Depreciation Plan

This page describes the Depreciation Plan report in the Assets module.

---

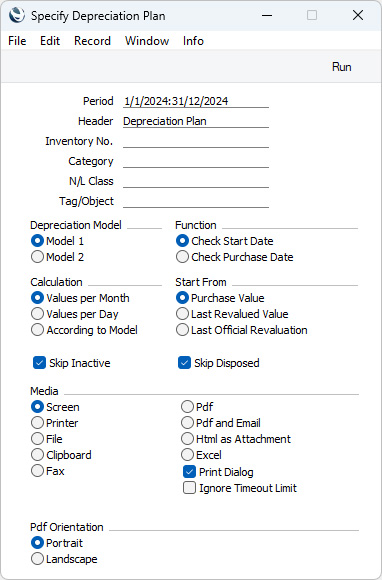

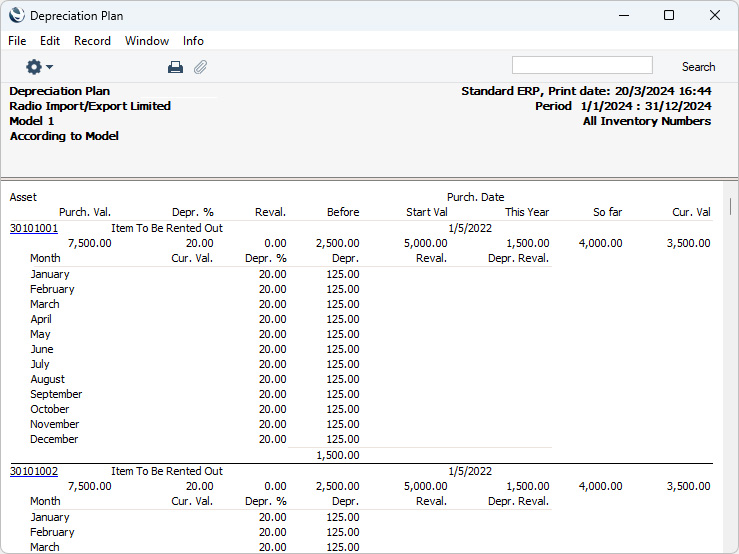

The Depreciation Plan report calculates depreciation for each Asset over a single calendar year on a month-by-month basis.

As with most reports in the Assets module, you can produce the Depreciation Plan for a future period. The report will then show planned depreciation for the selected Assets, based on information currently in the Asset and Revaluation registers.

- Period

- Paste Special

Reporting Periods setting, System module

- Specify the time period for which depreciation will be calculated. Since the report displays monthly depreciation figures, the period should consist of a selected number of whole months. The first date of the period should be the start of a calendar year. If you specify a period in which these criteria are not met, it will be adjusted automatically (e.g. if you specify a period that does not begin on January 1, the report will provide monthly depreciation figures from January to the final month in the specified period).

- Header

- Enter your own title for the report. This title will be printed in the report header, and will also appear in the title bar of the report window if you print the report to screen.

- Inventory No.

- Paste Special

Asset register, Assets module

- Range Reporting Alpha

- If you need to report on a particular Asset, enter its Inventory Number here. You can also enter a range of Inventory Numbers, separated by a colon (:)..

- Assets that belong to Asset Categories in which you have selected the Exclude from Reports option will not be included in the report.

- Category

- Paste Special

Asset Category register, Assets module

- Enter an Asset Category here if you need the report to list the Assets belonging to a particular Category.

- N/L Class

- Paste Special

Asset Classes setting, Assets module

- Specify an Asset Class here if you need the report to list Assets belonging to a particular Asset Class.

- You can assign an individual Asset to an Asset Class using the N/L Class field in the header of the Asset record, or you can leave that field empty and assign the Asset to an Asset Category that belongs to the Asset Class. Only the first of these will be found when you specify the Class here.

- Tag/Object

- Paste Special

Tag/Object register, Nominal Ledger/System module

- Specify a Tag/Object in this field if you want the report to list Assets with a certain Tag/Object. If you leave the field blank, all Assets, with and without Tags/Objects, will be included in the report. If you enter a number of Tags/Objects separated by commas, the report will list Assets featuring all the Tags/Objects entered. If you enter a number of Tags/Objects separated by plus signs (+), the report will list Assets featuring at least one of the Tags/Objects entered. If you enter a Tag/Object preceded by an exclamation mark (!), the report will list Assets featuring any Tag/Object except the one entered.

- For example:

- 1,2

- Lists Assets with Tags/Objects 1 and 2 (including Assets with Tags/Objects 1, 2 and 3).

- 1+2

- Lists Assets with Tags/Objects 1 or 2.

- !2

- Lists all Assets except those with Tag/Object 2.

- 1,!2

- Lists Assets with Tag/Object 1 but excludes those with Tag/Object 2 (i.e. Assets with Tags/Objects 1 and 2 will not be shown). Note the comma before the exclamation mark in this example.

- !1,!2

- Lists all Assets except those with Tag/Object 1 or 2 or both. Again, note the comma.

- !(1,2)

- Lists all Assets except those with Tags/Objects 1 and 2 (Assets with Tags/Objects 1, 2 and 3 will not be listed).

- !1+2

- Lists Assets without Tag/Object 1 and those with Tag/Object 2 (Assets with Tags/Objects 1 and 2 will be listed).

- (1,2)+(3,4)

- Lists Assets with Tags/Objects 1 and 2, and those with Tags/Objects 3 and 4.

- 1*

- Lists Assets with Tags/Objects beginning with 1 (e.g. 1, 10, 100).

- 1*,!1

- Lists Assets with Tags/Objects beginning with 1 but not 1 itself.

- *1

- Lists Assets with Tags/Objects ending with 1 (e.g. 1, 01, 001).

- 1*,*1

- Lists Assets with Tags/Objects beginning and ending with 1.

- Depreciation Model

- Select one of these options to specify which of the two Depreciation Models specified on the 'Models' card of each Asset record is to be used to calculate its depreciation.

- Function

- Assets purchased after the report period will not be included in the report. Select one of these options to choose how "purchased" is defined:

- Check Start Date

- Assets with Start Dates 1 or 2 (depending on whether you are using Model 1 or 2) later than the report period will not be included in the report.

- Check Purchase Date

- Assets with Purchase Dates later than the report period will not be included in the report. The consequence will be that an Asset whose Purchase Date is earlier than or within the report period and whose Start Date is later than the report period will be included in the report, but no depreciation will be calculated. Depreciation is always calculated from the Start Date onwards.

- Calculation

- Please refer to the description of the 'Create Depreciation Simulations' Maintenance function for full details about the

Values per Day and Values per Month options. Choose the According to Model option if you want to use the Period specified in the Depreciation Model of each Asset: you must select this option if you have any Depreciation Models in which the Period is "Quarter" for depreciation to be calculated correctly.

- Start From

- Please refer to the description of the 'Create Depreciation Simulations' Maintenance function for full details about the Purchase Value and Last Revalued Value options. The Last Official Revaluation option is similar to the Last Revalued Value option, but uses the latest Revaluation record with a Legal Code.

- Skip Inactive

- Select this option if you do not want Assets that you have marked as Inactive to be included in the report.

- Skip Disposed

- Select this option if you do not want Assets that you have disposed of (i.e. that you have written off or sold using Disposal records) to be included in the report.

---

Go back to:

|