Entering an Invoice - Items Card Part 1 (Flips A and B)

This page describes the fields on flips A and B of the 'Items' card of the Invoice record. Please click the following links for descriptions of the other cards:

---

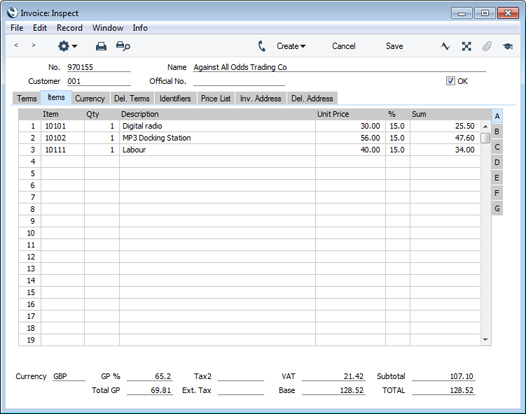

Use the grid on the 'Items' card of the Invoice window to list the invoiced Items. This grid is divided into seven horizontal flips. When you click on a flip tab (marked A-G), the two or three right-hand columns of the grid are replaced.

Before adding any rows to an Invoice, ensure that the Price List, Currency and Exchange Rate are correct. As you add Items to the Invoice, the correct prices will be brought in automatically, converted into Currency if necessary. If you change the Currency or Exchange Rate after you have added Items to the Invoice, the prices of those Items will not usually be recalculated automatically. You will need to force a recalculation using the 'Update Currency Price List Items' function on the Operations menu. If you would like prices to be recalculated automatically when you change the Currency or Exchange Rate, select the Update Prices on records with Currency when changing Dates option in the Item Settings setting in the Sales Ledger. Prices will always be recalculated automatically if you change the Price List.

To add rows to an Invoice, click in any field in the first blank row and enter appropriate text. To remove a row, click on the row number on the left of the row and press the Backspace key. To insert a row, click on the row number where the insertion is to be made and press Return.

You can also bring Items into an Invoice by opening the 'Items: Browse' or 'Paste Special' windows, selecting a range of Items by clicking while holding down the Shift key, and then dragging them to the Item field in the first empty Invoice row. You can copy a list of Item Numbers from a spreadsheet or word processor and paste them in the Item field in the first empty row. Finally, you can use the 'Item Search' function on the Operations menu to add Items to the Invoice.

Flip A - Item

- Paste Special

Item register

- With the insertion point in this field, enter the Item Number, Alternative Code or Bar Code for each Item sold. Pricing, descriptive and other information will be brought in from the Item record. If you leave this field blank, you can enter any text in the Description field, perhaps using the row for additional comments to be printed on Invoice documentation.

- If the Item is a Structured Item in which you have ticked the Paste Components during Entry box, its components will be listed on the following rows when you enter a Quantity. If you then change the Quantity of the Structured Item, the Quantities of the components will be updated automatically.

- If the Customer has been assigned a Default Item record (on the 'Pricing' card of the Customer record), all Items in that record will be added to the Invoice automatically when the Customer Number is entered. Note that these Items will not have a Quantity, so be sure to enter one before saving, printing and marking the Invoice as OK.

- You can use Access Groups to prevent users from selling Items of a particular Type. Assign them an Access Group in which you have granted Full access to the 'Disallow Sales of Plain Items', 'Disallow Sales of Stocked Items', 'Disallow Sales of Structured Items' and/or 'Disallow Sales of Service Items' Actions as necessary.

- Qty

- Enter the number of units sold. The Sum will then be calculated automatically.

- After entering a Quantity, pressing the Return or Enter key will cause the insertion point to move to the Item field in the next row.

- In an Invoice created from an Order or a Delivery, the Quantity will default to that delivered. You can reduce this if necessary. If you need to invoice a greater Quantity than was delivered, you must do so by adding a new row to the Invoice. Ensure that the Update Stock box on the 'Del. Terms' card is ticked so that stock levels will be updated accordingly and, if appropriate, to cause cost of sales postings for the extra quantity to be included in the Nominal Ledger Transaction created from the Invoice. The Update Stock box will only apply to Invoice rows that are not related to the Order or Delivery.

- Negative quantities will usually not be allowed in this field. If you would like negative quantities to be allowed, use the Allow Negative Quantities on Invoices option in the Optional Features setting in the System module. This can be useful to facilitate returns in a retail environment. Be careful using this option in Invoices that Update Stock. If the Quantity is negative, the Item will be received into stock, at a cost determined by its Cost Model. If the Cost Model is Queued the cost will always be zero, and if the Cost Model is Weighted Average the cost will be zero if you currently have no units in stock. Please refer here for more details about Cost Models. The Allow Negative Quantities on Invoices option does not allow negative quantities to be used with Serial Numbered Items.

