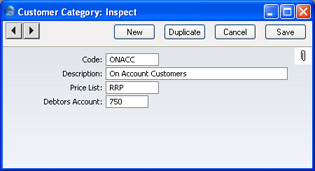

Customer Categories

Customer Categories are defined using the setting in the Sales Ledger. Use the [Select Module] button in the Master Control panel to enter the Sales Ledger and then select 'Settings' from the File menu or click the [Settings] button, also in the Master Control panel. Double-click 'Customer Categories' in the resulting list. Then click [New] to open a new record, or double-click an existing record to modify it.

- Code

- Specify a unique code, by which the Customer Category may be identified from the Customer screen and elsewhere in FirstOffice.

- Description

- Enter text describing the Customer Category here.

- Price List

- Paste Special

Price Lists setting, Sales Ledger

- Used as default in Customers, Sales Orders, Sales Invoices

- The Price List entered here determines the prices used in Sales Orders and Sales Invoices for all Customers belonging to this Category.

- Debtors Account

- Paste Special

Account register, Nominal Ledger/System module

- Specify here the Debtor Account that you wish to be debited by the Nominal Ledger Transactions created when Sales Invoices are raised for Customers that belong to this Category. In the example shown in the illustration above, a Customer Category has been defined to post Invoices for all Customers with credit accounts to a special Nominal Account.

- Note that you can only specify a Debtor Account at the Customer Category level, not at the individual Customer level. If you do not specify a Debtor Account in a Category, the Debtor Account specified in the Account Usage S/L setting in the Sales Ledger will be used.

- If you have Sub-ledger Checking switched on, any Account entered here must first be defined as a Debtor Control Account. Sub-ledger Checking is switched on using the check box on the 'Debtors' card of the Account Usage S/L setting, and Control Accounts are defined using the Control Accounts setting in the Nominal Ledger.