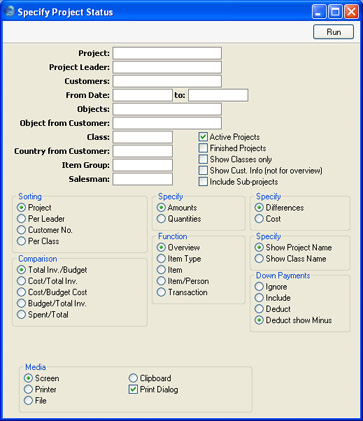

Project Status

This report lists Projects, showing for each the amounts invoiced and to be invoiced and, depending on the options selected, the cost of the Project or the amount budgeted. The Invoiced total shown in the report is calculated by adding together invoiced Project Transactions.

When printed to screen, this report has Hansa's Drill-down feature. Click on any Project Number or amount in the report to open the Project and on any Budget amount to open the Project Budget record.

- Project

- Paste Special

Project register, Job Costing module

- Range Reporting Alpha

- Enter a Project Number, or leave blank to select all Projects.

- Project Leader

- Paste Special

Person register, System module

- Enter a Person's initials to report on all Projects where that person is recorded as Project Leader.

- Customer

- Paste Special

Customers in Customer register

- Range Reporting Alpha

- Enter a Customer Number to restrict the report to Projects for that Customer.

- From Date, to

- Paste Special

Choose date

- The calculation of the amounts invoiced and to be invoiced can be taken from Invoices and Project Transactions of a certain period. These two fields are used to define this period: enter a start and/or end date as appropriate.

- Objects

- Paste Special

Object register, System module

- Specify an Object to list only those Projects that have at least one Project Transaction featuring that Object in the report. If you enter a number of Objects separated by commas, only those Projects with Project Transactions featuring all the Objects listed will be shown.

- Object from Customer

- Paste Special

Object register, System module

- To restrict the report to Customers with a particular Object, enter the Object's Code here.

- Class

- Paste Special

Project Classes setting, Job Costing module

- Enter a Project Class to restrict the report to Projects of that Class.

- Country from Customer

- Paste Special

Countries setting, System module

- To restrict the report to Customers in a particular Country, enter the Country Code here.

- Active Projects

- Use this option to include in the report only those Projects that have been marked as Active or No More Transactions (using the options on the 'Terms' card of the Project screen).

- Finished Projects

- Use this option to include in the report only those Projects that have been marked as Finished.

- Show Classes Only

- You can only use this option if you have also chosen to sort the report by Class. Instead of listing Projects individually, it gives figures for each Project Class.

- Show Cust. Info (not for overview)

- Choose this option if you would like the Customer Number and Name to be shown for each Project. This option is not used with the Overview.

- Include Sub-projects

- Mother Projects and sub-projects can be used when there is an overall plan or scheme that consists of several smaller jobs. For example, if the overall plan (the Mother Project) is to move office, various sub-projects might be installing the network cabling, installing a telephone system and moving the stock to the new warehouse or stock room.

- Check this box if you would like the figures for a Mother Project to be calculated from Project Transactions registered both for itself and for all its sub-projects. If you do not check this box, the figures for the Mother will be calculated from Project Transactions registered for itself only. The sub-projects will be listed separately in the report, assuming they meet the other reporting criteria.

- Sorting

- These options are used to determine the order in which the Projects will be listed in the report.

- Specify Amounts, Quantities

- Use these options to determine whether amounts or quantities are to be shown in the report. If the Quantities option is selected, in the Overview (described below), quantities for time spent (i.e. hours) are added to quantities for purchases, materials and Sales Orders (i.e. number supplied) to produce a single figure.

- Comparison

- The report can compare the following figures:

- Budget

- The total sales value is calculated from invoiced and invoiceable Project Transactions and compared with the Project Budget. The Difference total shows Budget-Invoiced-Invoiceable.

- Cost

- The total sales value is calculated from invoiced and invoiceable Project Transactions and compared with the total cost, also calculated from Project Transactions. The Difference total shows Invoiced+Invoiceable-Cost.

- Cost/Budget Cost

- This option compares the total cost, calculated from Project Transactions, with the costs entered in the Project Budget. The Difference total shows Project Budget Cost-Project Transaction Cost.

- Budget/Total Inv.

- This is similar to the Budget option above, except that the comparison is reversed. So, the Difference total shows Invoiced+Invoiceable-Budget.

- Spent/Total

- This option can be used when there is a Project Budget, one or more of whose invoicing options has been set to As Budgeted. In this case, the Customer will be invoiced the As Budgeted figure. The report compares the As Budgeted figure with the value of the work actually carried out (represented by the Project Transactions). The Difference total shows Invoiced+Invoiceable-As Budgeted.

Down Payments can be included in the invoiced and invoiceable figures in various ways: see the description of the Down Payments options below for details.

- Function

These options control the level of detail to be included in the report.

- Overview

- This option displays a single line per Project including amounts to be invoiced and invoiced to date. These are compared with budgeted amounts or costs incurred.

- Item Type

- This option displays four lines per Project: one each for time, purchases, materials and Sales Orders.

- Item

- This option shows a total for each Item used for each Project.

- Item/Person

- For each Item used, this option provides a person-by-person analysis, thus showing the contribution each member of staff has made to each Project.

- Transaction

- This option lists all Project Transactions for each Project individually.

- Specify Show Project Name, Show Class Name

- Use these options to specify whether the Project Name or the Project Class Name is to be shown next to each Project Number. These options apply to the Overview only: the Project Name is always used in the other versions of the report.

- Down Payments

- In calculating the total sales value of a Project from invoiced and invoiceable Project Transactions, Down Payments can be handled in various ways.

- Irrespective of the option chosen here, Down Payments will not be included in the report if you have chosen to show Quantities in the report (using the Specify option above).

- Ignore

- Down Payments are not shown in the report. The total sales value of the Project is calculated from invoiced and invoiceable Project Transactions only.

- This option can be used for Projects where Down Payments are not being used.

- Include

- Down Payments are included in the report. The total sales value for the Project is calculated as follows. First, an invoiceable total is calculated from uninvoiced Project Transactions and uninvoiced Down Payments. The calculation assumes the Down Payments will be invoiced first.

- For example, let us say there is an uninvoiced Down Payment for 10.00 and an uninvoiced Project Transaction for 18.48. The Down Payment will be invoiced first, so the invoiceable total will be:

| | 10.00 | Down Payment amount(1st Invoice) | | + | 18.48 | Project Transaction(2nd Invoice) | | - | 10.00 | Down Payment amount | | = | 18.48 | Total |

- In other words, the invoiceable total will be the Project Transaction total or the Down Payment total, whichever is the greater.

- Second, an invoiced total is calculated from invoiced Project Transactions and invoiced Down Payments, using the same method. If you have entered dates in the From and To fields above, Down Payments will only be included if their Transaction Dates fall within this period.

- The uninvoiced and invoiced totals are then added together to produce a total sales value for the Project.

- This option can be used for Projects where Project Transactions are not being used (i.e. where invoicing is determined by Down Payments only).

- Deduct

- This option is similar to the Include option described above: the invoiced total is calculated in the same way. However, in calculating the invoiceable total, invoiced Down Payments are deducted from uninvoiced Project Transactions.

- For example, let us say there is an uninvoiced Down Payment for 10.00, an invoiced Down Payment for 5.00 and an uninvoiced Project Transaction for 18.48. The value of the Project Transaction is first reduced to 13.48 by subtracting the invoiced Down Payment (18.48 - 5.00). The remainder of the calculation is the same as for the Include option above:

| 10.00 | Down Payment amount(1st Invoice) | | + | 13.48 | Project Transaction(2nd Invoice) | | - | 10.00 | Down Payment amount | | = | 13.48 | Total |

- Again, the invoiceable total will be the invoiceable Project Transaction total (less invoiced Down Payments) or the invoiceable Down Payment total, whichever is the greater.

- The invoiceable Project Transaction total (less invoiced Down Payments) will be set to zero if the value of invoiced Down Payments is greater than the value of uninvoiced Project Transactions. To illustrate this, let us repeat the example above, with the exception that the invoiced Down Payment is valued at 20.00. The value of the Project Transaction is first reduced to -1.52 by subtracting the invoiced Down Payment (18.48 - 20.00) and is therefore set to zero. The remainder of the calculation is as follows:

| 10.00 | Down Payment amount(1st Invoice) | | + | 0.00 | Project Transaction(2nd Invoice) | | - | 10.00 | Down Payment amount | | = | 10.00 | Total |

- The uninvoiced and invoiced totals are then added together to produce a total sales value for the Project.

- This option can be used for Projects where Project Transactions and Down Payments are both used, especially when Down Payment Invoices have already been raised and Project Transactions have not yet been invoiced.

- Deduct show Minus

- This option is similar to the Deduct option described above: the invoiced total is calculated in the same way. As with the Deduct option, in calculating the invoiceable total, invoiced Down Payments are deducted from uninvoiced Project Transactions, but this time, if a negative figure is the result, it will not be set to zero. Also, invoiceable Down Payments are ignored.

- For example, let us say there is an uninvoiced Down Payment for 10.00, an invoiced Down Payment for 5.00 and an uninvoiced Project Transaction for 18.48. The uninvoiced total is simply calculated to be 13.48 by subtracting the invoiced Down Payment (18.48 - 5.00). The invoiceable Down Payment is ignored. If the invoiced Down Payment is valued at 20.00, the uninvoiced total will be -1.52 (18.48 - 20.00).

- The uninvoiced and invoiced totals are then added together to produce a total sales value for the Project.

- This option can be used for Projects where Project Transactions and Down Payments are both used, especially when Down Payment Invoices have already been raised and Project Transactions have not yet been invoiced. In this circumstance, if the invoiceable total for a Project is negative, it indicates that a Down Payment Invoice has been issued and that insufficient work (represented by invoiceable Project Transactions) has been carried out to cover the value of that Down Payment.

|