Credit Limit

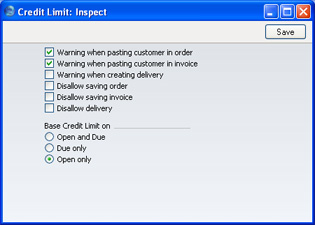

This setting allows you to control the actions when the Credit Limit of a Customer has been (or is about to be) exceeded.

The warnings (first three options) will appear when you enter a Customer that has already exceeded their Credit Limit (set using the Sales Credit Limit field on the 'Terms' card of the Customer record) in a transaction. Saving (next three options) will not be allowed if the transaction will take the Customer over their Credit Limit.

You can use one of three methods to calculate a Customer's credit status:

- Open and Due

- The outstanding total from all unpaid Invoices will be compared with the Customer's Credit Limit.

- Due only

- The outstanding total from unpaid Invoices that have exceeded their Payment Terms only ('Due' Invoices) will be compared with the Customer's Credit Limit. For example, if a Customer has Payment Terms of 30 days, Due Invoices are those that have been outstanding for more than 30 days.

- Open only

- If there are any Due Invoices, the Customer will immediately be said to have exceeded their Credit Limit, irrespective of the value of those Invoices. If there are no Due Invoices, the outstanding total from unpaid Invoices that have not exceeded their Payment Terms only ('Open' Invoices) will be compared with the Customer's Credit Limit.

Credit limit checking will not take place if the Customer has not been given a Credit Limit. If you want to allow a Customer no credit at all, set their Credit Limit to 0.01.