Inventarie kategorier

Each Asset must belong to an Asset Category, while each Asset Category in turn must belong to an Asset Class. Asset Classes control how depreciation is handled in the Nominal Ledger (i.e. the Accounts used), while the Asset Category has two roles:

- When entering new Assets that are similar, assigning them to the same Category will ensure they use the same Depreciation Models and Objects. Depreciation will therefore be calculated for these Assets using the same formula. You can override these defaults for an individual Asset if necessary.

- In Portugal, Asset Categories can also be used to control how groups of Assets are treated in reports.

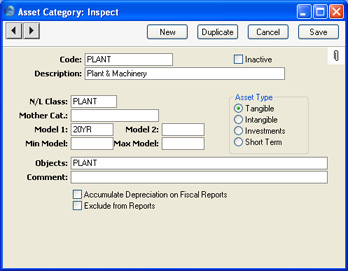

When you select the setting, the 'Asset Categories: Browse' window will be displayed, showing all Categories previously entered. Click [New] to enter a new record, and [Save] to save it.

- Code

- Specify a unique code, by which the Asset Category may be identified from the various registers and reports in the Assets module. You can enter a maximum of twenty characters.

- Inactive

- Check this box if the Asset Category is no longer to be used. Closed Categories will appear in the 'Asset Categories: Browse' window but not in the 'Paste Special' list. Assets belonging to the Category will still be included in reports unless they themselves have been marked as Inactive. A closed Category can be re-opened at any time.

- Description

- The comment that you enter here is shown in the 'Paste Special' list: it should therefore be descriptive enough to make the selection of the correct Asset Category easy for all users.

- N/L Class

- Paste Special

Asset N/L Classes setting, Assets module

- Each Asset Category must be assigned an Asset Class. This determines how the depreciation of Assets belonging to the Category will be handled in the Nominal Ledger (i.e. the Accounts used).

- Note that you cannot specify an Asset Class in an individual Asset record. Therefore, for depreciation to be calculated, each Asset must belong to an Asset Category, and each Category must belong to an Asset Class.

- Model 1, Model 2

- Paste Special

Depreciation Models setting, Assets module

- Used as default in Assets

- The Depreciation Model determines how the depreciation of an Asset will be calculated. Two Models can be specified for each Asset.

- If you specify a Depreciation Model in either or both of these fields, they will be copied automatically to the corresponding fields of an Asset as soon as you assign it to this Category.

- Objects

- Paste Special

Object register Nominal Ledger/System module

- Used as default in Assets

- If you specify an Object here, it will be copied automatically to an Asset as soon as you assign it to this Category. You can enter several Objects, separated by commas.

- Comment

- Record any further notes about the Asset Category here. These notes are not copied to the Comment field of any Assets that you assign to this Category.

- Exclude from Reports

- Check this box if you do not want Assets belonging to the Category to appear in reports such as the Depreciations Report and the Simulation Preview - Depreciations.

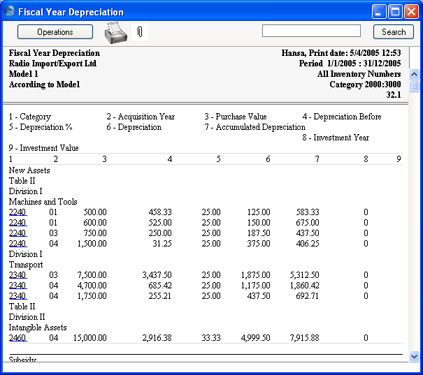

Use the remaining fields and options on this screen to control how Assets belonging to each Category are shown in the Fiscal Year Depreciation, Fiscal Year Revaluations and Fiscal Year Write-offs reports. These reports are designed to satisfy official reporting requirements in Portugal.

- Mother Cat.

- Paste Special

Asset Categories setting, Assets module

- Use this field to define hierarchical report headings in the Fiscal Year Depreciation and Fiscal Year Revaluations reports.

