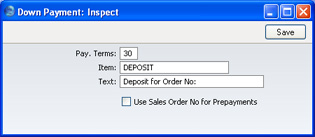

Down Payments

A Down Payment is an Invoice for part or the whole amount sent to the Customer ahead of the delivery of the goods or service.

Use this setting to specify the text to be shown on Down Payment Invoices, and the Sales Account to be credited. You can create these Invoices using the 'Create Down Payment' item on the Operations menu of the Receipt screen.

- Pay Terms

- Paste Special

Payment Terms setting, Sales/Purchase Ledger

- Specify here the Payment Terms to be used for Down Payment Invoices. You cannot use a "Cash" Type Payment Term.

- Item

- Paste Special

Item register

- Use this field can be used to specify the default Sales Account and VAT Code for Down Payment Invoices. These are taken from an Item entered in the Item register solely for this purpose and whose Item Number you specify here.

- If you leave this Item field blank, the default Sales Account and VAT Code will be taken from the Account Usage S/L setting in the Sales Ledger. The Description of the Item will not appear on the Invoice.

- Text

- Specify here the text that is to appear on the first row of the Down Payment Invoice. Note that the Order Number will be added to this text, so a suitable model might be "Down Payment for Order No " (with trailing space).

- Use Sales Order No for Prepayments

- When you create a Down Payment Invoice from a Receipt, you should enter an identifying Prepayment Number on flip C of the Receipt screen. This can be an arbitrary number of your own generation, the number allocated to the Prepayment by the Customer or the number of the Sales Order against which the deposit has been received. Switch on this option if you wish to ensure the last option is always used (i.e. if the Prepayment Number must be a Sales Order Number).