Introduction to the Purchase Invoice Register

The Purchase Invoice register is a record of your company's purchases. Each time you make a purchase, you will receive a Purchase Invoice from the Supplier, which you should enter to the Purchase Invoice register. You will therefore use this register for a number of tasks:

- The Purchase Invoice is a record of the payment demanded from your company by the Supplier;

- Unpaid Purchase Invoices in the register provide the basis for your creditor management reports; and

- Each Purchase Invoice can cause a Nominal Ledger Transaction to be created, thus generating the overall purchase and creditor figures in your monthly and yearly management reports. This creation process is automatic, requiring no intervention or work from you.

Four types of purchase transaction can be recorded in the Purchase Invoice register:

- Standard Purchase Invoices are received where the goods have been delivered or work carried out before payment has been issued. Payments against such Purchase Invoices should be recorded in the Payment register.

- The Cash Note represents the issuing of a payment at the same time as the work is carried out. When a Cash Note is entered to the Purchase Invoice register, FirstOffice will treat it as having being paid, so there is no need to enter a separate payment record in the Payment register. FirstOffice can also look after the Nominal Ledger implications for you (crediting the Cash Account rather than the Creditor Account).

- A Deposit is the issuing of money before an Invoice has been received. These should be recorded in the Payment register as a Prepayment Payment. These can be allocated to the Invoice when it is received at a later date. Alternatively, they can be entered as Cash Notes in as described in point (2) above.

- Credit Notes are used to correct mistakes in Purchase Invoices, or to cancel Invoices that have been raised in error. They are, in effect, negative Invoices that reduce your overall purchase and creditor figures. Again, FirstOffice can look after these Nominal Ledger implications automatically.

If you would like FirstOffice to look after the Nominal Ledger implications of all these types of Invoice as described, switch on the Purchase Invoice option in the

Sub Systems setting in the Nominal Ledger.

Before you start entering Purchase Invoices, you must ensure you have defined the current financial (accounting) year, using the Fiscal Years setting in the System module. You should also have defined a journal number series for Purchase Invoices using the Number Series - Purchase Invoices setting. Other settings can be adjusted as you go along.

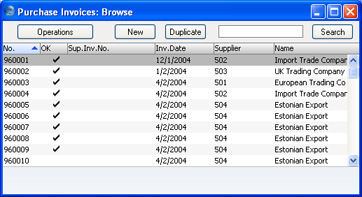

To open the Purchase Invoice register, first ensure you are in the Purchase Ledger module, then click the [Purchase Invoices] button in the Master Control panel. The 'Purchase Invoices: Browse' window is opened, showing Purchase Invoices that have already been entered.

Purchase Invoices are given a unique internal identifying code, using a consecutive numbering system. This is in addition to any number allocated to the Invoice by the issuer (the Supplier). The internal number is shown in the left-hand column, followed by a check mark (if the Purchase Invoice is approved), the Supplier's Invoice Number, the issue date and finally by the Supplier Number and Name and the Invoice total. Credit Notes have the letter "C" in the Name column, after the Supplier's Name.

As in all browse windows you can change the sort order by clicking on the column headings. To reverse any sort, simply click once again on the column heading. You can also scroll the list with the scroll bars. Finally, you can search for a record by entering a keyword in the field in the top right-hand corner. FirstOffice will search for the first record matching the keyword in the same column as the selected sorting order.