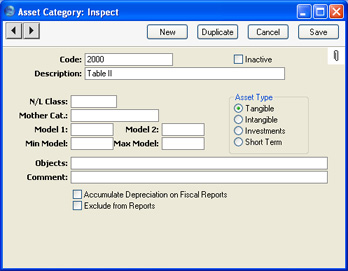

- The Asset Categories in an example section of these reports might be defined as follows:

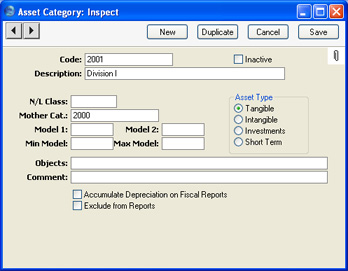

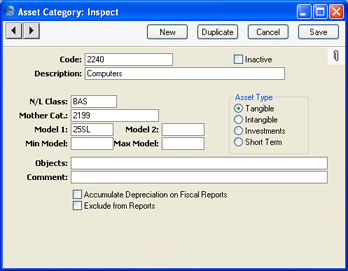

| Asset Cat. | Mother Cat. | Name | Comment | | 2000 | - | Table II | Main heading | | 2001 | 2000 | Division I | 1st level subheading | | 2199 | 2001 | Machines and Tools | 2nd level subheading | | 2240 | 2199 | Computers | Assets are assigned to this Category | | 2319 | 2001 | Transport | 2nd level subheading | | 2340 | 2319 | Motorcycles | Assets are assigned to this Category | | 2458 | 2000 | Division II | 1st level subheading | | 2459 | 2458 | Intangible Assets | 2nd level subheading | | 2460 | 2459 | Installation Expenses | Assets are assigned to this Category |

- Enter the report headings and subheadings to the Asset Categories setting in the form of separate records. Leave all fields except the Code, Description and, in the case of subheadings, the Mother Category, blank in these records (Categories 2000, 2001, 2199, 2319 and 2458 in the example).

- Build up the report heading hierarchy using the Mother Category field. In each Category representing a subheading, the Mother Category is the Code of the immediately superior heading. So, in the example, one main heading, "Table II", will appear in the Fiscal Year reports. This is represented by Category 2000. Since this is a top-level heading, the Mother Category field in this Category is blank:

- This main heading has two subheadings, "Division I" and "Division II", represented by Categories 2001 and 2458 respectively. In these Categories, 2000, the main heading, has been entered as the Mother Category:

- Within Category 2001 ("Division I"), there are two further subheadings, "Machines and Tools" and "Transport". These are represented by Categories 2199 and 2319 respectively. In these Categories, 2001, the immediately superior subheading, has been entered as the Mother Category.

- This structure is continued down through the hierarchy. In this example, there are three levels of headings and subheadings. Below these, on the fourth level of the hierarchy, are the Categories to which Assets will be allocated. These are the only Categories with N/L Classes and Models, and their Mother Category contains a reference to a Category on the level above:

- The result of this hierarchical structure is shown below:

- Note that the Codes of the Categories in the example are in numerical order. It is not necessary to adhere strictly to this system, but it is recommended at least that headings have lower number Codes than their subheadings, that first level subheadings have lower number Codes than their second level subheadings, and so on. This will result in the Fiscal Year reports being neater in appearance.

- The Fiscal Year reports will be empty if no Category has been assigned a Mother Category.

- Min Model, Max Model

- Paste Special

Depreciation Models setting, Assets module

- In Portugal, there are statutory minimum and maximum rates by which an Asset can be depreciated. Usually the minimum rate is half the maximum. You should specify the Depreciation Models with the minimum and maximum rates here. If you specify a Depreciation Model in either or both of these fields, they will be copied automatically to the corresponding fields of an Asset ('Models' card) as soon as you assign it to this Category.

- If you decide to depreciate an Asset using a greater rate than the maximum or a lower rate than the minimum, it will be necessary to inform the fiscal authorities. In the case of a rate greater than the maximum, the increase in depreciation is shown in the Fiscal Year Depreciation report as a non-fiscal cost (column 15).

- Asset Type

- Specify the type of Asset that will belong to this Category. This is for information only: it has no effect on how depreciation will be calculated. You can produce Fiscal Year Depreciation reports for Assets belonging to one or more of these types.

- Accumulate Depreciation on Fiscal Reports

- By default, Assets are listed individually on separate rows in the Fiscal Year reports. Use this option if you would like the Assets belonging to this Category to be grouped together on a single row in the reports.

|