Liquidity Forecast

This report presents a forecast of all actual and future payments to and from the firm during a specified period. The forecast is based on the Due Dates of

Purchase and

Sales Invoices.

When printed to screen, this report has FirstOffice's Drill-down feature. Click on any Transaction Number in the report to open the Transaction. Invoices will be shown in the 'Invoice: Inspect' window, Purchase Invoices in the 'Purchase Invoice: Inspect' window.

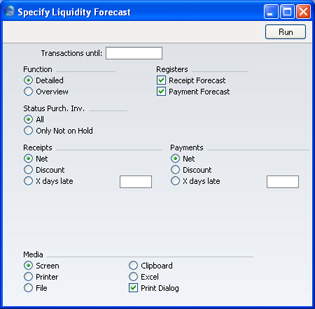

Double-clicking 'Liquidity Forecast' in the 'Reports' list opens the following window:

- Transactions Until

- Paste Special

Choose date

- A date entered here instructs FirstOffice to end the report at a particular date. The date can be any date, before or after the current date. The start date of the report will be taken from the first period in the Reporting Periods setting.

- Function

- Choose between the Detailed option, showing each Transaction, and the Overview, showing a single line summary for each day.

- Registers

- By default, the report contains Debtors' and Creditors' forecasts. You can exclude either of these sections from the report by clicking in these boxes.

- Status Purch. Inv.

- You can choose to exclude those Purchase Invoices for which payment has been prevented (those whose Hold check box has been switched on).

- Receipts, Payments

- Select an alternative for the payment pattern to be used in calculating the Receipt and Payment schedule.

- Net

- This option assumes that payment will be received or issued on the Due Date.

- Discount

- This option assumes that invoices with a cash discount term will be paid by the Discount Date in order to qualify for the cash discount.

- X days late

- This option allows you to assume that all Invoices will be paid on average a specified number of days late.

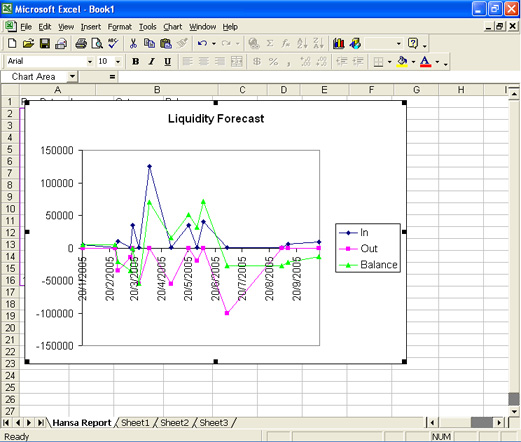

This report can be a very useful tool in your liquidity management. Like all FirstOffice's reports it can be exported as a text file. Import the data to an Excel model, and use Excel's excellent graphing capabilities to produce a graph of the money flowing through your business.