have a Legal Code are usually referred to as "Official Revaluations" in Standard ERP and in this documentation.

- Description

- If you entered the Revaluation directly to the Revaluation register, the name of the Asset will appear here after you have specified the Inventory Number. Otherwise, if the record was created by the 'Revaluate Asset Acquisition Value' Maintenance function, this fact will be recorded here instead.

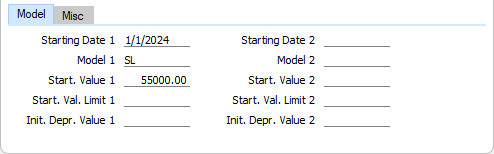

Model Card

- Starting Date 1, Starting Date 2

- Paste Special

Choose date

- Enter the date when the Revaluation record is to take effect. You can specify separate Starting Dates for each Depreciation Model.

- For example, you purchased an Asset on 1/1/2024. You have entered two Revaluation records for the Asset, with Starting Dates of 1/1/2025 and 1/7/2025. Depreciation will be calculated for 2024 using the specification in the Asset record, for the first six months of 2025 using the first Revaluation record, and for the second half of 2025 and thereafter using the second Revaluation record.

- It is recommended that the Starting Dates should be close to the Transaction Date. When depreciation is calculated for a particular period, there will first be a search for Revaluation records whose Transaction Dates fall in that period and the Revaluation records that are found will be applied them from their Starting Dates on. So, a Revaluation record will have no effect if its Starting Date falls within the period but its Transaction Date does not. A Revaluation record will also have no effect if its Starting Date is blank.

- Please refer to the description of the Start. Date 1 and 2 fields on the 'Models' card of the Asset record for a discussion about whether these dates should be the first of a month.

- Model 1, Model 2

- Paste Special

Depreciation Models register, Assets module

- Specify here the Depreciation Models that are to be used from the Starting Date onwards.

- If you don't want to change the Depreciation Models, you can leave these fields blank. This will mean the depreciation calculation will continue to use the Models in the previous Revaluation or, if there are no previous Revaluations, the Models in the Asset record

- If you are using a Straight Line Depreciation Model, you should think about whether you need to change the Model when you revalue an Asset. For example, an Asset has a Purchase Value of 50000.00 and is being depreciated using a 5% Straight Line Depreciation Model. This means the Asset will be depreciated over a period of 20 years, at a rate of 2500.00 per year. When the Asset is five years old, it will have depreciated by 12500.00 to a value of 37500.00. If the Asset is revalued to 55000.00 at that moment, this in effect sets its Purchase Value to 55000.00. Its value after five years will then be 55000.00 - 12500.00 = 42500.00. If there is no change of Depreciation Model, it will be depreciated at a rate of 2750.00 per year, so its life will be extended slightly. If you want the life of the Asset to remain 15 years after the Revaluation, you should change the Model to 5.152% Straight Line. To calculate the new percentage, use the formula:

- percentage = (((new value - depreciation so far) / remaining life in years) / new value) x 100

- percentage = (((55000.00 - 12500.00) / 15) / 55000.00) x 100 = 5.152

- If you don't want to change the Model, you might consider calculating depreciation using the Start from Last Revalued Value option. This option assumes that the original value of the Asset was 55000, and that it has already been depreciated for five years at a rate of 2750.00 per year. The remaining life of the Asset will be unchanged at 15 years. By treating the value in the latest Revaluation as the original Purchase Value of an Asset, this option effectively recalculates the depreciation from previous years retrospectively. Depending on advice from your auditor, you may need to record the change in depreciation in the Nominal Ledger.

- Start. Value 1, Start. Value 2

- Enter the depreciation base, i.e. the Asset Value to be used as the basis for the calculation of depreciation. You should determine this Value as follows:

- If you are using a No Depreciation method, the value is the current book value.

- If you are using a Straight Line depreciation method, the value should be the original Purchase Value unless the purpose of the Revaluation record is specifically to change the depreciation base (perhaps because of inflation).

- If you are using a Declining Balance method, you should enter the current book value after accumulated depreciation, again unless the purpose of the Revaluation record is specifically to change the depreciation base. You can obtain the current book value by producing a Depreciations Report for the Asset for the period up to the Start Date of the Revaluation record. The declining balance method will be used from that date on.

- If you do not enter a figure here, depreciation will no longer be calculated, as you are in effect changing the value of the Asset to zero. If the purpose of the Revaluation is to change the Depreciation Model and you need depreciation still to be calculated, you must therefore copy the Starting Value from the previous Revaluation or, if there are no previous Revaluations, from the Purchase Value field in the Asset record.

- Starting Value 1 is used by the Depreciation Model specified in the Model 1 field, and Starting Value 2 by that in the Model 2 field.

- If the Quantity on the 'Owner' card of the Asset record is greater than one, these fields should contain figures for the Starting Value per unit, not the total Starting Value.

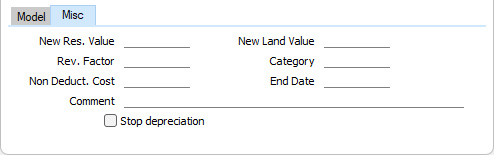

Misc Card

- New Res. Value

- The new Residual Value of the Asset. If you leave this field blank, the Residual Value from the previous Revaluation record for the Asset or, if there are no previous Revaluation records, the Residual Value from the 'Values' card in the Asset record will be used.

- If the Quantity on the 'Owner' card of the Asset record is greater than one, this field should contain a figure for the Residual Value per unit, not the total Residual Value.

- New Land Value

- The new Land Value of the Asset. If you leave this field blank, the Land Value from the previous Revaluation record for the Asset or, if there are no previous Revaluation records, the Land Value from the 'Values' card in the Asset record will be used.

- Rev. Factor

- Paste Special

Revaluation Factors setting, Assets module

- In the case of a Revaluation created by the 'Revaluate Asset Acquisition Value' Maintenance function, the Code of the Revaluation Factor that caused the record to be created will appear here. This field cannot be modified and is for information only.

- Category

- In the case of Revaluations created by the 'Revaluate Asset Acquisition Value' Maintenance function, the Asset Category to which the Asset belongs will appear here. This field cannot be modified and is for information only.

- Non Deduct. Cost

- This field is used in Portugal. Revaluing an Asset will usually result in higher periodic depreciation, but not all of this increase can be deducted as an expense for fiscal purposes. Specify here how much cannot be deducted: this should be an annual figure. It will be printed in the Portuguese depreciation reports and should be included in Portuguese tax statements.

- In the case of Revaluations created by the 'Revalue Asset Acquisition Value' Maintenance function, the Non Deductible Cost will be calculated by applying the % in the Revaluation Factor row to the increase in value.

- Comment

- Any comment about the Revaluation record can be entered here.

---

The Revaluation register in Standard ERP:

Go back to:

|