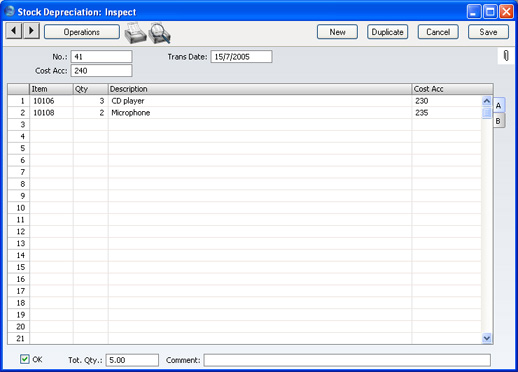

Entering a Stock Depreciation transaction

From the 'Stock Depreciations: Browse' window, click the [New] button in the Button Bar to open a new Stock Depreciation transaction. Alternatively, if one already exists that is similar to the one you are about to enter, find it in the list, highlight it and click [Duplicate].

The 'Stock Depreciation: New' window is opened, empty if you clicked [New] or containing a duplicate of the highlighted Stock Depreciation transaction.

- No.

- Paste Special

Select from another Number Series

- The number of the Stock Depreciation transaction: FirstOffice will enter the next unused number from the first number sequence entered in the Number Series - Stock Depreciations setting. You may change this number, but not to one that has already been used.

- Trans Date

- Paste Special

Choose date

- The Transaction date: FirstOffice enters the current date as a default.

- If you are using the FIFO stock valuation method, either in the Stock List or in the Nominal Ledger, you must make certain that you enter all stock transactions in strict chronological order. Failure to do this may cause your FIFO values to become incorrect. Do not, for example, enter a Stock Depreciation with yesterday's date if you have already entered one with today's. It is also recommended that you always approve Stock Depreciations when you save them for the first time. Do not, for example, go back to an earlier unapproved Stock Depreciation and approve it if there are later approved ones, unless you change the date as well.

- Cost Acc.

- Paste Special

Account register, Nominal Ledger/System module

- The default debit Account for the Stock Depreciation transaction. You can specify a Cost Account in any of the Stock Depreciation rows, to override the one entered here. The default is the Stock Cost Account specified in the Account Usage Stock setting.

- If you do not enter an Account here or in a Stock Depreciation row, the Cost Account from the Item Group will be debited.

Use the grid that takes up most of the window to list the Items that are to be removed from stock.

Flip A

- Item

- Paste Special

Item register

- As with all Item Number fields in FirstOffice, enter the Item Number of the Item.

- If you choose an Item of which there is no stock, it will not be included in the resulting Nominal Ledger Transaction. However, the stock balance of the Item will be reduced (i.e. negative stock will be created) unless you are using the Do Not Allow Over Delivery option in the Stock Settings setting.

- If the Item is a Plain Item, it will not be included in the resulting Nominal Ledger Transaction: stock values are not stored for Plain Items.

- Qty

- The quantity of the Item that is to be deducted from stock levels. If you are using the Do Not Allow Over Delivery option in the Stock Settings setting, you will not be able to enter a greater figure than you have in stock.

- Description

- FirstOffice enters the Item Name in this field: you can change it if necessary.

- Cost Acc

- Paste Special

Account register, Nominal Ledger/System module

- You can enter an individual Cost Account number for each row, to override that entered for the Stock Depreciation overall.

Flip B

- FIFO

- The value of the Item, to be subtracted from your Nominal Ledger Transaction stock valuation. If the Quantity is greater than one, this field will show the average unit FIFO cost. This figure will be brought in automatically when you approve the Stock Depreciation record.

- If the Item belongs to an Item Group and you are using the Use Item Groups For Cost Model option in the Cost Accounting setting, the figure in this field will be calculated using the Cost Model specified in the Item Group. Otherwise, it will be calculated using the Cost Model, Invoice in the Cost Model setting in the Sales Ledger. If the Cost Model is % of Base Price or Cost from Invoice, FIFO values will be used.

Footer

OK

Check this box to approve the Stock Depreciation transaction. After approving the transaction, you will not be able to change it.

If you have so determined in the Sub Systems setting in the Nominal Ledger, a Nominal Ledger Transaction will be created in the Transaction register. The nature of this Transaction is described on the Nominal Ledger Transactions from Stock Depreciation transactions page.

You can use Access Groups to control who can approve Stock Depreciations. To do this, deny access to the 'OKing Stock Depreciation' Action.

References in these web pages to approved Stock Depreciation transactions are to those whose OK check box is on.

Tot. Qty

This shows the total number of Items included in the Stock Depreciation transaction.

Comment

Record any comment about the Stock Depreciation record here, such as the reason for its entry.Please click here for details about the Location field added to this screen by the Stock Locations Value Pack.