- If you have specified a Default Return Location in the Local Machine setting in the User Settings module, that Location will be placed in the field on flip B automatically if you enter a negative Quantity. The Local Machine setting is specific to the client machine you are working on.

- Description

- Default taken from

Item

- This field contains the name of the Item, brought in from the Item register. Usually, it will be the Item's Description that is brought in but, if you have entered various translations of the Description on the 'Texts' card of the Item record, the correct translation for the Language of the Invoice (specified on the 'Price List' card) will be brought in instead.

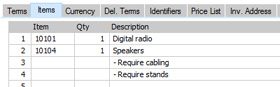

- In addition to the Description or its translation, any rows of text that you have entered on the 'Texts' card of the Item record without a Language will be brought in to the following rows of the Invoice, as shown in rows 3 and 4 in the illustration below.

If you want to add an extra description, you can do so: there is room for up to 100 characters of text. If you need more space, you can continue on the following lines.

- In multi-user systems, you can prevent certain users from changing any Description in an Invoice using Access Groups, by denying them access to the 'Change Item Description on Invoice' Action. Separate similar Actions are available for Quotations, Orders and Deliveries.

- You will not be able to change any Description in an Invoice if you are using the Register Cash Sales in Fiscal Control Unit option in the Account Usage S/L setting.

- Unit Price

- The Unit Price according to the Customer's Price List will be brought in when you specify the Item Number. If the Customer does not have a Price List, or the Item is not on the Price List in question, the Base Price from the Item record will be brought in instead. If there is a Price List applying to an Invoice, it will be shown on the 'Price List' card.

- The maximum number of decimal places that you can use in a Unit Price is three. If you need more decimal places, use the Unit Price in combination with the Price Factor on flip D.

- This figure will include VAT (and Extra Tax) if the Price List is one that is Inclusive of VAT or if you have specified on the 'VAT / Tax' card of the Account Usage S/L setting that Base Prices include VAT (or VAT and Extra Tax).

- If the Invoice has a Currency and Exchange Rate, the figure shown will be in the Currency concerned (i.e. having undergone currency conversion).

- Please refer to the Controlling Prices in Invoices page for details about how you can control access to this field and otherwise control pricing in Invoices.

- You will not be able to change any Unit Price in an Invoice if you are using the Register Cash Sales in Fiscal Control Unit option in the Account Usage S/L setting.

- %

- If you are offering the Customer a discount on the Item, enter the discount percentage in this field.

- A discount percentage will be brought in to this field automatically if you are usingDiscount Matrices and if there is a Discount Matrix that includes the Item applying to the Invoice. Discount Matrices allow you to offer quantity discounts based on the value, quantity, weight or volume of each Item sold, so the discount percentage will be recalculated whenever you change the Quantity. If there is a Discount Matrix applying to this Invoice, it will be shown on the 'Price List' card.

- If the Discount Matrix is one that calculates quantity discounts based on Item Group quantities rather than Item quantities, the calculated discount may become incorrect if you specify another Item belonging to the same Item Group in a later row in the Invoice. To cater for this, be sure to select 'Recalculate Discount' from the Operations menu when the Invoice is complete. This will recalculate the discount percentage for each Item in the Invoice.

- Please refer here for more details about Discount Matrices.

- The Discount Calculation options in the Round Off setting in the System module allow you to determine whether the discount should be applied to the Unit Price before it has been multiplied by the Quantity, or to the Sum. In certain circumstances (where there is a very small Unit Price and a large Quantity), this choice can cause the calculated discount to vary due to rounding. Please refer here for details and an example.

- The percentage entered here can act as a discount, margin factor or markup. This is controlled using the Discount Options setting in the System module.

- Please refer to the Controlling Prices in Invoices page for details about how you can control access to this field and otherwise control pricing in Invoices.

- In the Nominal Ledger Transaction created from an Invoice, the discounted price of an Item will usually be credited to the Sales Account. If you would like the full sales price of the Item to be credited to the Sales Account and the value of the discount to be debited to a separate Account, select the Post Discount option in the Account Usage S/L setting and specify that separate Account in the Invoice Discount field in the same setting. You can also specify separate Discount Accounts in each Item Group. For Invoices created from Hotel Reservations, select the Post Discount option in the Hotel Settings setting in the Hotel module.

