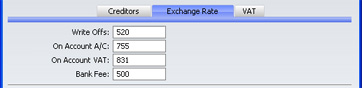

Account Usage P/L - Exchange Rate Card

- Write Offs

- Please click here for a description of this field.

- On Account A/C

- If you issue Prepayments or On Account Payments to a particular Supplier without reference to a specific Invoice (usually before you have received the Invoice), you can enter them to the Payment register with a Prepayment Number on flip D of the Payment screen (a "Prepayment") or without a Prepayment Number (an "On Account" Payment). You may want to use a special account for such Payments. Specify that Account here, and switch on the On Account check box on the 'Company' card of the Customer record for the Supplier in question. When you enter and approve a Prepayment or On Account Payment, its value will be debited to this Account.

- On Account VAT

- The Account specified here is used when the Nominal Ledger Transactions from Prepayments are to include a VAT element (i.e. if you are using the Post Prepayment VAT option on the 'Creditors' card). This is the case in Russia and for users of the Cash VAT scheme in the UK where VAT can be claimable on Prepayment Payments. When you receive a Prepayment Payment, you should specify the VAT Code and Amount on flip E. If the VAT Code field contains a value, the VAT Amount will be credited to the On Account VAT Account and debited to the I/P Account for the VAT Code (or the Prepayment VAT Account specified on the 'Creditors' card when you approve and save the Payment.

- Bank Fee

- Enter here the Account Code of the Account to be debited by any bank changes you may incur when issuing Payments.