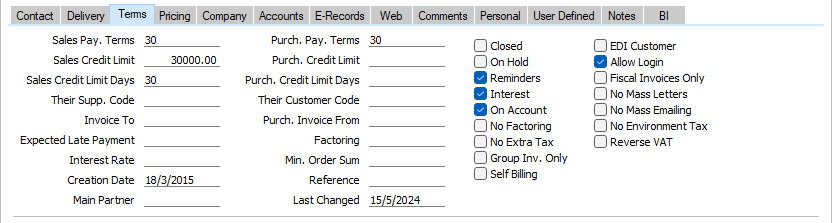

Entering a Contact - Terms Card - Check Boxes

This page describes the check boxes on the 'Terms' card of the Contact record. Please follow the links below for descriptions of the other cards:

---

- Closed

- Tick this box if a Contact is no longer to be used (if a Contact is a Customer or Supplier, you will not be able to delete the record altogether if they have at least one Sales Order or Sales or Purchase Invoice). Closed Contacts will appear in the 'Contacts: Browse' window but not in the Contacts 'Paste Special' list. You will not be able to enter Sales Orders or Sales or Purchase Invoices for closed Customers or Suppliers. You can re-open a closed Contact at any time.

- If a Closed Contact is a Contact Person working for a Customer or Supplier company, they will still appear in the list of people working for that company at the bottom of the 'Contact' card, but a red line will be drawn through their name and details. They will not appear in the 'Paste Special' list of Contact Persons when you open it from the Primary Contact and Attention fields in various registers.

- You can mark several Customers or Suppliers as Closed at once using the 'Close Contacts' Maintenance function in the CRM module.

- EGO Customer

- The EGO Customer check box will only be visible in Denmark (i.e. when the VAT Law in the Company Info setting is "Danish"). This check box is designed for use in Denmark, where Invoices issued to some Customers are not printed out but are sent electronically to a third party such as the Post Office for processing. If a Contact is such a Customer, tick this box. Please refer to your local HansaWorld representative for full details.

- On Hold

- If a Contact is a Customer that you have put on hold, tick this box. You can raise Sales Invoices for Customers that are on hold, but you will not be able to mark them as OK (i.e. you won't be able to commit them to the Sales and Nominal Ledgers). You will be able to enter Orders for such Customers, but you won't be able to create Deliveries (ship any goods to them).

- Some Maintenance functions (e.g. 'Create Contract Invoices' in the Contracts module and 'Create Deliveries from Orders') will not create new records for Customers that are on hold.

- EDI Customer

- The EDI (Electronic Data Interchange) module allows you to receive Sales Orders and issue Invoices electronically in particular formats. If you are using this module and a Contact is a Customer that uses this system, tick this box. You can only raise EDI Invoices for Customers for whom this box has been ticked. Please refer to your local HansaWorld representative for full details.

- Reminders

- Tick this box if a Contact is a Customer to whom you will need to send Reminders for late payment when appropriate.

- If you have ticked this box in the Contact record for a particular Customer, you can ensure that reminders will not be sent for individual Invoices by ticking the No Reminder box on the 'Delivery' card of the Invoice window.

- If you have not ticked this box in the Contact record for a Customer, Reminders will never be printed for that Customer. You can also specify that Open Invoice Customer Statements will not be printed for that Customer, by selecting the Customers with Reminders Only or Skip No Reminders options. The Skip No Reminders option will also exclude Invoices in which you have ticked the No Reminder box from the statements. When sending Open Invoice Customer Statements by email using the 'Create Open Invoice Customer Statement Email' Maintenance function, statements will never be sent to the Customer.

- Allow Login

- If you are using the Standard ERP Web Shop facility and wish to allow the Contact to be able to log in to your website, tick this box. They can use their Customer Number or email address as Login IDs, and you can allocate them a password using the 'Change Password' function on the Operations menu of the 'Contacts: Browse' window.

- Examples of when a Contact will need to be able to log in to your website include the following:

- The Contact is a Customer who will log in to place and pay for Orders in your webshop.

- The Contact is a Customer who will log in to place Reservations for hotel rooms.

- The Contact is a Teacher or Student who will log in to view or manage training courses.

- If you would like this check box to be ticked by default in new Contact records that you enter, select the Allow Login option in the Contact Settings setting.If you would like this check box to be ticked by default in new Contact records that are created online (i.e. by the Customers themselves), select the Allow Login option in the My Account Settings setting in the Webshop and CMS module.

- Interest

- Tick this box if a Contact is a Customer that is to be sent interest Invoices for late payments. Please refer here for full details about this feature.

- If you have ticked this box in the Contact record for a particular Customer, you can ensure interest will not be charged for individual Invoices by ticking the No Interest box on the 'Delivery' card of the Invoice screen.

- Fiscal Invoices Only

- If a Contact is a Customer, tick this box if their Invoices are to be classified as Fiscal Invoices. Fiscal Invoices should be printed on fiscal printers in some countries. Please refer to your local HansaWorld representative for more details.

- On Account

- Tick this box if a Contact is Customer from whom you want to be able to receive Prepayments and On Account Receipts (i.e. you want to allow them to pay before you have invoiced them) and/or the Contact is a Supplier to whom you want to be able to issue Prepayments and On Account Payments (i.e. to be able to pay them before you receive Invoices). Full details about the sales side can be found here and about the purchase side here.

- On the sales side, before you can enter Prepayments and On Account Receipts, you must specify an On Account A/C on the 'Debtors' card of the Account Usage S/L setting. Additionally, you can specify such an Account in the Debtors On Account A/C field in the Customer Category. This Account will be credited with the value of these Receipts.