- Sum

- The total for the row: Quantity multiplied by Unit Price less Discount. Changing this figure will cause the Discount Percentage to be recalculated. This figure will include VAT (and TAX) if the Price List specified is one that is Inclusive of VAT or if you have specified on the 'VAT / Tax' card of the Account Usage S/L setting that Base Prices include VAT (or VAT and TAX).

- This figure will be rounded up or down according to the Row Sum rounding rules set for the Currency/Payment Term combination in the Currency Round Off setting in the System module. If that setting does not contain an entry for that combination, the Row Sum rounding rules in the Round Off setting also in the System module will be applied.

- Please refer to the Controlling Prices in Invoices page for details about how you can control access to this field and otherwise control pricing in Invoices.

- If you are using the Disallow Negative Row Sums on Sales option in the Account Usage S/L setting in the Sales Ledger, you will not be able to mark an Order as OK and save it if the Sum in any row is negative.

Flip B- A/C

- Paste Special

Account register, Nominal Ledger/System module

- The Sales Account specified here will be credited with the Sum in the Nominal Ledger Transaction generated from the Invoice. Sales Accounts are used to record the levels of sales of different types of Items in the Nominal Ledger.

- The default Sales Account in each row will be chosen as follows:

- In the special case of an Invoice created from a Service Order, the Sales Account will be the Service Invoiceable Sales A/C specified in the Item record or in the Item Group to which it belongs (if you are not using the Use Item Groups for Cost Accounts option in the Cost Accounting setting in the Stock module), or from the Item Group or Item (if you are using that option). If there is no Service Invoiceable Sales A/C, then Sales Accounts in Invoices created from Service Orders will be chosen as described below but omitting points 2 and 6.

- If you are using the Use always option in the Payment Term Sales A/C setting, the Sales Account will be taken from the Payment Term.

- If the Customer has a Price List and there is a record in the Price register for the Item/Price List/Customer combination or in the Quantity Dependent Prices setting for the Item/Price List combination (depending on the Type of the Price List), the Sales Account will be taken from that Price or Quantity Dependent Price record.

- If you have specified a Sales Account for the Location in the Location Accounts setting in the Stock module, that Sales Account will be used. The Location is the one specified in the field to the right or, if blank, on the 'Del. Terms' card.

- The Sales Account will be taken from the Item record.

- If you are using the Use if no Account on Item option in the Payment Term Sales A/C setting, the Sales Account will be taken from the Payment Term.

- The Sales Account will be taken from the Item Group to which the Item belongs.

- The Sales Account on the 'Sales' card of the Account Usage S/L setting will be used.

In the cases of points 3, 4, 6 and 7, the choice of Sales Account will depend on the VAT Zone of the Customer (specified on the 'Company' card of the Contact record for the Customer).

- You can change this default in a particular Invoice row if necessary.

- If the Payment Term in the Invoice is of the "Credit Note" type and if you are using the Use Credit Sales Accounts option on the 'Debtors' card of the Account Usage S/L setting, a credit Sales Account will be used in place of the standard one. This will taken from the 'Credit A/C' card of the appropriate Item Group record or from the 'Credit' card of the Account Usage S/L setting.

- Accrual

- Paste Special

N/L Accruals setting, Nominal Ledger

- Default taken from Sales Account

- Please refer to the Accruals page for details of this field and an illustrated example.

- Location

- Paste Special

Locations setting, Stock module

- You can enter a separate stock Location for each row of the Invoice. Please refer to the section describing the Location field on the 'Del Terms' card for full details.

- If you have specified a Location in this field, the figures in the 'Item Status' window will refer to this Location. If this field is empty, those figures will refer to the Location specified on the 'Del. Terms' card. If you have not specified a Location here or on the 'Del. Terms' card, the figures will refer to all Locations. This will be the case even if you have specified a Main Location in the Stock Settings setting.

- If you have specified a Default Return Location in the Local Machine setting in the User Settings module, that Location will be placed here automatically if you enter a negative Quantity. The Local Machine setting is specific to the client machine you are working on.

- Position

- Paste Special

Position register, Warehouse Management module

- You can only use this field if you are using the Warehouse Management module. If so and if the Demand Position option has been checked in the relevant Location, you must specify the Position in the Location from which the Item will be taken.

- Objects

- Paste Special

Object register, Nominal Ledger/System module

- Default taken from Item or Item Group

- You can assign up to 20 Objects, separated by commas, to an Invoice row, to be transferred to the consequent Nominal Ledger Transaction. You might define separate Objects to represent different departments, cost centres or product types. This provides a flexible method of analysis that can be used in Nominal Ledger reports. Usually the Objects specified here will represent the Item.

