Nominal Ledger Transactions from Work Sheets

If you are maintaining stock valuations in the Nominal Ledger, you will need to have a Nominal Ledger Transaction generated when you save a Work Sheet that you have marked as OK. This Transaction will update the stock valuation in the Nominal Ledger, deducting the value of the spare parts or other

Stocked Items that you removed from stock to effect the repair.

You will need to have Nominal Ledger Transactions generated from Work Sheets if you have specified in the Cost Accounting setting in the Stock module that Cost of Sales Postings will be made from Deliveries or from Invoices with Accruals from Deliveries. If you are using either of these options, ensure you have selected the Work Sheets option in the Sub Systems setting in the Nominal Ledger. Do not select this option if you have specified in the Cost Accounting setting that Cost of Sales Postings will be made from Invoices.

If you are updating the stock valuation in the Nominal Ledger from Work Sheets, you should also select the Work Sheets Update Stock option in the Account Usage Service Order setting. This will ensure that Work Sheets will also update stock levels of the spare parts and other Stocked Items.

The Stock Account credited in Nominal Ledger Transactions created from Work Sheets will be determined as follows:

- The Stock Account for the specified Location will be credited.

- If this is blank, or you have not specified a Location, and if you are using the Use Item Groups for Cost Accounts option in the Cost Accounting setting (Stock module), the Stock Account for the Item Group to which the Item belongs will be credited.

- In all other cases, the Stock Account on the 'Stock' card of the Account Usage Stock setting will be credited.

On the debit side, you can specify that dedicated Cost Accounts will be debited in the Cost or Cost of Sales postings made from Work Sheets. If you need to use these Accounts, specify them using the Service Invoiceable Cost, Service Warranty Cost, Service Contract Cost and Service Goodwill Cost Account fields in your

Item or

Item Group records. The choice of Service Cost Account in each case will depend on the Item Type specified on flip B of the

Work Sheet row. For example, if the Item Type is "Warranty", the Service Warranty Cost Account will be debited. If the Item Type is "Goodwill", the Service Goodwill Cost Account will be debited.

The Service Cost Account of the appropriate type will be taken from the Item record or from the Item Group to which the Item belongs, as follows:

- If you are using the Use Item Groups for Cost Accounts option in the Cost Accounting setting in the Stock module, the Service Cost Account will be taken from the Item Group to which the Item belongs. If that is blank or the Item does not belong to an Item Group, the Service Cost Account will be taken from the Item record.

- If you are not using the Use Item Groups for Cost Accounts option, the Service Cost Account will be taken from the Item record. If that is blank, the Service Cost Account will be taken from the Item Group to which the Item belongs.

It is particularly important that you specify Service Warranty Cost, Service Contract Cost and Service Goodwill Cost Accounts if you have specified in the

Cost Accounting setting that Cost of Sales postings will be made from Invoices with Accruals from Deliveries. If you have not specified Service Cost Accounts, costs from Work Sheets will be debited to the Cost of Sales Accruals Account. As Warranty, Contract and Goodwill Work Sheets will not be invoiced, there will be no Invoices to move the costs from the Accrual Account to the final Cost Account.

If you have not specified Service Cost Accounts in your Item or Item Group records, then the Cost of Sales Account debited in Nominal Ledger Transactions created from Work Sheets will be determined as follows:

- In the special case where you have specified in the Cost Accounting setting that Cost of Sales postings will be made from Invoices with Accruals from Deliveries, the Cost of Sales Accruals Account specified in the Account Usage Stock setting will be debited. When you create the Invoice for the Work Sheet, the Cost of Sales Accruals Account will be credited and a Cost of Sales Account chosen as described in the following points will be debited. In all other cases (i.e. if you have specified that Cost of Sales postings will be made from Deliveries), the Cost of Sales Account will also be chosen as described in the following points.

- If you have specified a Cost Account for the Location in the Location Accounts setting in the Stock module, that Cost Account will be used. The Location is the one specified on the 'Date' card of the Work Sheet.

- If you are using the Use Item Groups for Cost Accounts option in the Cost Accounting setting, the Cost Account for the Item Group to which the Item belongs will be debited. If that is blank or the Item does not belong to an Item Group, the Cost Account for the Item will be debited.

However, if you are not using the Use Item Groups for Cost Accounts option, the Cost Account for the Item will be debited. If that is blank, the Cost Account for the Item Group to which the Item belongs will be debited.

- In all other cases, the Cost Account specified in the Account Usage Stock setting will be debited.

In all cases, the appropriate Cost Account for the Zone of the Customer will be used. The default Cost of Sales Account will be shown on

flip E of each Work Sheet row, where you can change it if necessary.

The values posted to the Stock and Cost of Sales Accounts will be calculated using the Cost Model specified in the relevant Item or Item Group record. If that Cost Model is Default, the Primary Cost Model specified in the Cost Accounting setting in the Stock module will be used.

Plain and Service Items will only be included in the Nominal Ledger Transaction if you are using the Cost Accounting for Plain and Service Items option in the Cost Accounting setting in the Stock module.

Any Tags/Objects specified on the 'Date' card of the Work Sheet will be assigned to the debit posting to the Cost Account. They will also be assigned to the credit posting to the Stock Account if you are using the Tag/Object on Stock Account option in the Cost Accounting setting in the Stock module. However, if you are using the Skip Header A/C Tags/Objects on Sales and COS A/C option in the Account Usage S/L setting in the Sales Ledger, these Tags/Objects will not be assigned to either posting. By default, these Tags/Objects will be copied from the 'Del Terms' card of the Service Order, and these in turn will have been copied from the Sales Tags/Objects field on the 'Accounts' card of the Contact record for the Customer.

Any Tags/Objects specified for the Items in the Work Sheet will be visible on flip E of the matrix and will also be assigned to the debit posting to the Cost Account. Again, they will also be assigned to the credit posting to the Stock Account if you are using the Tag/Object on Stock Account option.

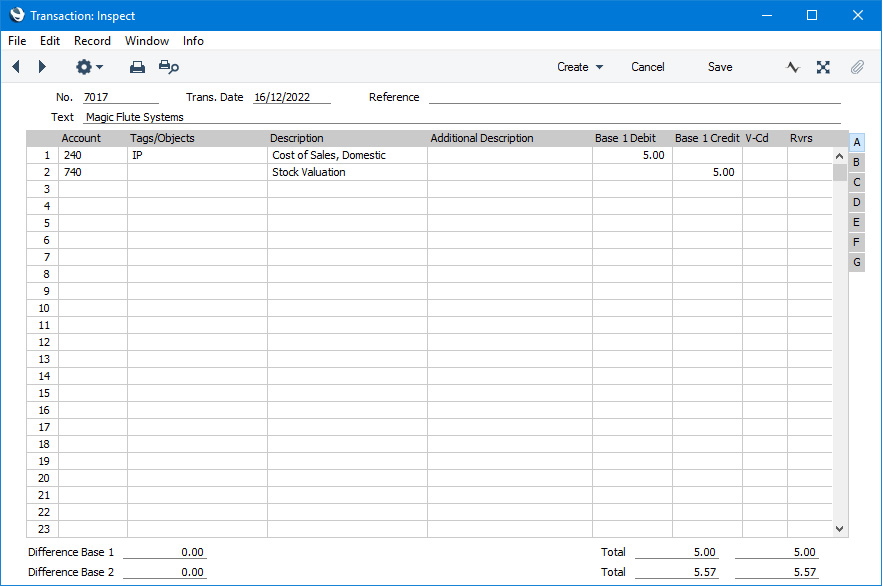

Shown below is an example of a Nominal Ledger Transaction generated from a Work Sheet that has been marked as OK and saved:

Once the Transaction has been generated, you can look at it straight away using the

'Open NL Transaction' function on the Operations menu (Windows/macOS) or Tools menu (iOS/Android) (subject to access rights).

Please refer here for a full discussion of cost accounting.

---

The Work Sheet register in Standard ERP:

Go back to: