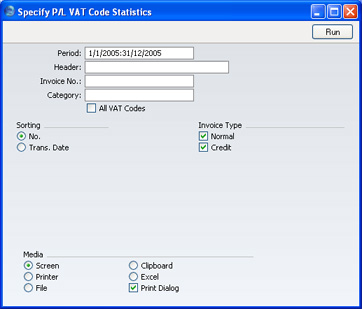

P/L VAT Code Statistics

This report contains information about VAT paid to each Supplier. The report is designed for use in countries where detailed VAT reporting is necessary.

- Period

- Paste Special

Reporting Periods setting, System module

- Enter the start and end dates of the period covered by the report.

- Header

- Enter a title for the report. If you leave this field blank, the title "P/L VAT Code Statistics" will be used.

- Invoice No

- Range Reporting

Numeric

- If necessary, enter here the internal Purchase Invoice Number of the Purchase Invoice (or range of Purchase Invoices) you wish to include in the report.

- Category

- Paste Special

Supplier Categories setting, Purchase Ledger

- To restrict the report to Suppliers of a single Category, enter a Category Code here.

- All VAT Codes

- By default, the report shows for each Purchase Invoice the VAT Codes used together with the VAT percentage and totals including and excluding VAT. If you would like to show for each Purchase Invoice all VAT Codes, including those not used by the Invoice, switch this option on.

- Sorting

- The report can be sorted by internal Purchase Invoice Number or Transaction Date.

- Invoice Type

- Determine here whether Normal and Credit Invoices are to be included in the report. Cash Notes are included as Normal Invoices for this purpose.