Revaluate Asset Acquisition Value - The 'Revaluate Asset Acquisition Value' Maintenance Function

This page describes the 'Revaluate Asset Acquisition Value' Maintenance function in the Assets module.

---

Once you have entered the Revaluation Factors, Revaluation Run Lists and, if appropriate, Inflation Coefficients, you can revalue your Assets by running the 'Revaluate Asset Acquisition Value' Maintenance function. This will revalue the Assets by creating the appropriate Revaluation records.

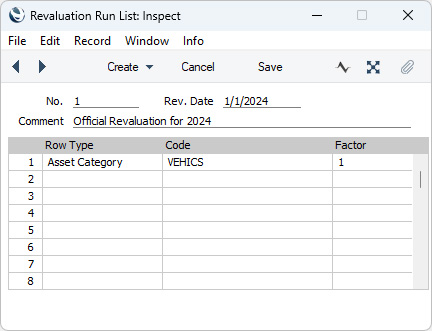

The function will first search for a Revaluation Run List with a specified date. It will then create

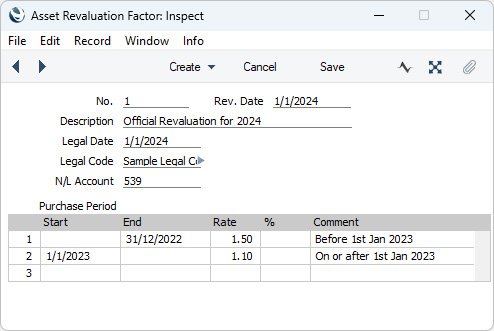

Revaluation records by following the instructions in the grid area in the Run List. For example, the Run List illustrated above will cause a separate Revaluation record to be created for each Asset belonging to the "VEHICS" Category. Each Asset will be revalued using the Factor illustrated below, and, in Portugal and Russia only, using the Inflation Coefficient applying at the Run List date.

Revaluation records will not be created for Assets that have been disposed of (sold or written off using records in the

Disposal register that you have marked as OK) or for Assets that you have marked as Inactive. In addition, a

Revaluation record will not be created for an Asset if one already exists with a Transaction Date that is the same as the Run List Date.

However, Revaluation records will be created for Assets that have been fully depreciated using Straight Line Depreciation Models. For example, an Asset with a 20% Straight Line Depreciation Model will be fully depreciated after five years. A Revaluation record will be created for this Asset if you run this Maintenance function in the sixth or subsequent year. If you do not want this to happen, mark the Asset as Inactive at the end of its life.

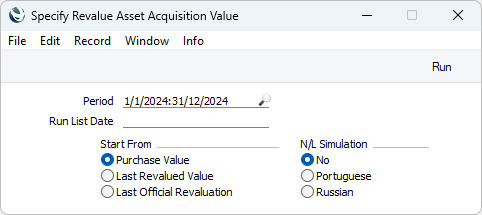

- Period

- Paste Special

Reporting Periods setting, System module

- This field is only used in Portugal and Russia, where the change in depreciation resulting from the Revaluation is recorded in the Nominal Ledger. The period over which the change in depreciation is to be calculated will begin with the Start Date of each Asset and end with the last date of the period specified here.

- Run List Date

- Paste Special

Choose date

- Specify here the date of the Revaluation Run List record that you want to be used to create Revaluation records. You must enter a date if the Maintenance function is to have any effect.

- In Portugal and Russia, if there are any records in the Inflation Coefficients setting, the Maintenance function will search for the one applying at the date specified here (i.e. the one with the nearest date earlier than that specified here).

- Start From

- Use these options to specify how the new Starting and Residual Values of each Asset are to be calculated.

- Purchase Value

- The new Starting Value will be calculated by multiplying the Purchase Value of the Asset by the Rate in the relevant Revaluation Factor record and, in Portugal and Russia only, by the Coeff. in the relevant Inflation Coefficient record. This figure will appear in the Starting Value 1 and 2 fields in the new Revaluation.

- The new Residual Value will be calculated by multiplying the original Residual Value of the Asset by the Rate in the relevant Revaluation Factor record.

- Last Revaluated Value

- The new Starting Values 1 and 2 will be calculated by multiplying the Starting Values 1 and 2 in the latest existing Revaluation record by the Rate in the relevant Revaluation Factor record and, in Portugal and Russia only, by the Coeff. in the relevant Inflation Coefficient record. The Transaction Date field in the Revaluation is used to determine which is the latest Revaluation record, not the Starting Date field. If there is no previous Revaluation record, the Purchase Value of the Asset will be used.