- On the purchase side, before you can enter Prepayments and On Account Payments, you must specify an On Account A/C on the 'Creditors' card of the Account Usage P/L setting. Additionally, you can specify such an Account in the Supplier Category or in the individual Contact record (on the 'Accounts' card). This Account will be debited with the value of these Payments.

- If you would like this check box to be ticked by default in new Contact records, select the On Account option in the Contact Settings setting.

- No Mass Letters

- Tick this box if you do not want printed letters to be sent to the Contact from the Customer Letter register.

- Note that if you have included a Contact in a Mailing List that you have used in a Customer Letter, printed letters will be sent to the Contact from that Customer Letter even if this box is ticked.

- You can switch this option on or off for several Contacts at once using the 'Mass Emailing' Maintenance function in the CRM module. You can also switch this option on for every Contact belonging to a particular Customer Category using the 'Exclude customer category from mass mailing' Maintenance function in the same module. If you would like this check box to be ticked by default in new Contact records, select the No Mass Letters option in the Contact Settings setting.

- No Factoring

- If you use a factoring company to pay your Sales Invoices, you will regularly use the 'Invoices for Factoring' Export function in the Sales Ledger to send your Invoices to the factoring company. If you want to receive payment from a particular Customer yourself and do not want that Customer's Invoices to be sent to the factoring company, tick this box.

- The 'Invoices for Factoring' Export function is capable of creating files in many different formats suitable for sending to many different banks. You should specify the format that you wish to use by choosing a Factoring Bank in the Factoring Export setting in the Sales Ledger. The 'Invoices for Factoring' function will not export Invoices issued to Customers in which the No Factoring box has been ticked if you are using one of the following Factoring Banks :

If you are using a Factoring Bank that is not listed above, the No Factoring check box will be ignored (i.e. a Customer's Invoices will be exported by the 'Invoices for Factoring' Export function even if you have ticked the No Factoring box for that Customer).

- If you are using the 'Finvoice' Export function in the Sales Ledger, you can again use the No Factoring box to prevent that function from exporting Invoices issued to a particular Customer. The 'Finvoice' Export function is only available in Finland (i.e. when the VAT Law in the Company Info setting is "Finnish").

- No Mass Emailing

- Tick this box if you want do not emails to be sent to the Contact from the Customer Letter register.

- Note that if you have included a Contact in a Mailing List that you have used in a Customer Letter, letters will be emailed to the Contact from that Customer Letter even if this box is ticked.

- You can switch this option on or off for several Contacts at once using the 'Mass Emailing' Maintenance function in the CRM module. You can also switch this option on for every Contact belonging to a particular Customer Category using the 'Exclude customer category from mass mailing' Maintenance function in the same module. If you would like this check box to be ticked by default in new Contact records, select the No Mass Emailing option in the Contact Settings setting.

- No Extra Tax

- If a Contact is a Customer, tick this box if you do not want Extra Tax to be charged on their Invoices. Please refer to the description of flip B of the VAT Codes setting here for full details about this feature. If you want to charge Extra Tax to a Customer but at a discounted rate, use the Extra Tax Customer Discounts setting in the Sales Ledger.

- If a Contact is a Supplier, this check box will not apply. Extra Tax will always be calculated in Purchase Invoices at the full rate if the VAT Code has a Tax %.

- No Environment Tax

- If the Contact is a Customer, tick this box if you do not want environment tax to be charged on their Invoices. Please refer to the description of the Environment Tax setting here for full details about this feature.

- No Region Perceptions

- This option is only used in Argentina and will not be visible in many countries.

- If a Contact is a Customer, tick this box if you do not want Regional Perception Tax to be charged on their Invoices. If you want to charge Regional Perception Tax to a Customer but at a discounted rate, use the Regional Perception Customer Discounts setting in the Sales Ledger.

- Group Inv. Only

- Tick this box if a Contact is a Customer to whom Invoices can only be issued from Sales Orders using the 'Group Invoicing' Maintenance function in the Sales Orders module. Selecting this option will mean that you will not be able to create Invoices directly from Orders or Deliveries using the 'Invoice' function on the Create menu, and the 'Invoice Delivered Orders' Maintenance function will not create Invoices for the Customer. You will still be able to enter Invoices directly to the Invoice register.

- The 'Group Invoicing' Maintenance function includes an Only Group Invoice Customers option that you can use if you only want to issue Invoices to Customers for whom the Group Inv. Only box has been ticked.

- Reverse VAT

- This option will only be visible in Latvia, Lithuania, Poland and the UK (i.e. when the VAT Law in the Company Info setting is "Latvian", "Lithuanian", "Polish" or "Default").

- Tick this box if a Contact is a Customer in the Domestic VAT Zone to whom you will sell Items of any value on a reverse charge VAT basis. If you do not tick this box, you will still be able to sell Items on a reverse charge VAT basis, but only if the value of the sale falls between specified minimum and maximum figures. Please refer to the 'Reverse Charge VAT in Sales Invoices' page for more details about selling Items on a reverse charge VAT basis to a Customer in the Domestic VAT Zone.

- Self Billing

- Used as default in Invoices and Purchase Invoices

- A self-billing Invoice is an Invoice that a company issues to itself. For example, a company may have received goods from a Supplier on the agreement that invoicing will occur as it sells or consumes them. That company will create self-billing Purchase Invoices when necessary, notifying the Supplier as it does so. That Supplier should then create corresponding Sales Invoices. If you are the Supplier in a self-billing agreement, you can mark the Contact record for your Customer as self-billing using this check box. Similarly, if you are the Customer in a self-billing agreement, you can mark your Supplier as self-billing. When you create Sales or Purchase Invoices for the Customer or Supplier respectively, they will be marked as self-billing. Self-billing Invoices and Purchase Invoices are separately flagged when included in SAF-T exports in Portugal.

---

The Contact register in Standard ERP:

Go back to:

|