- In the Nominal Ledger Transaction generated from the Invoice, any Objects specified here will be assigned to the credit posting to the Sales Account and, if the Invoice will update the stock valuation in the Nominal Ledger, to the cost of sales postings. This assignment will merge these Objects with those of the parent Invoice (shown on the 'Terms' card).

- V-Cd

- Paste Special

VAT Codes setting, Nominal Ledger

- The VAT Code entered here will determine the rate at which VAT will be charged on the Item and the Output VAT Account that will be credited with the VAT value.

- The default offered in each row will be chosen as follows:

- The VAT Code in the Delivery Address specified on the 'Del. Address' card of the Invoice will be used.

- The Sales VAT Code specified in the Contact record for the Customer will be used.

- The VAT Code will be taken from the appropriate row for the Item or Item Group in the Customer's Price List.

- It will be taken from the Item record.

- It will be taken from the Item Group to which the Item belongs.

- The VAT Code on the 'Sales' card of the Account Usage S/L setting will be used.

In the cases of points 4-6, the correct VAT Code for the Zone of the Customer will be used.

- You can change this default in a particular Invoice row if necessary. However, this won't be possible if you are using the VAT Code Control option on the 'VAT / Tax' card of the Account Usage S/L setting. This option will mean that the VAT Code specified here must be the same as the one specified for the Sales Account in the Account register. If the VAT Codes don't match, you will not be able to save the Invoice.

- Using the VAT Code Control option means that you will probably need to use different Sales Accounts for Customers in the Inside EU and Outside EU Zones. This is because you will probably need to use different (zero-rated) VAT Codes with these Customers, but you can only specify one VAT Code in an Account record. Therefore, you will need separate Sales Accounts for each Zone, containing appropriate VAT Codes.

- If the Payment Term (above) is of the "Credit Note" type and you are using the Use Credit Sales Accounts option on the 'Sales' card of the Account Usage S/L setting, a credit VAT Code will be used in place of the standard one. This will taken from the 'Credit A/C' card of the appropriate Item Group record or from the 'Credit' card of the Account Usage S/L setting.

- In the Nominal Ledger Transaction generated from the Invoice, this VAT Code will be assigned to the credit posting to the Sales Account. If you want it assigned to the credit posting to the Output VAT Account as well, use the Add VAT Code to VAT A/C rows option in the Transaction Settings setting in the Nominal Ledger.

- T-Cd

- Paste Special

Tax Templates setting, Nominal Ledger

- In some countries, Tax Templates are used instead of VAT Codes to determine the rate at which VAT or sales tax will be charged on the Item and the Output VAT Account that will be credited with the VAT or sales tax value. VAT Codes should be used where each sales and purchase transaction (e.g. each row in an Invoice) is taxed at a single rate, while Tax Templates should be used where different taxes and/or several tax rates are applied to one transaction (e.g. to one row).

- If you need to use Tax Templates, you should first choose the Use Tax Templates for Tax Calculation option in the Transaction Settings setting in the Nominal Ledger. This option will cause a Tax Template field ("T-Cd") to appear here instead of the VAT Code field ("V-Cd"). Having done so and having entered your Tax Templates in the Tax Templates setting also in the Nominal Ledger, you should specify the Tax Templates that are to be used in each Invoice row here.

- If you are not using the Combine Tax Templates from Items and Contacts option in the Transaction Settings setting, the default offered in each row will be chosen as follows:

- The Sales Tax Template specified in the Contact record for the Customer will be used.

- The Tax Template will be taken from the appropriate row for the Item or Item Group in the Customer's Price List.

- It will be taken from the Item record.

- It will be taken from the Item Group to which the Item belongs.

- The Tax Template on the 'Sales' card of the Account Usage S/L setting will be used.

In the cases of points 3-5, the appropriate Tax Template for the Zone of the Customer will be used.

- If you are using the Combine Tax Templates from Items and Contacts option, two or more Tax Templates separated by commas will be brought in to this field, chosen as follows:

- A Tax Template representing the Customer will be chosen as follows:

- The Sales Tax Template specified in the Contact record for the Customer will be used.

- The Tax Template will be taken from the Contact record for the Branch, and/or from the Delivery Address specified on the 'Del. Address' card of the Invoice.

- The Tax Template will be taken from the Account Usage S/L setting.

- A Tax Template representing the Item will be chosen as follows:

- The Tax Template will be taken from the appropriate row for the Item or Item Group in the Customer's Price List.

- It will be taken from the Item record.

- It will be taken from the Item Group to which the Item belongs.

- The Tax Template will be taken from the Account Usage S/L setting.

Flips C-G of the 'Items' card are described in Part 2 here, and the Footer is described here.

---

The Invoice register in Standard ERP:

Go back to:

|