- The new Residual Value will be calculated by multiplying the Residual Value in the latest Revaluation record by the Rate in the relevant Revaluation Factor record.

- Last Official Revaluation

- This option will only be visible in Portugal (i.e. if the VAT Law in the Company Info setting is set to "Portuguese"). It is similar to the Last Revaluated Value option above, but uses the latest existing Revaluation record with a Legal Code.

- N/L Simulation

- The N/L Simulation options will only be visible in Portugal and Russia (i.e. if the VAT Law in the Company Info setting is set to "Portuguese" or "Russian").

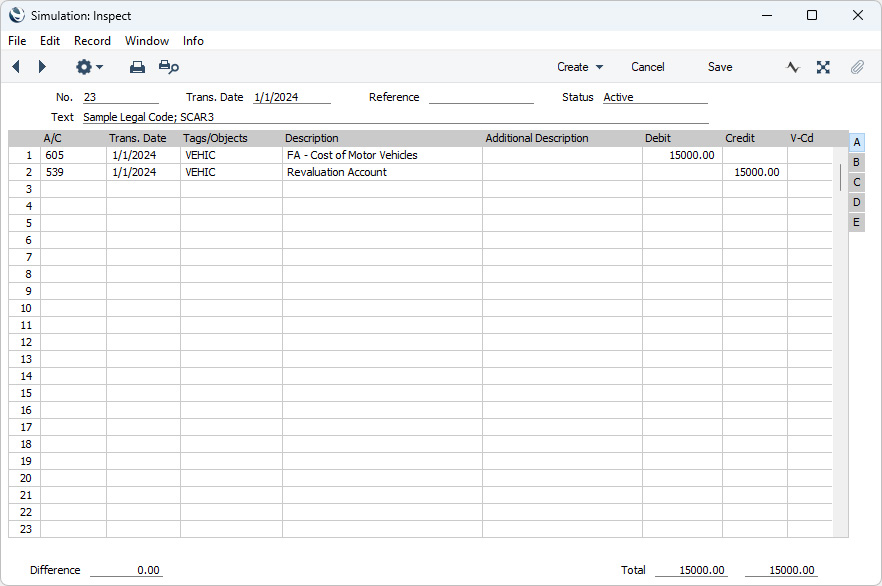

- In some countries, the revaluing of Assets should be recorded in the Nominal Ledger. Use one of these options if you want a Simulation to be created for each Asset Revaluation. You can check this Simulation later and create a Transaction from it.

- You should choose the Russian model if you want an Inflation Coefficient to affect how the new Asset values are calculated. Usually, these will be calculated by multiplying the previous Asset value by the Rate in the relevant Revaluation Factor record. If you choose this option, the previous Asset values will be multiplied by the Coeff. in the relevant Inflation Coefficient record as well.

- If you choose to have Simulations created, one will be created for each Asset. Note that the resulting Simulations are different to those created by the 'NL Simulation' function on the Create menu (Windows/macOS) or + menu (iOS/Android) in the Revaluation window.

- If Simulations are not created when expected, the following are possible causes: there is no valid Number Series for the current year in the Number Series - Simulations setting in the Nominal Ledger; the Asset-Asset Category-Asset Class chain is broken, or valid Accounts have not been entered in the Asset Class; or a valid Account was not entered in the Revaluation Factor record. Note that the function will still create Revaluations, so you will need to delete these Revaluations as well as correcting the error preventing Simulations from being created, before running the function again.

- No

- Choose this options if you don't want Simulations to be created by the Maintenance function.

- Russian

- Choose this option if you want Simulations to be created using the Russian model.

- If the Asset has increased in value, that increase multiplied by the Quantity on the 'Owner' card of the Asset record will be debited to the Asset Account specified in the relevant Asset Class and credited to the N/L Account specified in the relevant Revaluation Factor record. These postings will be reversed if the Asset has decreased in value. The Tags/Objects in all postings will be taken from the Asset Class (Tags/Objects field).

- The Legal Code from the Revaluation Factor and the Inventory Number of the Asset will be copied to the Text field in the Simulation.

- The date of the Simulation will be the date of the Revaluation Run List record (i.e. the date that you entered in the 'Specify Revaluate Asset Acquisition Value' window).

More information about the 'Revaluate Asset Acquisition Value' function:

---

Go back to: