Account Usage

This page describes specifying Accounts for gains and losses resulting from Currency conversion.

---

It will often be the case that an Exchange Rate will change in the time between the issuing of an Invoice and its payment. When the payment is registered in the Nominal Ledger, the gain or loss due to the change in Exchange Rate should be posted to a gain or loss Account. This posting will be made automatically. If necessary, you can use separate gain and loss Accounts, and you can use different gain and loss Accounts for Sales and Purchase Ledger transactions. Alternatively, if your requirement is for a simplified Accounts structure, you can use the same Account in each case.

Please refer here for more details about posting Exchange Rate gains and losses from sales transactions (i.e. from Receipts) and here for details about posting Exchange Rate gains and losses from purchase transactions (i.e. from Payments).

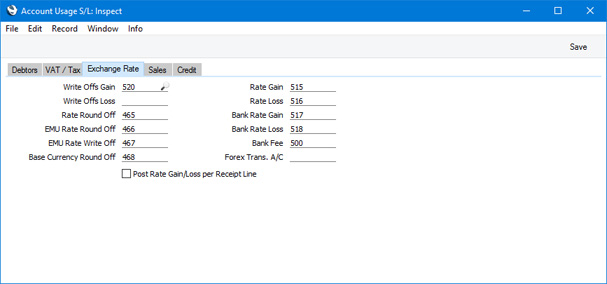

To specify the Account that is to be used in each circumstance, use the 'Exchange Rate' and 'Rate' cards of the Account Usage S/L and P/L settings in the Sales and Purchase Ledgers respectively. This is the 'Exchange Rate' card in the Account Usage S/L setting:

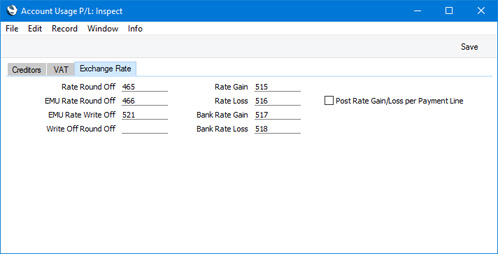

This is the 'Rate' card in the Account Usage P/L setting:

The Accounts in these settings that are relevant to Currency users are now described. Except where stated, you can specify separate Accounts for use in a particular circumstance depending on whether the originating transaction comes from the Sales or the Purchase Ledger.

- Rate Gain, Rate Loss

- The Rate Gain and Rate Loss Accounts will be used when you issue or receive an Invoice in Currency and the Exchange Rate changes before it is paid. In this situation, the amount paid will be the same as the outstanding amount when both figures are expressed in the Invoice Currency but not when they are converted to your home Currency. The difference between the amount paid and the outstanding amount in your home Currency will be posted from the Receipt or Payment to one of these Accounts, depending on whether a gain or loss is involved.

- Bank Rate Gain, Bank Rate Loss

- The Bank Rate and Bank Loss Accounts will be used when the amount paid or received at the bank against an Invoice is not the same as the outstanding amount, because the exchange rate levied by the bank is different to the rate offered to the Payment or Receipt. This situation will occur you change the Bank Amount in a Payment or Receipt). The difference between the amount paid and the outstanding amount when both are expressed in your home Currency will be posted from the Receipt or Payment to one of these Accounts, depending on whether a gain or loss is involved.

- Post Rate Gain/Loss per Receipt Line, Post Rate Gain/Loss per Payment Line

- When you enter a Receipt or Payment in which more than one row will post an exchange rate difference, the resulting Nominal Ledger Transaction will usually contain a single posting to the relevant Account (i.e. to the Rate Gain or Loss Accounts and/or the Bank Rate Gain or Loss Accounts described immediately above). Use these options if you would like such Transactions to contain separate exchange rate difference postings for each Receipt or Payment row. The Description in each posting will include the Invoice Number or Purchase Invoice Number.

- Base Currency Round Off

- Under the Dual-Base system, all Nominal Ledger Transactions should be expressible, and should balance, in both Base Currencies.

When a Nominal Ledger Transaction is created automatically (from a Sub System record such as an Invoice), it may not initially balance in Base Currency 2. If so, an additional row will be added to the Transaction posting a balancing amount in Base Currency 2 to the Base Currency Round Off Account specified here. This balancing row will not post an amount in Base Currency 1.

- You can only specify a Base Currency Round Off Account in the Account Usage S/L setting. This Account will be used for all Transactions.

- Write Offs Gain, Write Offs Loss, Write Off Round Off, Rate Round Off, EMU Rate Round Off, EMU Rate Write Off

- These Accounts will be used in the situation where an Invoice is to be treated as fully paid if the amount received is slightly different to that outstanding, providing that difference is within an allowable margin. The difference will be posted to one of these Accounts on the following basis:

- Write Offs Gain and Write Offs Loss (Sales Ledger), Write Off Round Off (Purchase Ledger)

- if the Received or Sent Currency is the same as the Invoice Currency, and it is not a member of the EMU;

- Rate Round Off

- if the Received or Sent Currency is different to the Invoice Currency, and the Received or Sent Currency is not a member of the EMU;

- EMU Rate Round Off

- if the Received or Sent Currency is different to the Invoice Currency, and the Received or Sent Currency is a member of the EMU;

- EMU Rate Write Off

- if the Received or Sent Currency is the same as the Invoice Currency, and it is a member of the EMU.

- Please refer to the pages describing the 'EMU' and 'Round Off' cards in the Currency window for more details about this feature, including specifying the allowable margin for each Currency.

- If the difference between the amount received or sent and the outstanding amount is caused by a change in Exchange Rate, it will not be posted to one of these Accounts, but to the Rate Gain or Loss Account (described above).

- The Write Offs Accounts in the Account Usage S/L setting will also be used for bad debts that you write off using the 'Add Write-off' function in a Receipt and by the 'Write off Invoices' Maintenance function. The 'Add Write-off' function is on the Row menu if you are using Windows or Mac OS X, and on the Tools menu if you are using iOS or Android. You only need specify a Write Offs Loss Account or a Write Offs Gain Account: amounts written off by these functions will be debited from whichever one you specify. If you specify both, they will be debited from the Write Offs Loss Account.

If you are unsure, consult with your auditor/accounting adviser or HansaWorld representative for advice concerning correct Account usage.

! | Check that the Accounts that you use also exist in the Chart of Accounts. |

|

---

Go back to: