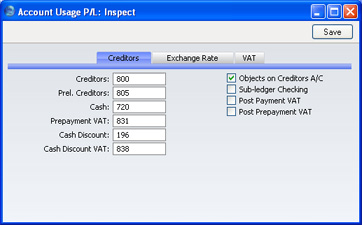

Account Usage P/L - Creditors Card

Account Fields

- Creditors

- When you approve a Purchase Invoice (i.e. post it to the Nominal Ledger), its value including VAT will be credited to a Creditor Account. When you enter a Payment, its value will be debited to the same Account. This Account therefore shows how much your company owes at a particular time.

- Enter here the Account Code of the Account that you wish to be used as your Creditor Account. It will be overridden if a separate such Account has been specified for the Supplier or its Supplier Category.

- Prel. Creditors

- You can post a Purchase Invoice to a preliminary Account when you first receive it, and subsequently move the posting to the normal Creditor Account when you approve it. If you need to use this feature, which allows for the late amendment of the Cost Accounts used in Purchase Invoices, specify the preliminary Account to be credited here.

- Cash

- The Account to be credited instead of the Creditor Account whenever you approve a cash purchase (Cash Note). Please refer to the description of the Payment Terms setting for details of Cash Notes.

- The Account specified here will be overridden if a separate such Account has been specified for the Payment Term used in the Cash Note.

- Prepayment VAT

- This Account is used together with the Post Payment VAT and/or Post Prepayment VAT options below. These options allow you to account for VAT based on Payments. When you approve a Payment, VAT will be moved from a temporary VAT Input Account to the final one. Usually, the final Input Account will be the I/P Account specified in the VAT Codes setting. If a particular VAT Code does not have an I/P Account, the VAT amount will be debited to this Account instead.

- Cash Discount

- In the event of an Invoice attracting a settlement discount when it is paid on time, the Account specified here will be credited with the discount amount. You can define settlement discounts using the Payment Terms setting.

- Cash Discount VAT

- This field should only be used in those cases when cash discounts taken are allowed to change the VAT amount noted on the original invoice. Check with local VAT regulations.

Check Boxes

- Objects on Creditors A/C

- With this setting on, FirstOffice will transfer the Object(s) entered for the Supplier to the 'Identifiers' card of all Purchase Invoices entered in their name.

- When approving Purchase Invoices, any Objects specified on the 'Identifiers' card will be assigned to the debit posting to the Purchase Account(s) when a Nominal Ledger Transaction is generated. If this box is checked, they will be assigned to the credit posting to the Creditor Account as well.

- Sub-ledger Checking

- Check this box if you want to use the sub-ledger checking feature in the Purchase Ledger. This will mean that you will only be able to post to specified Accounts (such as Creditor Accounts) from the sub-ledger (i.e. from Purchase Invoices or Payments in the Purchase Ledger). If you then try to post to a controlled Account directly from the Nominal Ledger (using the Transaction register) you will get an alert message.

- You can use this feature, for example, to ensure that Payments are issued from the Purchase Ledger rather than by journal in the Nominal Ledger. Using the Nominal Ledger for this purpose is incorrect because the Payment cannot be allocated against the appropriate Purchase Invoices. The feature also removes the risk of posting accidentally to your Creditor Account in Nominal Ledger Transactions.

- For this feature to work, you must specify the Accounts which are to be included in the sub-ledger checking function (i.e. the Accounts which are not to be used in the Transaction register). Do this using the Control Accounts setting in the Nominal Ledger.

- Note that this check box is used to control whether sub-ledger checking will take place for specified Purchase Ledger Accounts only. There is an option with the same name in the Account Usage S/L setting that performs an equivalent function for Sales Ledger Accounts.

- Post Payment VAT

- This option allows you to post VAT from Payments and On Account Payments. An On Account Payment is a Payment with no Purchase Invoice Number or Prepayment Number. This is a requirement in Latvia and for users of the Cash VAT scheme in the UK. If you need to use this option, you should enter I/P Accounts for all your VAT Codes (in the VAT Codes setting in the Nominal Ledger), or at least a Prepayment VAT Account in the field above.

- UK Cash VAT users only should also switch on the Post Receipt VAT option on the 'Debtors' card of the Account Usage S/L setting and specify O/P Accounts for all VAT Codes. The Cash VAT scheme is described on the VAT Codes page.

- Users in Poland can also use this option and the Post Receipt VAT option in the Sales Ledger, but should not use the Post Prepayment VAT options.

- Post Prepayment VAT

- This option allows the posting of VAT from Prepayments, a requirement for users of the Cash VAT scheme in the UK. Prepayments are Payments without a Purchase Invoice Number but with a Prepayment Number specified on flip D. If you are using this option, you should also specify an On Account VAT Account on the 'Exchange Rate' card and a Prepayment VAT Account in the field to the left of this check box.